Livongo Health: An Exponential Growth Opportunity

When you find a young company with exponential opportunities for growth in the long term, buying early and holding on through the years can produce spectacular returns if the thesis plays out well. Livongo Health (LVGO) is a highly innovative player in healthcare, and the company offers outstanding potential.

On the other hand, Livongo is also a very risky stock, and investors in the company need to be willing to tolerate substantial volatility and fundamental uncertainties in the years ahead.

A Transformative Opportunity

Livongo provides data science technologies to improve the health and the overall quality of life of patients with chronic and behavioral health conditions. The company started with diabetes, and then it expanded to hypertension, pre-diabetes and weight management, and behavioral health in areas such as depression, anxiety, stress, substance abuse, chronic pain, and insomnia with the acquisition of myStrength.

Livongo is pioneering a new category in healthcare called Applied Health Signals. With Livongo for Diabetes, for example, members receive a smart cellular-connected meter, automatically-delivered testing materials, real-time coaching, and monitoring 24 hours a day, seven days a week.

When members track their blood glucose, they receive a highly personalized message about what to do that very moment, which the company calls a Health Nudge.

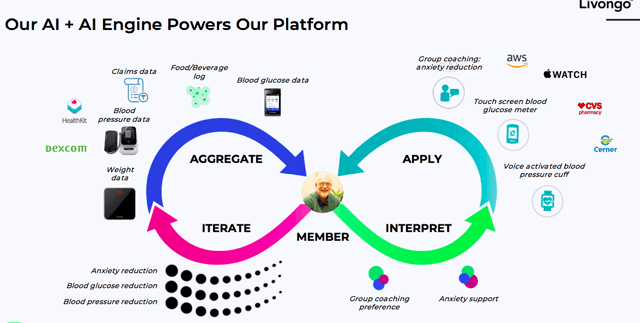

Source: Livongo

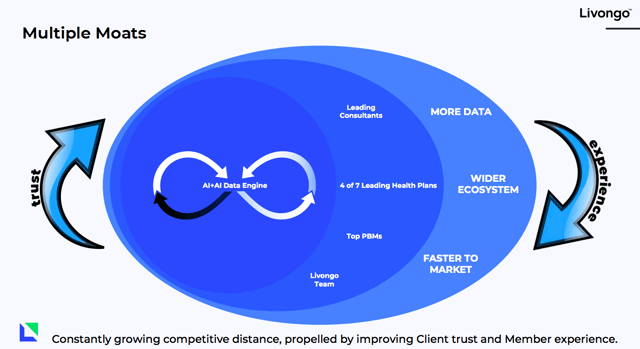

Livongo's proprietary artificial intelligence engine aggregates data from multiple sources, it interprets that data and it offers advice to specific members at specific points in time. This provides a valuable tool to make behavior changes that can lead to better health results and lower costs.

Modifying behavior - doing the right things at the right time - can have a massive impact on your health and your quality of life, and the benefits in terms of healthcare cost savings are also enormous. Importantly, behavior modification is also quite empowering, providing patients with more self-confidence.

The problem is that behavior modification can be remarkably hard to do with consistency. This is why Livongo is offering a truly transformative innovation in the healthcare industry by addressing such a crucial factor.

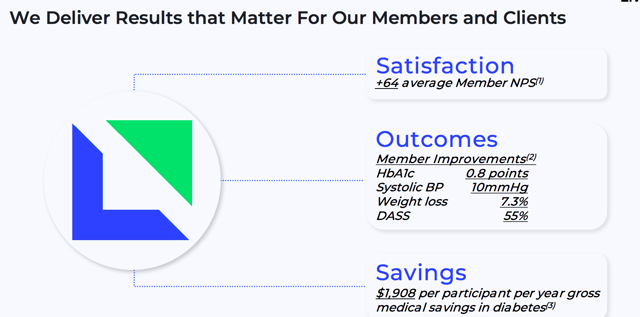

The average member Net Promoter Score among members is +64, so the data is showing that members are more than happy with the results and the overall experience with Livongo.

The company is actively compiling data to show how its solutions can drive superior health outcomes and lower costs. For example, Livongo for Hypertension demonstrated a 10 mmHg reduction in systolic blood pressure over a six-week period in individuals with starting blood pressure greater than 140/80 mmHg.

To date, Livongo has presented 34 papers and abstracts in peer-reviewed articles across its various chronic condition programs, and it has 16 additional papers and abstracts in the pipeline. The company's data shows that it can achieve average gross medical savings of more than $1,900 per participant per year in diabetes alone.

