HFMDX: A Growth-Focused Fund That Remains Attractive In A Tougher Market

Image source: Pexels Photo by Monstera:

The 10-year Treasury – which closed at 3.86% on Feb. 1 – closed above 4.65% on Tuesday. Growth stocks, and tech, in particular, detest higher interest rates.

Although earnings season has gotten off to a pretty good start, investors are focused on the Fed right now. Recent hot inflation readings have pretty much-taken interest rate cuts off the table for a while…possibly the rest of this year or beyond. Fed Chair Jerome Powell said it is “likely to take longer than expected” to get enough confidence that inflation is headed toward their 2% target.

Our global markets were mostly lower for the reporting period (April 11 – April 17). The S&P 500 finished 2.7% lower; the Euro Stoxx 50 dropped 1.7%; the Nikkei 225 declined by 4.1%; the Shanghai Composite moved higher by 1.5%.

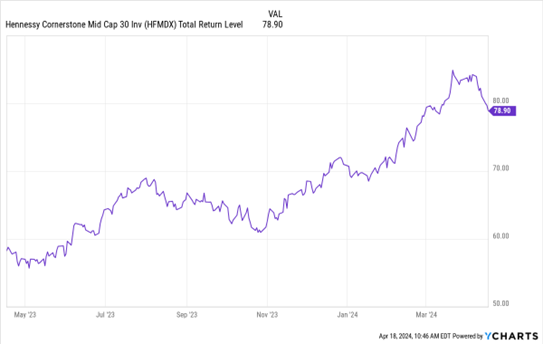

Data by YCharts

Pristine conditions for stock investors (i.e. what we’ve had since the end of October) are no longer in place. We are finally pulling back amid some inflation uncertainty and accompanying market volatility. We also believe there is some additional short-term risk in the markets if we get more disappointing data on economic activity and/or inflation.

These risks, however, do not discourage our longer-term outlook for the stock markets. HFMDX is a domestic stock fund worth considering as a new “Buy.” The fund normally invests at least 80% of its net assets in mid-cap growth-oriented common stocks by utilizing a quantitative formula known as the Cornerstone Mid Cap 30 Formula (the “Mid Cap 30 Formula”).

It purchases 30 stocks weighted equally by dollar amount, with 3.33% of the portfolio's assets invested in each. Using the Mid-Cap 30 Formula, the universe of stocks is re-screened and the portfolio is rebalanced annually, generally in the fall.

Recommended Action: Buy HFMDX.

More By This Author:

Cathay General Bancorp: A California-Based Bank With Solid Value, Strong PotentialGlobal ETFs: Why Going Outside Our Borders Could Pay Off Handsomely

Gold Miners: Primed To Catch Up, Overtake Gold As Precious Metals Rally

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.