Money: A Natural Method

Tracking your spending works a lot better than trying to budget, especially for people who, despite their efforts, stray easily from their preplanned, pre-constructed, predesigned, ideal budgetary picture. When you track your spending, you simply record everything that’s happened. You’re looking at reality objectively rather than projecting an ideal image onto reality that may make you feel good, but that you seldom live up to.

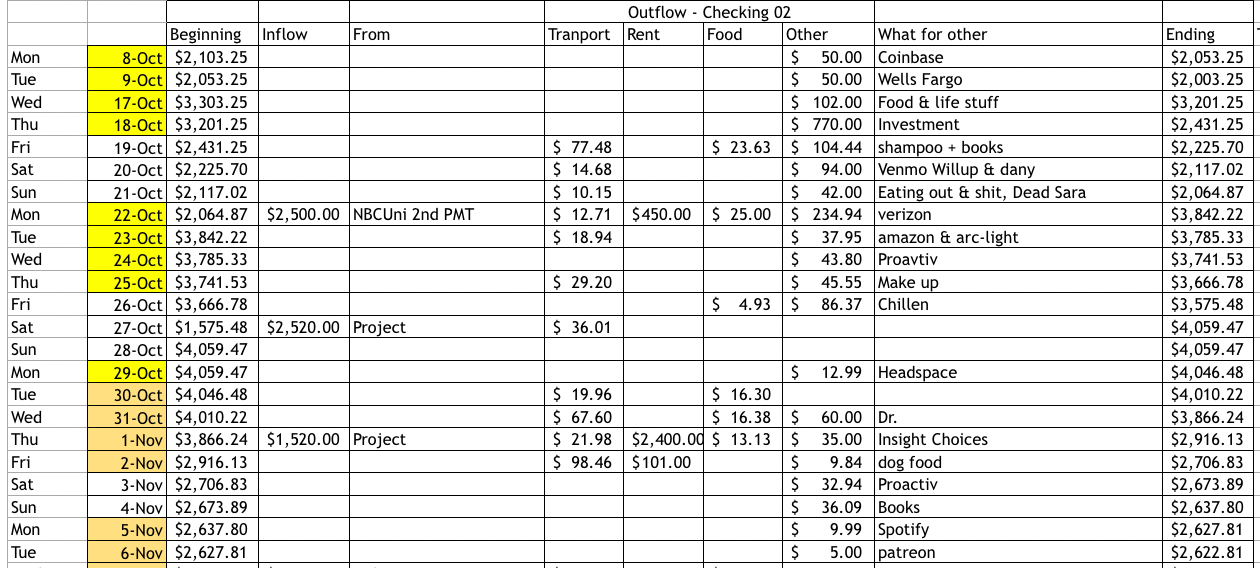

This isn’t to say budgeting is bad or useless all together. But if you struggle with prudence, like many middle and upper class people do in modern society, then try this first. Don’t budget at all. In fact, for right now, just throw it all out completely. Proceed with your spending normally. Then simply track all that you spent. It’s important you don’t use general estimates or smudged numbers (it won’t work if you do it that way). Instead, be specific with dollar amounts down to the penny. Go back and look at bank statements and credit card statements and make sure your figures are accurate for each and every line item. Then add them to a spreadsheet, like this:

When starting out with personal money management, we tend to be vague and often fail to capture the intricacies of our real world experiences. On paper, money is one thing but taking that out into the real world is like speaking a completely different language — nothing in our natural experience day to day matches up, goes to plan, or translates as you thought it would when you were planning it out.

Earn. Spend. Track.

So if budgets don’t work well for you, track you’re spending instead, and over a couple weeks of doing this, you’ll likely notice your financial habits start to change as a natural matter of course, as your preconscious mind begins to recognize which spending patterns are contributing to the problems you experience currently. (So long as you’re not overthinking it or beating yourself over it… as that will likely lead to guilt, regret, and then, more bad spending habits.)

Money won’t magically appear, you have to force money. You must to stay in control of it, and for you to do that, first you have to do is track it.

Then once you have a reliable, unyielding grasp on your spending patterns and financial tendencies, you can begin to assemble accurate framework (budget) for the future going forward.

This is an essential task any human in the modern world must be able to do. It’s as essential to survival as food and water. As humans, we’ve developed the ability to plan and think ahead, to save up resources and use strategy to optimize our results. Then in a world of scarcity and limited resources, this skill is vital to us as individuals and for the community people around us.

Regardless of how much or little you make, this habit can be a starting point for personal independence. Before you can begin to strategize for greater financial undertakings (i.e. debt management, home buying, investment, business and project planning, etc.) you must be able to first track spending objectively. In being aware of where your money’s going down to the penny, and ensuring you have no exposure to arbitrage gaps, you’re creating the basis for obtaining financial competence.

Today, financial domination is more common than physical domination. Budgeting is an abstract concept which in theory should protect you against financial weakness, resulting in financial domination. Yet all too often, budgeting fails us, as we forget the key to life is not in the preplanning and the abstract concepts themselves, but in taking these abstract concepts — the stuff we learn in school, from books, and from studying — and merging them with the physical reality of real experience.

You can’t always avoid or control conflict, but you can’t control how you react to it, as well as the habits you choose to hold on to.

“In order to succeed, you must first survive.”

— Warren Buffett

We can’t always stop the bad stuff from happening in life or in finance. But we can find a sense of competence in our experiences and since competence is what gives way to meaning and purpose in life, a life lead by competence means you can be happy or at least at peace, wherever you stand. You can create order and find stillness in the midst of the ever-changing chaos inherent in our 21st century globalized world economy.

It all starts with this: Earn. Spend. Track. And then go from there.

Disclaimer: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which course of ...

more