Source: Livongo

Growth Potential And Competitive Strengths

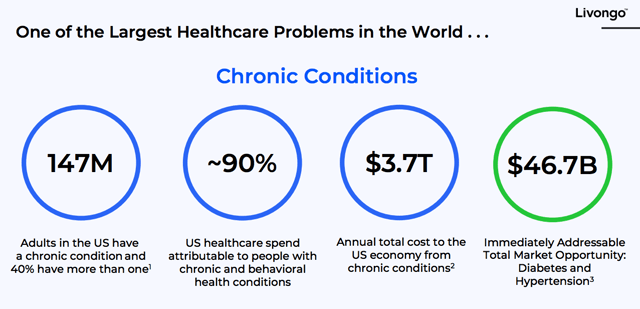

Nearly 147 million adults in the US have a chronic condition, and 40% of those adults have more than one. It is estimated that 90% of healthcare spending is attributable to people with chronic and behavioral health conditions. Only considering Diabetes and Hypertension, the immediately addressable market is estimated at $46.7 billion.

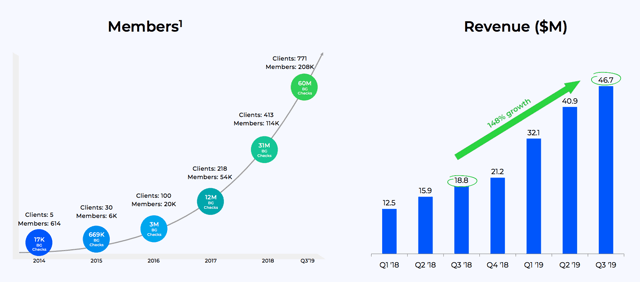

Livongo is barely touching the tip of the iceberg at this stage, there are currently 208,000 Livongo for Diabetes members versus 31.4 million people with diabetes in the U.S. and 500,000 new people being diagnosed with diabetes every year.

Source: Livongo

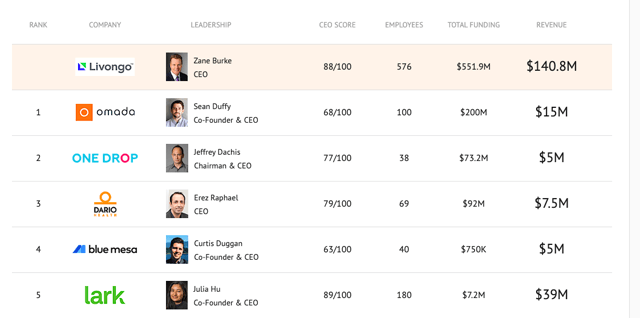

Livongo is a pioneer in the industry, and the company is the top player in the space as measured by factors such as funding and revenue. That said, competitive pressure will most probably increase over the years ahead, and this is an important consideration to keep in mind.

Source: Owler

Over 20% of Fortune 500 companies are currently Livongo for Diabetes clients, and the company has relationships with four of the seven largest health plans and the two leading pharmacy benefit plan managers in the country. CVS Health (CVS) has recently expanded its relationship with Livongo, building on the success of Livongo for Diabetes and adding Livongo for Hypertension, and Livongo for Diabetes Prevention.

The Blue Cross and Blue Shield of Kansas City has recently expanded its adoption of Livongo for Diabetes beyond its self-insured book of business to cover its fully insured clients. Getting into the fully insured book of business is a major validation for Livongo, since it requires intensive testing and due diligence of the company's solutions by the client. Management believes that this can be the first step in a number of wins with the Blue’s plans across the country.

The scale of the platform, the value of the data, proprietary technologies, and the overall size of the ecosystem provide valuable competitive advantage for Livongo.

That said, the company operates in an emerging field prone to technological disruption, so chances are that Livongo will need to face increasing competitive pressure in the years ahead.

Financial Performance And Valuation

Livongo's business model is based on recurring revenue. This provides a predictable revenue stream, which makes it easier to plan for growth and investments. The company's clients are employers, health plans, government entities, and labor unions. New client subscriptions typically have a term of one to three years, and Livongo charges on a per participant per month basis.

The company is growing at an impressive speed. Total revenue for the third quarter of 2019 was $46.7 million, an increase of 148% year-over-year. The company ended the quarter with 207,815 enrolled Livongo for Diabetes members, up 118% year over year.

