Major Shift Revealed As Western Investors Suddenly Run To Gold

In the past two years, the East has been responsible for a momentous move upward in the gold price, decoupling it from the West’s pricing model. But Western investors have taken back the baton and have been driving gold higher since June 2024.

Tellingly, Western investors are abandoning their old pricing model, too. Instead of participating in the gold market for speculative reasons, they are now buying gold as a safe haven. This is highly bullish because Wall Street has little exposure to gold.

Meanwhile, on a net basis, the East is not selling. In this tight market, the gold price is sharply rising: year-to-date, it’s up more than 30%.

Gold Prices Are Driven by the Marginal Buyer

What sets the price of gold is usually determined by global flows of gold from West to East or vice versa. It’s important to understand who the marginal buyer (price setter) actually is for several reasons.

Identifying the marginal buyer provides context to why the gold price goes up or down. Historically (for the past 100 years), Western institutional supply and demand have set the price, while the East lowered volatility by selling into bull markets or buying in bear markets.

As the East has recently shown, it can be a driving force in the gold market as well, and the reasons for doing so haven’t faded1. Were we to see continuous buying in two hemispheres at the same time, it would create a perfect storm in gold.

The Awakening of the East

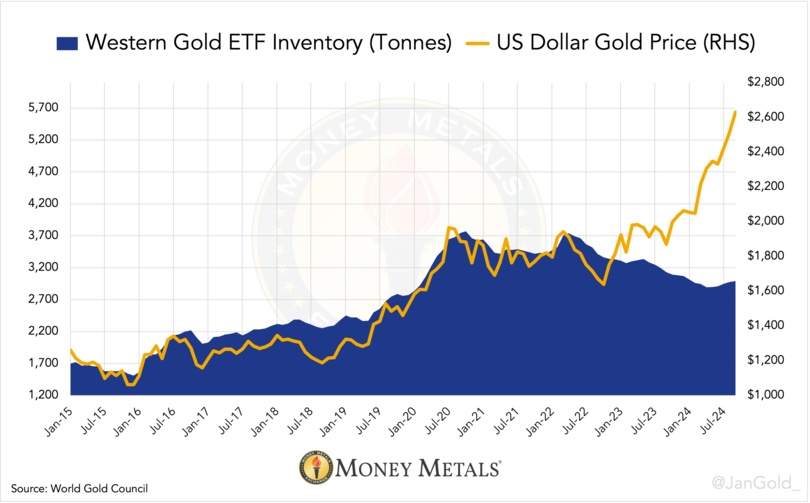

During the upward move in gold from late 2022 until May 2024, it was clear to market observers this wasn’t driven by Exchange Traded Fund (ETF) buying, as ETF holdings declined over this period.

Neither was it caused by OTC buying in London or Switzerland, as both trading centers were net exporters. Before 2022, ETF inventories would swell, and the U.K. and Switzerland would be net importing when the gold price increased.

