Key Takeaways From Akerna Corp. Q1 2021 Results Of Operation

On 5/10/21 Akerna Corp. (KERN) hosted their Q1 2021 earnings conference call which showed the following continued progress towards the company’s “path to profitability”:

First Quarter 2021 Financial Highlights

- Software revenue was $3.8 million, up 62% year over year.

- Total revenue was $4.0 million, up 31% year over year.

- Gross profit was $2.6 million, up 53% year over year.

- Net loss was $6.3 million compared to a net loss of $4.8 million in the same period last year.

- Adjusted EBITDA was negative $1.8 million compared to negative Adjusted EBITDA of $3.2 million for the same quarter last year.

First Quarter 2021 Key Metrics

- Total SaaS ARR of $15.7 million, up 73% year over year.

- Average new MJ Platform order up 29% year over year.

- MJ Platform transaction volume up 51% year over year.

- Retail order volume up 51% year over year.

- Retail order value up 29% year over year.

- New Bookings ARR of approximately $1M.

These are encouraging signs and the year-over-year comparisons should become more favorable going forward which would provide a catalyst for KERN to trade higher. Another key point is that 2021 will be the first full 12-month results of operation for the 3 acquisitions made in 2020. In addition, KERN will report 9 months of operation from the 4/1/21 acquisition of Viridian Corp., which the company has stated will be cash positive, which increase investor interest in KERN stock. The company’s recent trading volume has been much lower than the 90-day average of 1,370,000. Based on the promising Q1 results of operation, I anticipate increased volume and trend towards the 50-day of $4.44, which was last achieved on 4/13/21. KERN is a portfolio company of the Amplify Seymour Cannabis ETF (CNBS) and continued improving performance may attract the support of institutional investors, who as a group are known to be “patient” (or "long-term”) investors.

As part of my due diligence in the preparation of this article, I reviewed KERNs 2021 Q-1 filed on 5/21/21 which stated in part:

“ During 2020, we implemented a number of cost reduction initiatives reducing costs and identifying cost savings that we expect to result in annual savings of an additional $3.0M to $4.0M”

This will positively affect the company’s 2021 “bottom line” and coupled with increased revenues due to the aforementioned acquisitions and is a bullish indicator.

Company Leadership

Jessica Billingsley is Akerna’s Chairman of the Board &CEO. In June 2019 she became the first CEO of a cannabis ancillary company to be listed on NASDAQ. She co-founded MJ Freeway in 2010, where she served as President until April 2018, and later as the CEO until MJ Freeway was acquired by MTech to form Akerna Corp. and became a publicly-traded company on 6/18/19.

MJ Freeway

MJ Freeway is the cornerstone service offering of the Akerna family, which is the world’s largest global cannabis software company. Established in 2010, MJ Freeway invented seed–to–sale technology and developed the industry’s first cannabis enterprise software solution, MJ Platform. To date, MJ Freeway has tracked more than $20 billion in legal cannabis sales.

MJ Freeway provides cannabis-specific technology solutions, with a cloud-based seed-to-sale software platform, robust analytics, and the most experienced consulting team in the industry

Company 2020 Acquisitions

Akerna made the following acquisitions in 2020:

On 1/21/20Akerna announced the acquisition of a majority interest in privately held solo sciences inc., a recognized leader of patented anti-counterfeiting and consumer engagement technologies.

The solo sciences' mission is to build confidence and establish trust among consumers, enabling retailers and distributors to close the loop with creators and producers.

On 4/8/20 Akerna acquired Trellis, a cannabis cultivation management, and compliance software company for $2.0 million in an all-stock transaction. Trellis provides clients with the technology to manage and optimize their operational workflow throughout to cultivation, manufacturing, and distribution supply chain.

On 7/7/20 Akerna acquired 100% of the outstanding equity interest in Ample Organics, Inc. and Ample’s wholly-owned subsidiary, Last Call Analytics in exchange for Akerna common stock valued at $25.2 million.

Ample Organics is Canada’s leading seed-to-sale software solution fostering transparency, compliance, and trust between cannabis license holders, government bodies, and the public.

Ample has more than a 70% market share among Canadian license holders and “cannabis compliance made easy” is their stated mission according to the company’s website

Last Call Analytics leverages beverage-alcohol industry data to uncover consumption trends and other customer-driven insights that will improve decision making, performance, and sales.

