Larry Fink Uncomfortably Blurs Crypto Lines

Image Source: Unsplash

What is a digital currency worth? If it has President Donald Trump’s name on it, the answer is more than $7 billion. Despite years of shouting about a decentralized revolution, it’s a reminder that frothy and baseless memes keep flourishing.

Even BlackRock boss Larry Fink, steward of a $60 billion Bitcoin ETF, is getting bullish, telling the Davos crowd that the cryptocurrency could more than quintuple in value if big sovereign wealth investors pile in. It’s a fine line to be treading.

In their 2025 outlook, Goldman Sachs strategists put it bluntly: Bitcoin is “a speculative digital asset more suited to gambling than investing.” It generates no cash flows and has no claim on anything except its own scarcity. Like all cryptocurrencies, the logic is circular: If investors decide it’s different, it is.

And yet Bitcoin has cracked into traditional finance in large part through BlackRock’s exchange-traded fund, now the currency’s largest institutional holder, and others like it. After luring retail investors, Fink now thinks big, sophisticated ones are next.

At a Bloomberg-hosted panel held alongside the World Economic Forum on Wednesday, he cited a conversation with a fund manager about whether 2%, or maybe 5%, of assets is the right proportion to allocate to Bitcoin. If more sovereign wealth managers are thinking this way, Fink said the price could charge ahead from $105,000 to $500,000 or maybe $700,000.

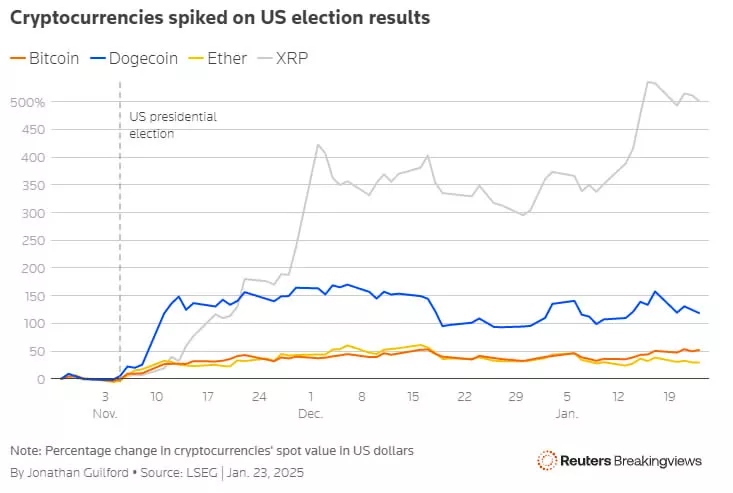

The brief aside, during which he also called cryptocurrency “a currency of fear,” was telling. Bitcoin more than doubled last year. It wasn’t alone, either. Since the self-declared “crypto president” won the U.S. election in November, the market capitalization of all digital currencies tracked by CoinMarketCap has spiked by $1.3 trillion.

If Bitcoin is not a hedge against inflation or a way to diversify – Goldman’s team found only a marginal negative correlation to price rises – then its only real promise is that it will continue to become more valuable.

It’s an odd pitch from a money-managing goliath that markets careful stewardship of its clients’ wealth. Although BlackRock’s CEO is in a reliable position to gauge which way investment winds are blowing, speculating about Bitcoin’s rise is uncomfortably timed amid the launch of Trump-branded coins that are largely owned by insiders.

It makes an especially uneasy pairing with Fink’s declaration that cryptocurrency could help those “frightened” of political or monetary instability. “Number goes up” is probably not the right slogan for a trusted money manager.

Context News

BlackRock CEO Larry Fink said on Jan. 22 that Bitcoin’s price could hypothetically rise to $500,000 or more if sovereign investors embraced the cryptocurrency and allocated higher percentages of the funds they manage to it.

During a Bloomberg-hosted panel alongside the World Economic Forum in Davos, Fink referred to a conversation he had with one fund manager asking if 2% or 5% would be the right proportion. Over the past year, Bitcoin’s price has jumped about 165% to more than $105,000.

More By This Author:

S&P 500 Earnings Dashboard 24Q4 - Friday, Jan. 24Russell 2000 Earnings Dashboard 24Q4 - Thursday, Jan. 23

Spotlight On Fund Flows In Europe Throughout 2024

Disclaimer: This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Refinitiv ...

more