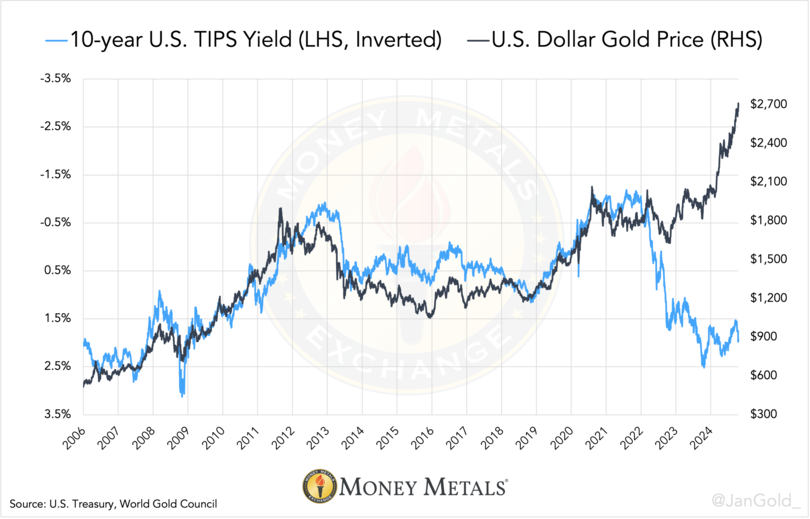

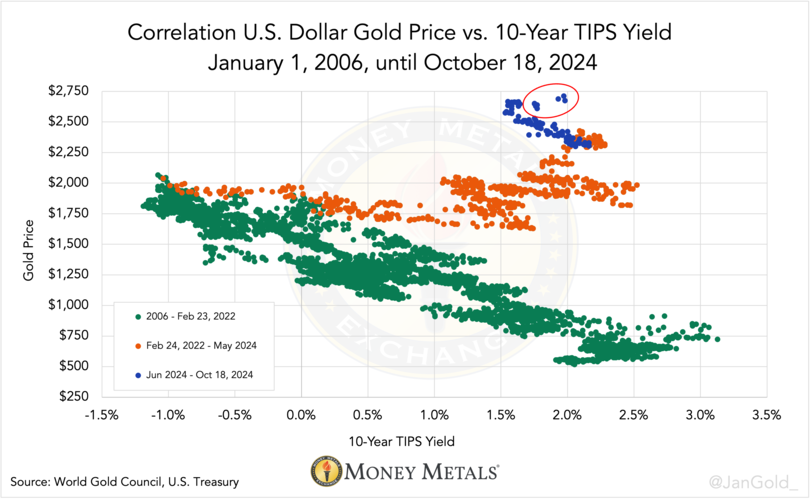

Something new was occurring as gold decoupled from the 10-year Treasury Inflation Protected Securities (TIPS) yield in 2022. Although this made little sense in the long run2, Western traders preferred the TIPS yield for pricing gold from 2006 through early 2022.

To a large extent, the Chinese and Saudi central banks—and to a lesser extent, the private sector in, for example, China, Thailand, and Turkey—were driving gold higher due to geopolitical tensions and deteriorating financial conditions.

From early 2022 until Q2 2024, central banks, in aggregate, bought 2,500 tonnes, of which, according to my research, the People’s Bank of China bought 1,600 tonnes, and its Saudi peer bought 160 tonnes (as explained here and here).

The East was in charge of the gold market during this period.

Western Investors Are Back Buying Gold

What happened since last June is that the gold price has been rising, gold ETF inventory has gone up, and the U.K.—home of the London Bullion Market—has turned into a net importer.

Chart 1. Monthly Western gold ETF holdings. ETF holdings by the rest of the world are only 6% of total gold ETF holdings.

In addition, the gold price was correlated to the TIPS yield again for more than four months. But starting this month, this correlation is now breaking down while the West continues to be the driving force for higher prices.

Chart 2. TIPS yield versus gold price up until October 18, 2024.

Chart 3. Since June, the blue dots have been forming a new diagonal cloud, reaffirming the old TIPS model at a higher price, though in October, the model was aborted (red oval).

Meanwhile, gold demand in the East has moderated. The premium at the Shanghai Gold Exchange went negative starting in July (and still is), Chinese imports have declined in recent months, and the same goes for India.

Global indicators signal the West is back in charge of the market.

A Tight Gold Market

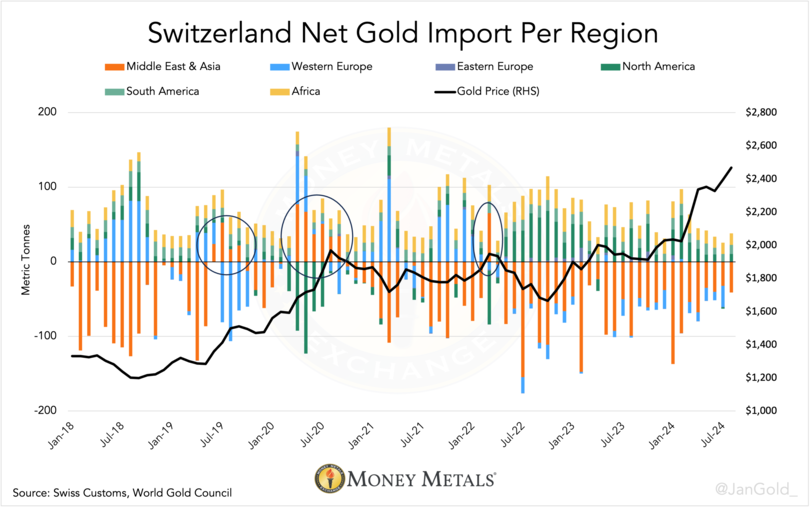

The gold market hasn’t entirely gone back to how it was before 2022. Dishoarding by the East to the world’s largest refining hub, Switzerland (as we saw before 2022 during rising gold prices) has not reoccurred since. My take is that the East is catching some breath in the most recent run-up, but it’s not done buying.

Chart 4. Net gold flows through Switzerland by region. Since Q2 2022, the East, on net, has not been dishoarding to Switzerland, despite higher prices.

