It's Happening Again: When Media Loves Investing, Investors Should Worry

Thesis: As we last saw in 2008, we now have popular TV shows devoted to Wall Street and hedge funds, as well as self-help gurus turning investment authors. All of these are ominous signs to the intelligent investor who can view these events in a historical context. Some examples of Wall Street, hedge funds, and investing invading the mainstream culture:

2008: (June 2008): CNBC: Super Wealth and New Gilded Age. CNBC presents "Untold Wealth: Rise of the Super Rich"

Faber interviews 43-year-old Anthony Scaramucci, a hedge fund executive worth over 80 million dollars who, like many of his colleagues, came from modest beginnings and grapples with his newfound wealth, mindful of the way he is seen by others.

In the upper reaches of American society there is an explosion in personal wealth like never before. There has always been extraordinary affluence in the United States, but today that wealth has soared to staggering heights, creating a new and growing class of Americans dubbed the Super Rich. This creation of unprecedented wealth has brought us to a moment in American history that has been described as the "New Gilded Age."

October 2008: End of Gilded Age:

October 2008: CNBC: Jim Cramer: Time to get out of the stock market

"I don't care where stocks have been, I care where they're going, and I don't want people to get hurt in the market," Cramer told Curry. "I'm worried about unemployment, I'm worried about purchases that you may need. I can't have you at risk in the stock market."

"Whatever money you may need for the next five years, please take it out of the stock market right now, this week. I do not believe that you should risk those assets in the stock market right now."

SPY 1 Year Price Returns (Daily) data by YCharts

2017: Billions. The Showtime drama series gives viewers a closer look at a hedge-fund manager who's making, well, billions.

- 'Billions' is the hot-button show Wall Street is obsessed with - here's what it's all about

- 'Billions' For The 99%: Breaking Down The Hedge Fund Speak Of Showtime's Newest Thriller

2017: Stocks in the mainstream.

Today, investing has become so much easier that even self-help guru Tony Robbins has released his second book on investing since this bull market began, Unshakeable. And there are 2M search results for Tony Robbins discusses investing in Google.

"If you don't sell, you don't lose money," says Tony Robbins. "Every single bear market has turned into a bull market."

-How to put together a simple, actionable plan that will deliver true financial freedom. Tony Robbins, March 2016

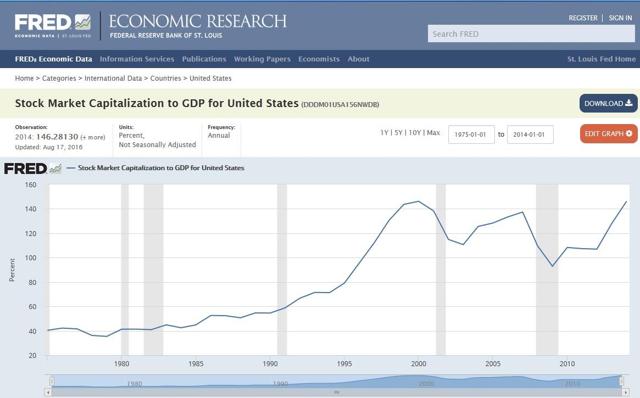

Valuations Still Matter

Valuations in 2017

The legendary macro trader says that years of low interest rates have bloated stock valuations to a level not seen since 2000, right before the Nasdaq tumbled 75 percent over two-plus years. That measure -- the value of the stock market relative to the size of the economy -- should be "terrifying" to a central banker, Jones said earlier this month at a closed-door Goldman Sachs Asset Management conference, according to people who heard him. - Paul Tudor Jones Says U.S. Stocks Should 'Terrify' Janet Yellen

Investor Complacency

Rising interest rates, high debt levels and lofty valuations can impact current and future returns. And nothing speaks louder than the incredible decline in volatility. (VIX) (VXX)

