More On Battery Metals

<< Read More: The Bust In Battery Metals

This is the second in a series of posts about battery metals. By battery metals I mean:

- Lithium

- Cobalt

- Graphite

- Nickel

This post will be about cobalt (Co).

The bull argument was that increased demand from electric cars and grid storage systems would raise demand for all these metals to a new plateau. There is actually some truth to the argument. Previously, all these metals were used in other applications. Cobalt and lithium are used primarily in the chemical industry, nickel in steel. The new source of demand should force producers to go out further on the cost curve.

But everything has its limits. The above narrative soon became a mania, with the usual suspects (retail, southwestern family offices) piling in. In cobalt, there is even a streaming company, Cobalt27. Nothing attracts retail like streaming.

There are a lot of counter movements.

- Technological improvement. Volkswagen plans to reduce the Co content of its EV batteries from the current 12% to 4%. Li-ion batteries are a relatively new technology. There's plenty of improvement yet to be made. It's true that the basic science is known, but there are a lot of improvements that can be made incrementally.

- Recycling. Right now very few Li-ion batteries get recycled. That is obviously not a long term solution. The whole point of EVs is environmental, so why create a poisonous landfill problem? This matters to the kind of person who will buy an EV and to the regulators who set the rules. I have seen estimates that 20% of Co demand will be covered by recycling by 2030.

- New Mines. Right now the Democratic Republic of the Congo (DRC) is by far the world's largest supplier. I can't think of a less stable source of supply. But Co isn't that rare. New mines are being considered in Australia and the US. These are probably only marginally economic at current prices, but might be worthwhile for security reasons.

OK, enough generalizations. Let's get specific about cobalt. I'm starting with this because I feel it has the best bull case and it's investible.

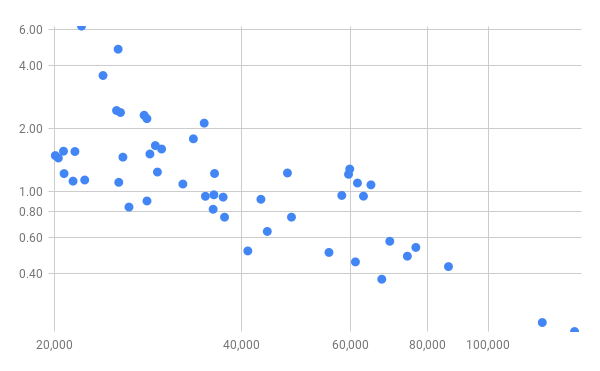

When looking at any new commodity investment, I always start with long term value. Here's a graph I like to use (BTW, I keep these graphs for about 200 commodities.)

(Click on image to enlarge)

For those of you who haven't seen this type of chart before:

- The X-axis is the real price of vanadium (inflation and currency adjusted) $ /tonne.

- The Y-axis is the 10-year forward price appreciation/depreciation in inflation-adjusted dollars.

Right now, the price is about $34,000. So the graph is forecasting about a 20% real price appreciation in the next ten years. That's 1.8% per year, not good enough to cover the cost of carry.

But what about the argument that the new source of demand will push Co-production out the cost curve? For that, we have to build a supply/demand model.

Disclaimer: This is for education only. I am not recommending anyone follow me in any trading/investing I do. If you follow someone else's trades without doing your own research, you will ...

more