Company 2021 Acquisition

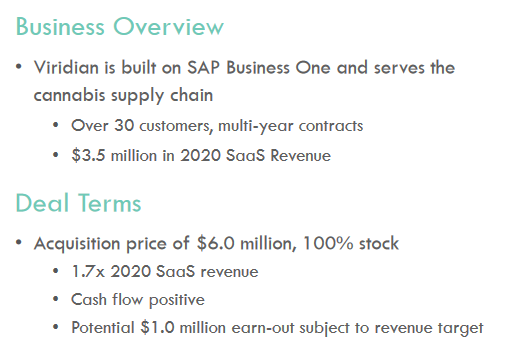

On 4/6/21 announced that the company had closed the acquisition of Viridian Sciences, a cannabis business management software system built on SAP Business One.

Here is a link to the investor presentation which provides comprehensive details about this transaction.

Thestreet.com reported on the significance of the SAP certification as follows:

“Cresco Labs (CRLBF) CIO talked about how important it was that Akerna Corp., the cannabis industry's first seed-to-sale enterprise resource platform, announced it has reached SAP Certification.”

Based on the endorsement of CRLBF, it would appear prudent for KERN to pursue a strategic alliance with this~ $5B market capitalization cannabis company.

Company 2021 Stock Performance

As the above chart shows, KERN has gained 10.2% YTD and closed at $3.57 on 5/24/21. Since 5/14/21 the stock has traded in a tight trading range of between $3.40 and $3.64. In my view, the sharp decline in KERN from $5.80 on 3/12/21 is due in part to a 5/7/21 SC 13G/A form filed with the SEC which disclosed that the company’s largest institutional holder had trimmed their ownership by 7.5%. Akerna’s trading pattern since 5/7/21, the trading pattern suggests KERN may be forming a support level close to its present price, and then be in position to trend to higher levels.

“Under the radar” Green Shoots May Be on The Horizon

In my view, the following 3 “green shoots” which would provide catalysts to a price spike in Akerna stock have not yet come to the full attention of Wall Street:

- On 5/12/21 Forbes reported that Trulieve Cannabis Corp. (TCNNF) the largest marijuana company in Florida, has reached an agreement to acquire Harvest Health & Recreation Inc. (HRVSF), the largest marijuana company in Arizona, in a $2.1 billion deal that would create the biggest cannabis company in the nation. This is a significant event for KERN since TCNNF is a key customer of Ample Organics Inc. Based on my cursory extrapolation of the financial data, over time this may result in a 20% or more increase in revenue from the TCNNF/HRVSF mega-merger. I also surmise KERN may be able to derive additional consulting income, which has a higher contribution margin, due to the integration of this business combination.

- In my view, the Viridian acquisition was on very favorable terms and the ability to automate key financial business functions will enhance the company’s SaaS business model and has the potential to materially increase their recurring revenue streams.

- In addition, there has been a crescendo of recent speculation that the Senate may approve the Safe Banking Act, which would be a big plus to the cannabis sector, including constituent companies access to capital, which has been hamstrung during the COVID-19 crisis. There is also anticipated that the Biden/Harris administration will spearhead passage of Federal legislation favorable to the industry, based on a platform of job creation and increased tax revenues.

The time frame for any of these “green shoots” to germinate and sprout is uncertain, and in the case of the Safe Banking Act, beyond the company’s control. But there is at least the potential for a positive effect on KERNs “path to profitability” in 2021 and beyond.

Conclusion

Based on the foregoing financial and operational review, I have added Akerna Corp. to my “stocks to watch” list based on their compelling value proposition, “first-mover advantage” and wide moat. The fundamental issue is centered around management’s ability to achieve higher revenues and earnings and positive cash flows synergies from their recent acquisitions and to be able to grow the business organically. A higher stock price would also support the company’s M & A expansion strategy. I believe that investors with a high-risk tolerance should consider initiating a starter position in KERN with a nominal portion of their "mad money” once the stock price has stabilized. Since the company has a beta of 3.63, discipline and timing are two key ingredients to success.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time ...

more

Recent large insider buy as reported here by FINTEL is a bullish indicator.

Impressive!

Thanks, I've been following $KERN since @[Lorimer Wilson](user:22485) and @[Maithya Kitonyi](user:5402) started covering it. Lorimer/Maithya, are you still bullish on $KERN?

Yes absolutely. There is a lot to unlock still. My previous target was $7.00-$8.00 but actually, now I think it's not farfetched to look at the price potentially hitting double digits in the next 12 months.

Nicely done. $KERN looks good.

Good read, thanks.