McIntyre Partnerships Q2 Letter: Long Spirit MTA REIT

McIntyre Partnerships June 2018 letter to investors for Q2 / H1 can be found below.

Dear Partners,

I hope you are all enjoying a nice start to summer. While the fund's returns were relatively uneventful in Q2 and H1 2018, we have added several new ideas.

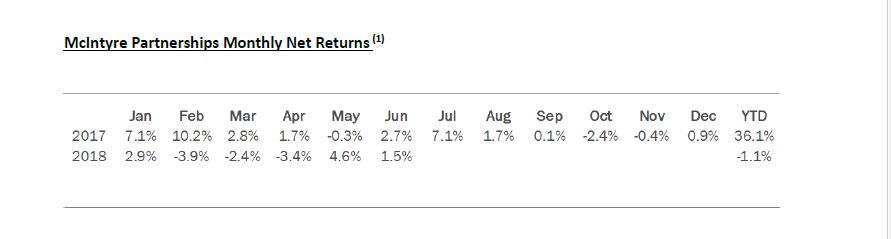

McIntyre Partnerships Monthly Net Returns (1)

Free-Photos / Pixabay

Performance Review - Q2 2018

Through June, McIntyre Partnerships returned -0.3% gross and -1.1% net. This compares to S&P 500 and S&P 600 returns, including dividends of 2.0% and 9.4%, respectively.

Year to date, our performance remains weak. Much like Q1, our performance has no substantial winners or losers. As always, I do not consider three-month performance relevant for our concentrated portfolio. Over many years, we will have stretches of lackluster underperformance, and we will always struggle to keep up with a 10% quarterly index advance (particularly if we have few bets related to said index).

In Q2, we had no significant (>100bps) losers. In the win column, our CBS loss reversed and, combined with DISCA (collectively, our "media" basket), contributed ~250bps in Q2. YTD, our only large losers are LILAK (~100bps) and CDR (~80bps). DDS (~150bps) and our media basket (~100bps) are our only YTD significant winners.

Portfolio Review - Exposures and Concentration

As of June end, our exposures are 127% long, 29% short, and 98% net. Our five largest positions were 76% gross exposure and our ten largest were 108%.

Our five largest positions are CBS/DISCA, LILAK, our small-cap financials basket, SMTA, and FBHS.

~72% of the portfolio is what I would consider a non-cyclical business (cable, beer, cell towers, etc.). ~61% of the portfolio has a "hard catalyst" (spinoff, merger, asset sale, etc.), while another ~30% have "soft catalysts" (earnings beats, price increases, etc.).

Portfolio Review - Existing Positions

CBS/DISCA

Legacy media generally rallied in Q2, and our "media basket," which consists of a large bet in CBS and a more modest bet in DISCA, broadly participated. The space reacted favorably to the TWX/T merger prevailing in court, which increased the potential for vertical integration. Further, year-to-date (YTD) pay-TV fundamentals have been better than feared: TV ad dollars remain stable, and OTT pay-TV subs continue to offset declines in traditional linear cable.

For CBS, two news stories have broken out: a boardroom drama, and sexual misconduct charges against CEO Moonves. During the quarter, CBS's board sued its controlling shareholder, National Amusements (NAI), seeking to dilute NAI's stake and fend off a merger with VIA. Personally, I am favorable towards the CBS+VIA merger given VIA's distressed price and substantial "hidden" asset value, but most market participants disagree. As the lawsuit puts a forced VIA merger on hold, shares reacted favorably.

More recently, CBS's CEO was accused of sexual harassment. As CEO Moonves is well-regarded, shares reacted quite negatively in the immediate aftermath. (Note: This news occurred after Q2, only a few days ago.) While the accusations are troubling and increase the likelihood of his departure, our investment in CBS is based upon my analysis of CBS/CBS+VIA valuation, earnings potential, and strategic positioning, not blindly following a messianic CEO, particularly a 68-year-old one. Rumors had circled Moonves for months, and while I acknowledge his talent, I am confident CBS, whether standalone or merged with VIA, has adequate managerial talent to fill the role. With or without Moonves, I believe the assets are well-positioned and at a particularly attractive price.

I remain bullish on our media basket and maintain a substantial position.

CDR and DDR

The REIT index bounced considerably in Q2, and our retail REIT investments participated. YTD, retail bankruptcies are down y/y and most retail REITs are reporting positive NOI growth. We have rotated the bulk of our retail real estate investment into Spirit MTA (SMTA), a position discussed below. While CDR remains a mistake and a modest realized loss, our overall retail real estate investment across CDR, DDR, and SMTA is now roughly flat on the year.

Portfolio Review - New Positions

Spirit MTA REIT

SMTA is a recent spin that fits into both our event-driven and distressed categories. SMTA is a classic "bad bank," where SMTA's parent, Spirit Realty (NYSE:SRC), decided to exit its troubled assets via spinoff, with the goal of quickly improving the parent's valuation. I am particularly attracted to bad-bank spins such as this, as it implies: 1) management believes the market is incorrectly valuing the bad bank, and 2) many current parent company shareholders will be excited to "get rid" of the troubled assets. Further, SMTA is a small percentage of SRC's overall market cap, and SMTA's assets are unfamiliar to typical REIT investors, placing the stock in most analysts' "too hard" buckets. I believe these factors have created an interesting entry point in an undervalued security.

