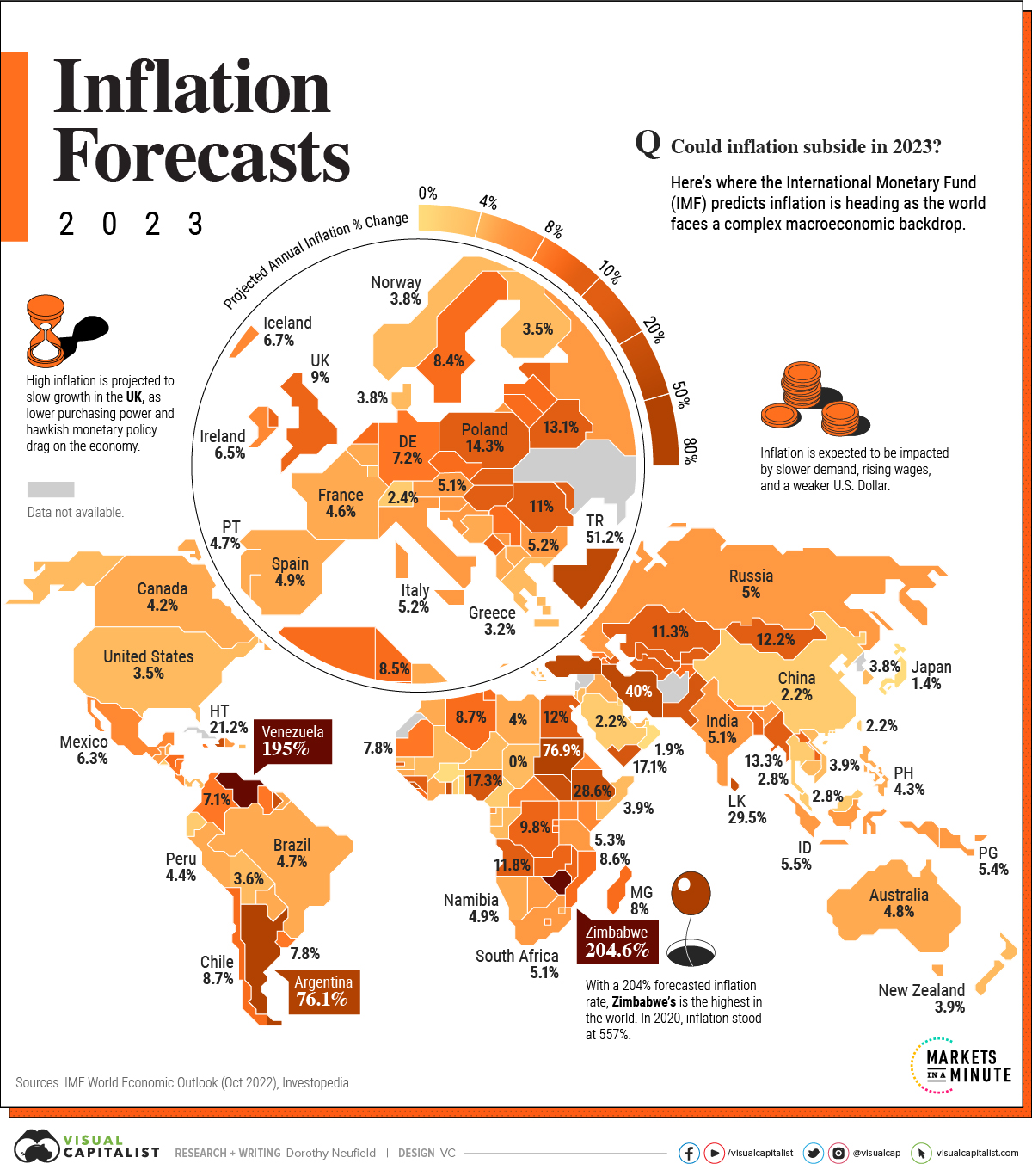

Mapped: 2023 Inflation Forecasts By Country

(Click on image to enlarge)

Inflation surged on a global scale in 2022, hitting record-level highs in many countries. Could it finally subside in 2023?