Source: Livongo

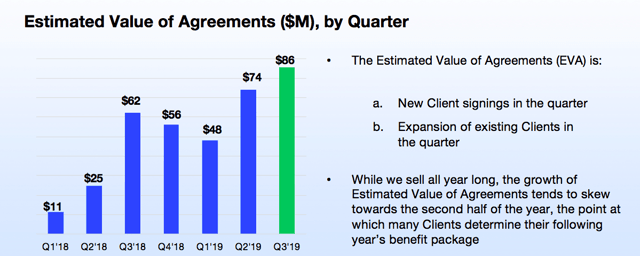

Signings accelerated during the quarter, with a record of 255 contracts in the quarter and 150 scheduled launches. The estimated value of agreements, or EVA, signed in the third quarter of 2019 was a record of $85.5 million.

Source: Livongo

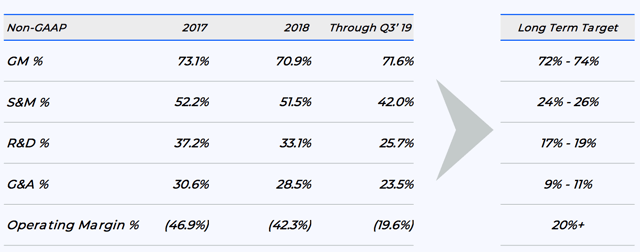

The company has solid gross margins, but sales and marketing, as well as R&D expenses, are a major drag on profitability at this stage. Stock-based compensation expenses amounted to a huge 27.5 million in the first nine months of 2019.

Over the long term, management is aiming for profit margins above 20% of revenue, but there is little visibility as to the time trajectory and the potential for increased margins in the near term.

Source: Livongo

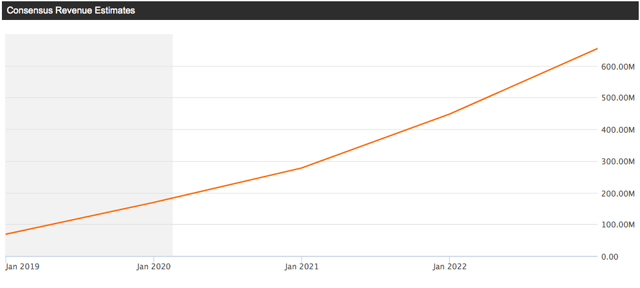

The chart below shows revenue estimates for Livongo over the next few years, and the table shows the revenue estimate numbers and the implied forward price to sales ratios based on those estimates.

Source: Seeking Alpha

The stock is not too cheap based on revenue multiples, but it is not overpriced either in comparison to other high-growth stocks in the market. More importantly, Livongo is still relatively small, and it has a lot of room for growth in the years ahead, so the company could easily justify the price tag if growth expectations materialize.

| Fiscal Period Ending | Revenue Estimate | YoY Growth | FWD Price/Sales |

| Dec 2019 | 168.93M | 146.86% | 15.2 |

| Dec 2020 | 277.72M | 64.40% | 9.24 |

| Dec 2021 | 447.78M | 61.23% | 5.73 |

| Dec 2022 | 654.70M | 46.21% | 3.92 |

Source: Seeking Alpha

If Livongo's business performs well over the long term, then the stock should offer plenty of potential for revalorization from current price levels.

The Bottom Line

Livongo is a pioneer in an emerging area of the healthcare industry, this provides exceptional opportunities for growth over the long term, but also considerable risks from an operational, competitive, and financial perspective.

It is hard to tell what kind of competitive pressure the company will face in the future, but it is only reasonable to expect competition to increase. While Livongo is a first-mover with strong competitive advantages in the market, this is still a major risk factor to consider when assessing a position in the stock.

With a market capitalization value of $2.57 billion, Livongo is relatively small in comparison to the top healthcare companies in the market. This makes the company a good candidate to be acquired by a larger firm, but it also puts Livongo at a disadvantage versus bigger players in terms of scale and financial resources.

Livongo is still losing money and burning cash. The business model could allow for expanding profitability over time, but this still remains to be seen. Even if Livongo moves toward profitability in the coming years, value dilution through share issuance could have a negative impact on returns.

In a nutshell, Livongo is not the right choice for conservative investors looking for a stable business that can produce predictable financial results.

For investors who can tolerate the risks, however, the stock is a pretty unique growth opportunity with extraordinary potential over the long term.

Disclosure: I am/we are long LVGO. I wrote this article myself, and it expresses my own opinions.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not ...

more