The market views SMTA as an overlevered, "too difficult" stock, but when properly analyzed, I believe SMTA is a simple story: a portfolio of real estate assets, with minimal recourse leverage, that is likely to be liquidated with the cash returned to shareholders in the next three years at price near $30/share, a 200% return. I believe the recent spin dynamics, combined with a lack of investor familiarity with the ABS structure of SMTA's largest asset, create a favorable entry point. Further, compensation incentives strongly align the board and management with shareholders.

The fund has an ~5-10% investment in SMTA, along with a substantial hedge to reduce the risk of rising rates.

A longer write-up of SMTA is available upon request.

Fortune Brands

Fortune Brands is a "blue-chip" building products business whose shares came under pressure in H1 2018 due to rising interest rates and a slight Q1 miss due to rising input costs. FBHS operates in four building product segments, including cabinets, doors, and security; however, FBHS's crown jewel is the plumbing business, which accounts for ~50% of EBIT. Focused on the Moen brand, the plumbing segment sells a branded consumer product with ~30% market share in a consolidated industry (top three manufacturers are ~75% of the market), and FBHS is gaining market share. Further, plumbing is a classic "small price as percentage of overall product" business, which we are generally favorable towards. For example, a typical kitchen remodel ranges from $15k-$25k, but a typical faucet costs only $100-$300 for what is often a design focal point. This allows FBHS to compete primarily on service/quality rather than price, which in turn leads to higher margins (~22% in 2017) and greater predictability. Further, I believe FBHS management is strong and the balance sheet is underlevered.

Regarding interest rates, the market has broadly punished housing-related equities as investors worry rising rates will push housing into a recession. However, while large moves in rates correlate with one-to-two year housing trends, long-term housing trends are driven by existing home supply and new household formation, both of which strongly indicate we are in the middle innings of a long-term housing bull market. At worst, I believe rising rates are likely to cause a small contraction in new residential construction, which would only modestly impact FBHS earnings. Roughly half of FBHS's sales are repair and remodel (R&R)-focused, which have little correlation with interest rates. Regarding rising input costs, FBHS has strong brands and has historically been able to pass along input cost inflation, albeit with a few quarters' lag. I expect FBHS's price increases to positively impact H2 2018 and FY2019 results, offsetting inflationary pressures.

Given the 20% YTD decline in shares and the underlying portfolio's quality, I believe our investment is adequately compensated for any cyclical risks related to rising rates and inflationary pressures. In the event cyclical pressures are worse than expected, I believe FBHS EBIT would at worst decline 30%, yielding ~$3 in EPS. This compares to a "realistic" 2020 EPS scenario of ~$5-$6, assuming ~8-12% new construction growth, ~5% R&R growth, and FBHS utilizing its underlevered balance sheet. At ~18x worst-case and ~10x "realistic" 2020 EPS, I believe FBHS shares are an attractive investment.

The fund currently has an ~10% investment in FBHS.

Perspecta (NYSE:PRSP)

Perspecta is a recent simultaneous merger/spinoff trading at a large discount to its peer group. PRSP is an IT servicing company providing end-to-end information technology ("IT") services and mission 4 solutions primarily to government customers at the U.S. federal, state and local levels. The "mastermind" behind PRSP's creation is DXC CEO and PRSP Chairman Mike Lawrie, who previously spun another government IT servicer, CSRA, which recently was acquired at a substantial premium to post-spin prices.

Despite Lawrie's track record, PRSP shares trade ~11-12x 2019 EPS and ~9x 2019 EV/EBITDA, a sharp discount to government IT services peers (BAH, CACI, SAIC, etc.), which trade 15-18x EPS and ~12-13x EV/EBITDA.

I believe shares trade at a discount largely for two reasons: 1) technical factors related to the recent merger+spin, and 2) PRPS has a large Navy contract up for renewal. Regarding the former, as the technical overhang from former DXC shareholders dissipates and the PRSP story becomes better known, I believe PRSP shares can reweight. Regarding the latter, PRPS's Navy contract ("NGEN") accounts for ~17-18% of sales but at below group margins. If the entire contract is not renewed, virtually all PRSP's costs would be quickly downsized and PRSP would retain several difficult to recreate functions. I believe assuming a worst-case ~15% drop in EBITDA is adequately conservative, which yields ~$1.50 in EPS and ~$580MM in EBITDA. Further, I believe PRSP has a greater than 50% chance of retaining the contract, as PRSP historically has a 90% renewal rate.

As PRSP trades at a slight discount to peers in my worst-case estimate and a substantial discount versus peers currently, I believe PRSP offers an attractive risk/reward.

The fund currently has an ~5% investment in PRSP.

Retail Shorts

As a rule, the fund will rarely comment on specific short ideas. However, I will try to explain any short strategies we take in general terms. YTD, consumer discretionary has outperformed, which we participated in with our DDS investment. However, many lower-quality retailers with real long-term business model risks have rallied as well, often outperforming the group. Given this backdrop, the fund has begun to short a basket of low-quality retailers with significant YTD rallies.

The fund targets an ~10% exposure to retail shorts.

As always, please feel free to contact me with any questions.

Sincerely,

Chris McIntyre

(929) 399-5485

chris@mcintyrepartnerships.com

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get ...

more