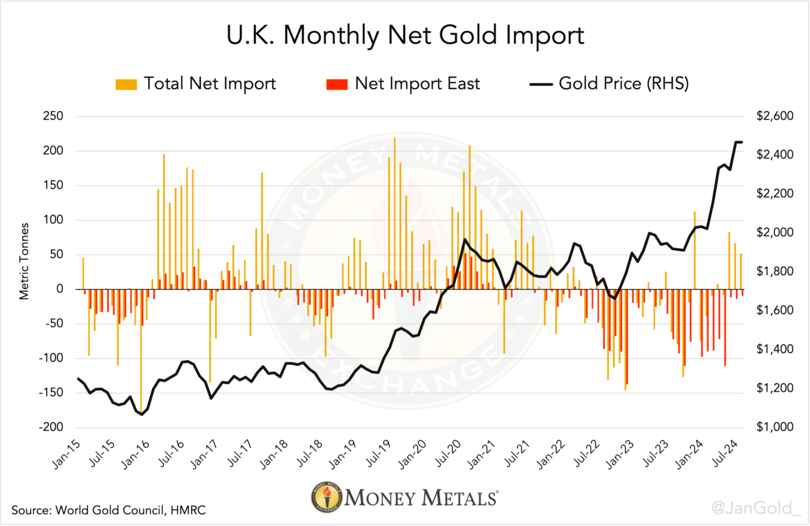

While the U.K., in total, has been a net importer of gold from June through August, causing the gold price to rise, there was a net outflow from Britain to countries in the Middle East and Asia over this time horizon.

Chart 5. Net gold import by the U.K. and its net flow with the East. Many ETFs store their physical gold in London. About 35% of the U.K.’s net flow can be ascribed to ETF hoarding and dishoarding, according to data by Goldchartsrus.com.

Investors in the West buying gold amid a tight market makes the price rise fast.

Wall Street Is Buying Gold as Financial Insurance

Whenever the West pegs the gold price to the TIPS yield, it enters the market mostly for speculative reasons. Instead of aiming, e.g., for a gold allocation of 10%, speculators evaluate real rates (TIPS yield) and make a decision to go long or short the yellow metal. At the end of the day, these speculators only care about making profitable bets on price direction3.

Now, Western investors have shifted from this model, and the gold price is going up. It demonstrates they are changing their views on gold, i.e., from a speculative trade to financial insurance.

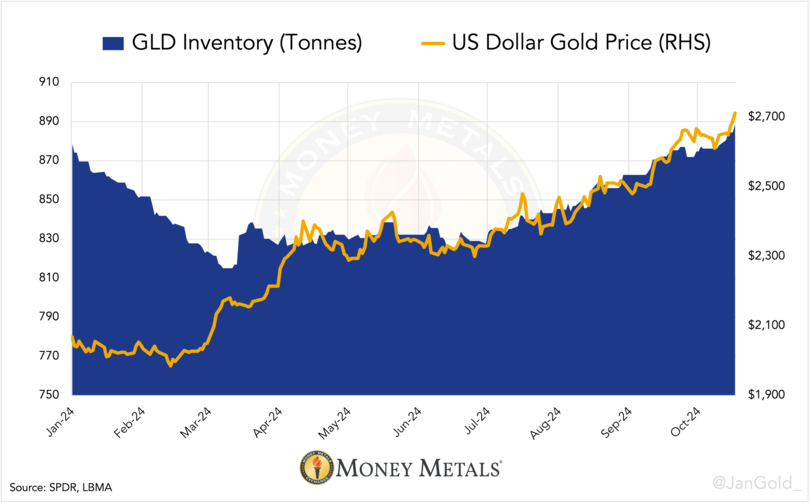

Chart 6. GLD inventory versus gold price up until October 18, 2024.

By using daily data from the largest gold ETF in the West (GLD) as a proxy for regional sentiment, we may conclude Western investors are still driving up gold. Note, this doesn’t mean Western investors all buy derivates such as ETFs; they buy gold outright as well.

Gold Outlook Remains Positive

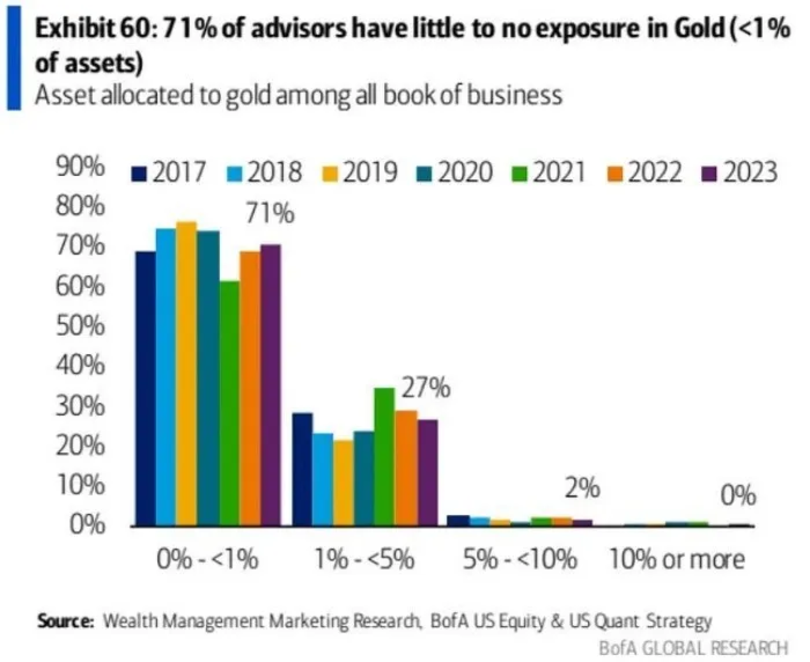

In 2023, a survey by Bank of America (BofA) indicated that 71% of U.S. investment advisors recommend a gold allocation between 0 and 1%, which is almost nothing.