SPY Annualized 5 Year Price Returns (Daily) data by YCharts

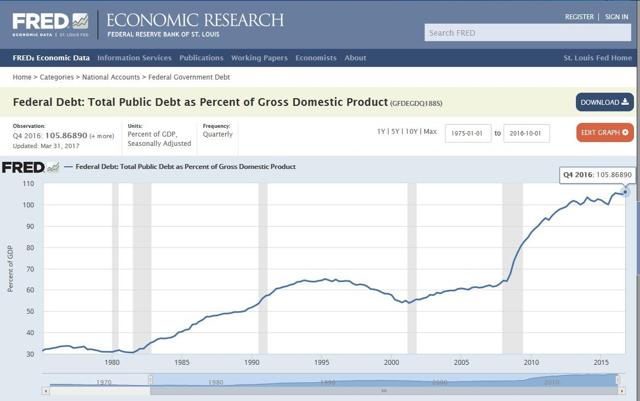

Debt

As the market was welcoming news of tax cuts, it was ironic that a former Fed official would question whether we could afford the infrastructure plan President Trump was proposing. Alan Greenspan on the infrastructure plan:

"At the moment, we can't afford it," he said, arguing the U.S. has "too much debt."

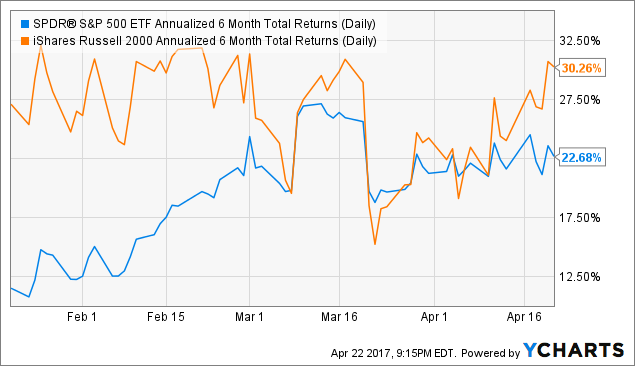

Election rally: Too far, too fast.

Here we see the large stock market rise since the election. These returns coupled with the previous lack of volatility suggest a complacency from a stock market that is used to getting whatever it wants: either fiscal stimulus from the Fed or now, tax cuts.

There is so much complacency due to the election and the Ffed that these incredible increases in prices seem normal.

SPY Annualized 6 Month Total Returns (Daily) data by YCharts

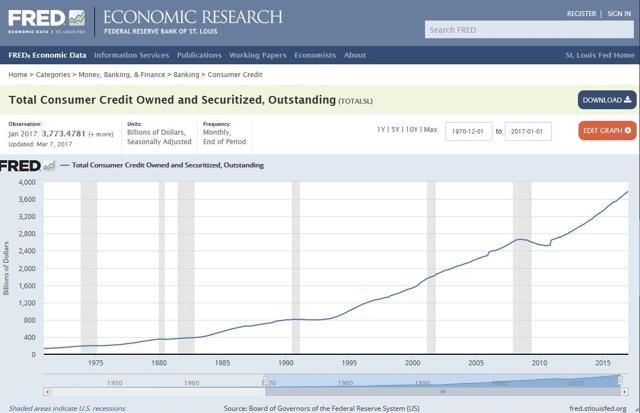

Consumer Debt

The consumer is still spending, but has tremendous accumulated debt from the past few years. Everything seems less expensive with such low interest rates. At some point, rates will need to rise. And the consumer will pull back.

Conclusion

Valuations due to Fed policy and extended debt levels should caution intelligent investors. In addition, the popularity in the mainstream of hedge fund managers, investing, and the stock market is an ominous development last seen in 2008, for those who have a good memory.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Bubblemucci works for Trump. Tony Robbins is a confidence guru. Isn't he out of his expertise? Nice article.

I have to add that Greenspan is the most perplexing economist. He says we are in too much debt, but he wants more treasury bonds and higher yields. Make up your mind, Greenspan.