Money-Market Fund Assets Hit Another New Record High As Domestic Bank Depos Surge To Pre-SVB Levels

Amid all the volatility of the last few weeks in stocks, money markets have seen a constant inflow of funds (six straight weeks) with the last week adding $23.4BN to total MM fund AUM to a new record high of $6.324TN...

Source: Bloomberg

That is $188BN of inflow in six weeks - the biggest since the turn of the year seasonal flows.

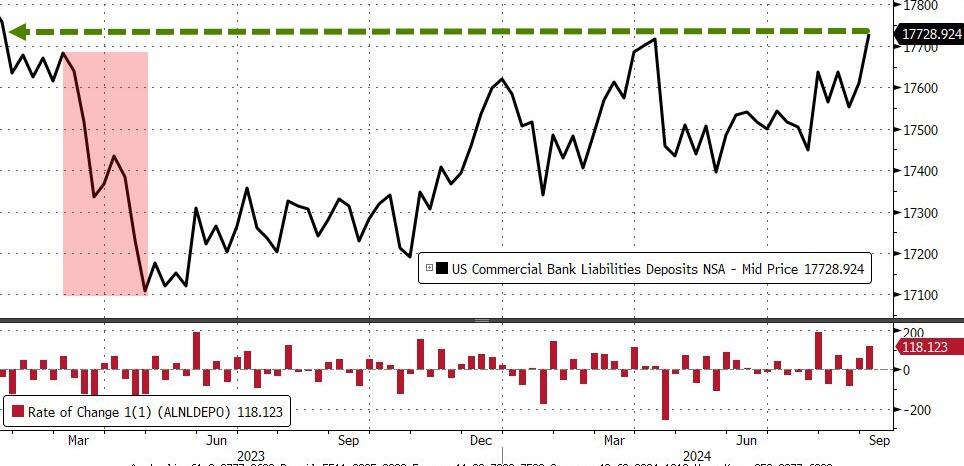

At the same time, US banks saw almost $53BN of deposit inflows in the week-ending 09/04, pushing total (seasonally-adjusted) deposits to their highest since before the SVB collapse...

Source: Bloomberg

On a non-seasonally-adjusted basis, US bank deposits soared $118BN last week - also back to its highest sine SVB...

Source: Bloomberg

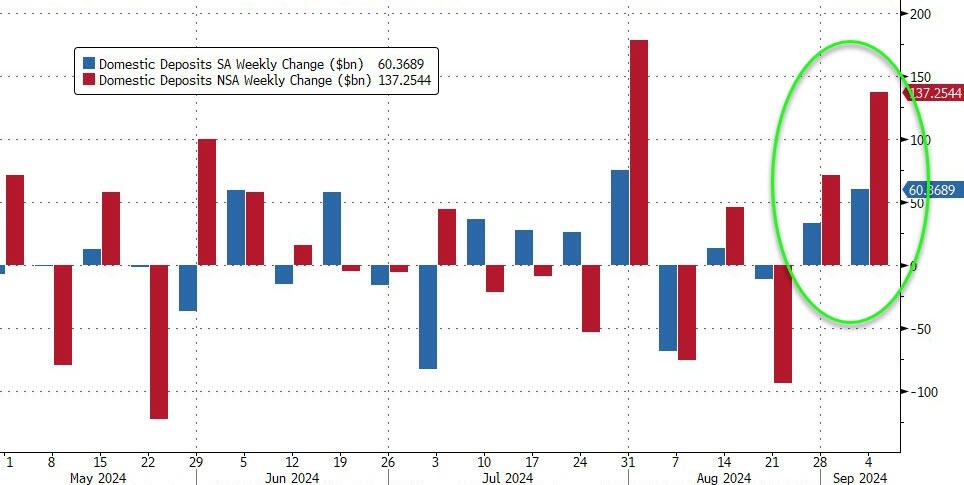

Excluding foreign deposits, domestic bank deposits soared on both an SA (+$60BN) and NSA (+$137BN) basis...

Source: Bloomberg

...back above pre-SVB crisis levels...

Source: Bloomberg

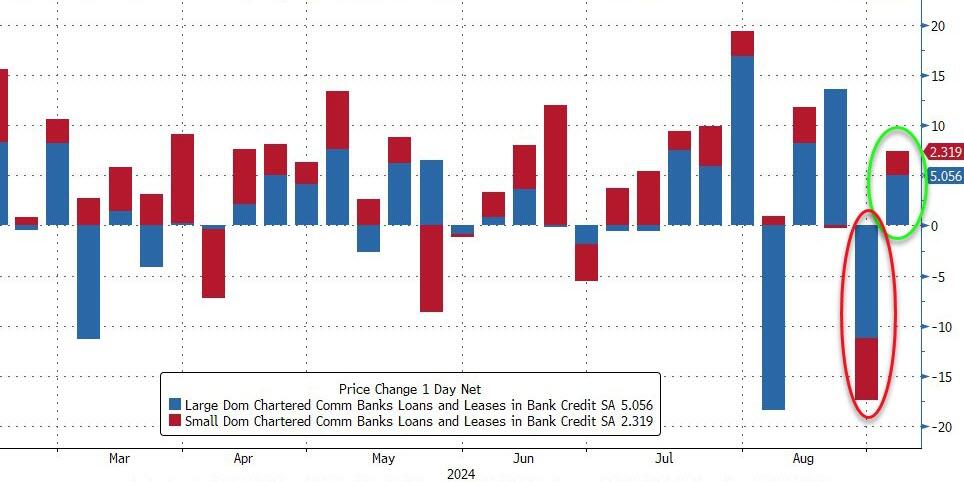

After last week's crash, domestic bank loan volumes rebounded modestly....

Source: Bloomberg

Finally, while US bank reserves at The fed have been trending lower, US equity market cap has stalled (at record highs)...

Source: Bloomberg

Which is more likely? A collapse back to reality for stocks (hard landing) or a huge sudden surge in reserves at The Fed?

More By This Author:

Nvidia & NikiLeaks Spark Surge In Stocks, Gold, & Crypto This WeekGold Surges To New Record High After Hot PPI As ECB/WSJ Trigger Dollar Dump

YIelds Hit Session High After Tailing 30Y Auction

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more