What’s more, their recommendation hasn’t changed since 2017, even though consumer price inflation has since risen to multi-decade highs, two wars have broken out, the West froze $300 billion in Russia’s foreign exchange reserves, and U.S. fiscal policy has spiraled out of control.

These developments make financial instruments that have counterparty risk (and that can be printed infinitely) less popular, which supports the case of owning physical gold.

Chart 7. Courtesy of BofA.

In a June 2024 survey among North American investors by the World Gold Council (WGC), some institutions that didn’t own any gold said one of their barriers was that “other large institutions are not investing in gold.” Wall Street is clearly underweight gold, and there is ample room for price upside when all entities board ship and allocate a substantial share of their portfolios to gold.

A few days ago, a strategist at BofA, ironically, said that gold looks to be the last “safe haven” asset standing, incentivizing traders, including central banks, to increase exposure because Treasurys face risks as U.S. debt levels soar.

“With lingering concerns over U.S. funding needs and their impact on the U.S. Treasury market, the yellow metal may become the ultimate perceived safe haven asset,” BofA wrote.

In conclusion, let’s focus on the main cause that drives gold by examining the long-term ratio between credit and gold.

The rationale behind this approach is that when too much credit is created, the financial system becomes unstable, and the gold price needs to rise, adding more trust to the financial system and restoring stability.

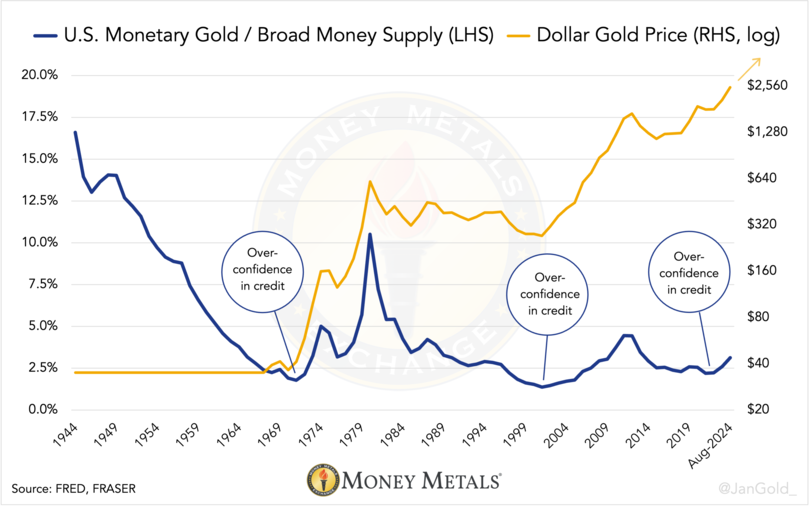

Chart 8. U.S. official gold reserves are divided by the broad dollar money supply (M2).

In the past, every time the ratio between the value of the U.S. monetary gold and the dollar money supply reached a bottom—meaning an abundance of credit was created relative to gold owned by the government providing trustworthiness to its currency—a gold bull market followed.

Similar credit-gold ratios indicate we are in the first innings of a gold bull market. We will analyze these long-term ratios in depth in a forthcoming article.

Notes

- Geopolitical tensions (war and the weaponization of the dollar), high debt levels, lofty equity valuations, and currency debasement.

- To me, the TIPS model has always been illogical because it correlates a nominal price to an interest rate denominated in percentages one on one. Given that the total U.S. public debt, to which the TIPS yield applies, grows much faster than the above-ground gold supply, I don’t see how that model is sustainable.

- Kindly note the gold market is bigger than what is suggested above. The marginal buyer, now in London, sets the price at which the rest of the market (mine supply, jewelry and coin demand, etc.) clears. When gold is correlated to the TIPS yield, investors can be adding to their positions but not in size.

More By This Author:

China's Secret Gold Buying, U.S. Gold Reserve Transparency, And The Future Of BRICS In The Global Gold Market

Why Are Long-Term Bond Yields Rising Despite Rate Cuts?

Gold's Long-Term Returns Are Better Than You Probably Thought

If you enjoyed reading this article please consider supporting "The Gold Observer" by subscribing to the ...

more