In the above infographic, we look to answer that question using the World Economic Outlook report by the International Monetary Fund (IMF).

Not Yet Out of the Woods

While the IMF predicts that global inflation peaked in late 2022, rates in 2023 are expected to remain higher than usual in many parts of the world. Following the 8.8% global inflation rate in 2022, the IMF forecasts a 6.6% rate for 2023 and 4.3% rate for 2024 based on their most recent January 2023 update.

For the optimists, the good news is that the double-digit inflation that characterized nearly half the world in 2022 is expected to be less prevalent this year. For the pessimists, on the other hand, looking at countries like Zimbabwe, Venezuela, Turkey, and Poland may suggest that we are far from out of the woods on a global scale.

Here are the countries with the highest forecasted inflation rates in 2023.

While the above countries fight to sustain their purchasing power, some parts of the world are expected to continue faring exceptionally well against the backdrop of a widespread cost-of-living crisis. Many Asian countries, notably Japan, Taiwan, and China, are all predicted to see inflation lower than 3% in the upcoming year.

When it comes to low inflation, Japan in particular stands out. With strict price controls, negative interest rates, and an aging population, the country is expected to see an inflation rate of just 1.4% in 2023.

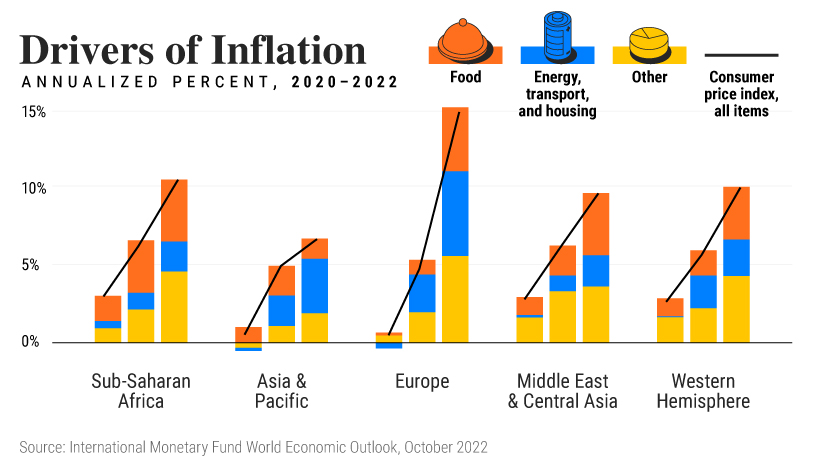

Inflation Drivers

While rising food and energy prices accounted for much of the inflation we saw in 2022, the IMF’s World Economic Outlook highlights that core inflation, which excludes food, energy, transport, and housing prices, is now also a major driving factor in high inflation rates around the world.

(Click on image to enlarge)

What makes up core inflation exactly? In this case, it would include things like supply chain cost pressures and the effects of

slowly trickling down into numerous industries and trends in the labor market, such as the availability of jobs and rising wages. As these macroeconomic factors play out throughout 2023, each can have an effect on inflation.

The Russia-Ukraine conflict and the lingering effects of the COVID-19 pandemic are also still at play in this year’s inflation forecasts. While the latter mainly played out in China in 2022, the possible resurgence of new variants continues to threaten economic recovery worldwide, and the war persists in leaving a mark internationally.

The confluence of macroeconomic factors currently at play is unlike what we’ve seen in a long time. Though the expertise of forecasters can give us a general understanding, how they will actually play out is for us to wait and see.

More By This Author:

Ranked: America’s 20 Biggest Tech Layoffs Since 2020Ranked: The Top Online Music Services In The U.S. By Monthly Users

Charted: Tesla’s Unrivaled Profit Margins

Disclosure: None.