Jobs Shocker: Sept Payrolls Print Above All Forecasts, But Unemployment Rate Hits 4 Year High

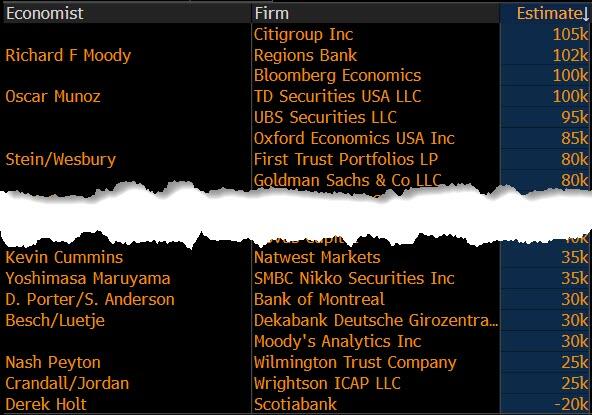

In our preview of today's jobs report, we showed that the range of estimates is (extremely) broad, from 105K on the upper end, to just -20K on the lower.

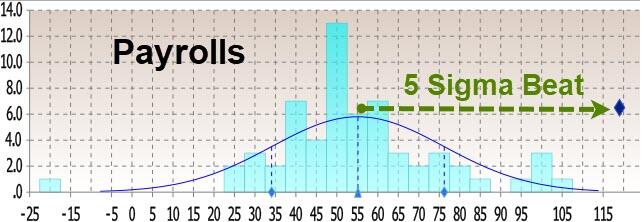

We also said that if today's jobs number is atrocious, the Fed would once again be viewed as being behind the curve. So perhaps working in conjunction with the newly returned BLS employees, the outgoing Fed chair snuck in a pointer or two, and in an attempt to avert allegations of blowing up the economy, moments ago the BLS reported that the (delayed) September number came in a stronger than all estimates 119k jobs...

... a 5 sigma beat to the median estimate...

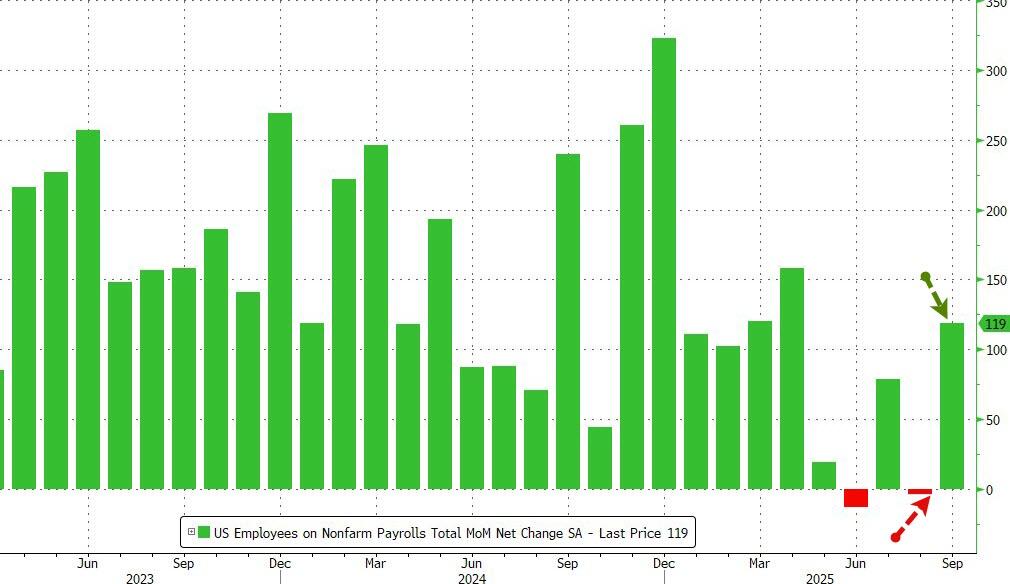

... which however followed yet another downward revision, as the total nonfarm payroll employment for July was revised down by 7,000, from +79,000 to +72,000, and the change for August was revised down by 26,000, from +22,000 to -4,000 (so much for Goldman's thesis August would be replaced sharply higher).

With these revisions, employment in July and August combined is 33,000 lower than previously reported, and continues the trend of relentless downward revisions.

Manufacturing jobs fell for the sixth straight month...

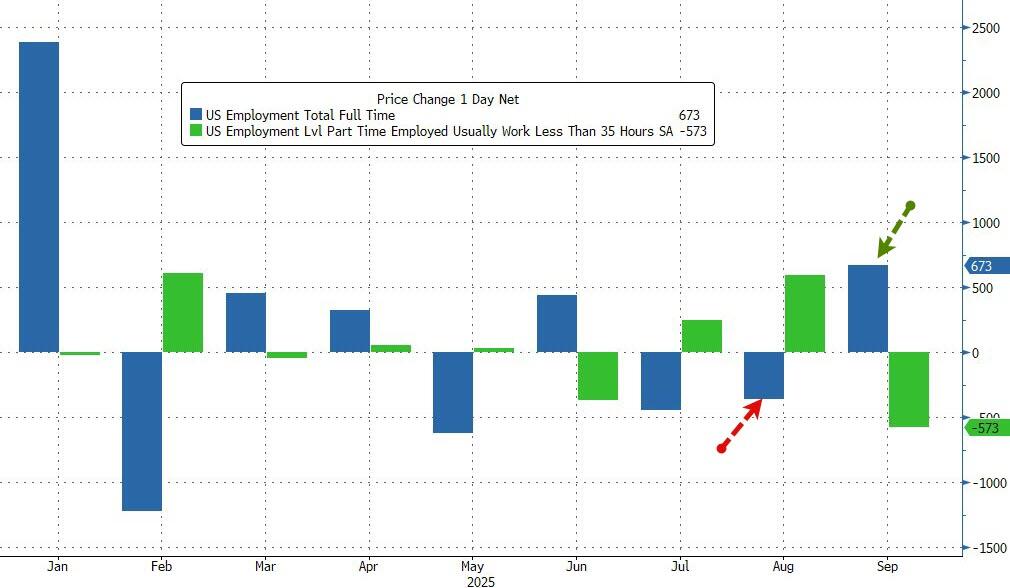

After August's surge in part-time jobs (decline in full-time), September flipped the script with a surge in full-time jobs as part-tiume jobs tumbled...

BUT... The US unemployment rate jumped to 4.4% in September - its highest in four years...

Led by Black unemployment...

The participation rate rose for the second month in a row...

But earnings growth slowed in September...

Rate-cut odds are higher following the jump in the unemployment rate...

Now, what will FedSpeak do now?

More By This Author:

Walmart Beats Earnings, Hikes Guidance As Consumer Trade-Down Accelerates"GPUs Are Sold Out": Nvidia Soars After Blowing Away Results, Projections

FOMC Minutes Expose Fractured Fed; "Many" See No Tariff Inflation, "Several" Fear Disorderly Drop In Stocks