Job Openings Slide, As Number Of Hires Unexpectedly Plunges

Image Source: Pexels

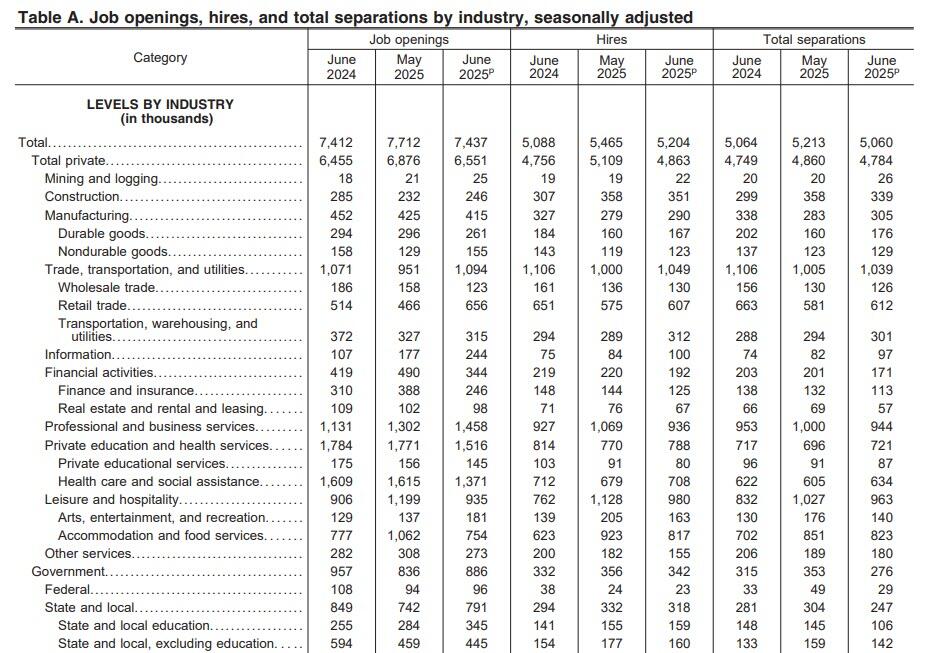

After several consecutive stronger then expected job openings reports and one month after the JOLTS report showed an unexpected surge in job vacancies, moments ago the BLS said that in June (with its usual one month lag, coming just days before the July nonfarm payrolls report), job openings in the US dropped to a lower than expected 7.437 million, down 275K from 7.712 million in May, and below the 7.5 million estimate.

According to the BLS, the number of job openings decreased in accommodation and food services (-308,000), health care and social assistance (-244,000), and finance and insurance (-142,000). The number of job openings increased in retail trade (+190,000), information (+67,000), and state and local government education (+61,000).

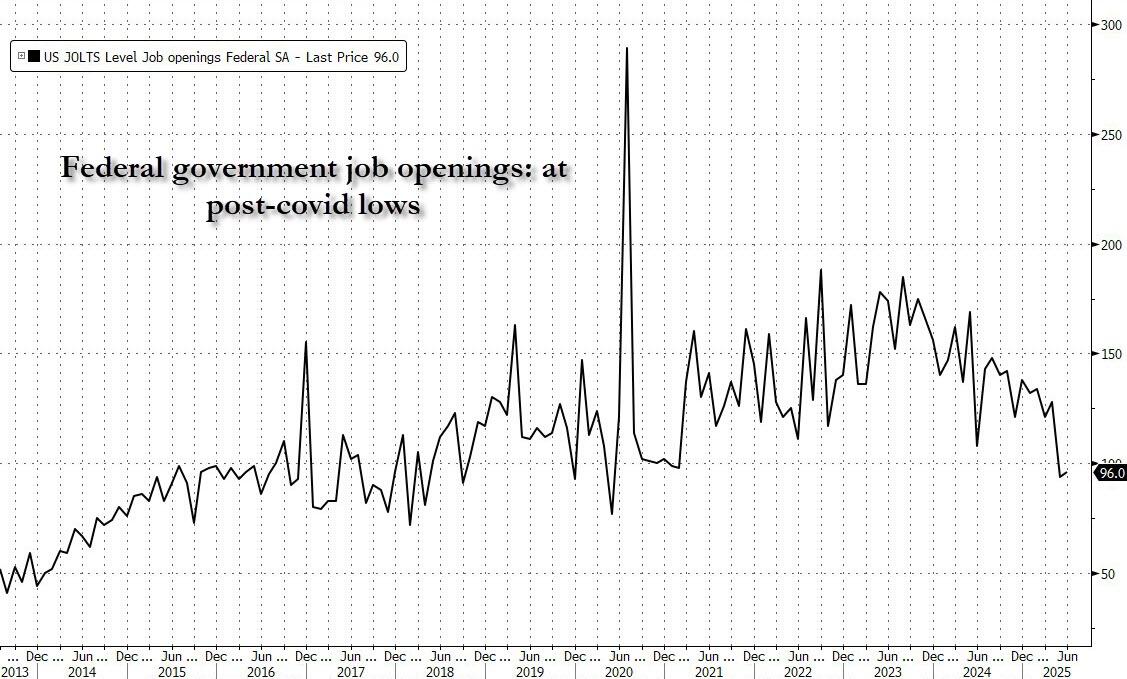

A testament to (what's left of DOGE), is that Federal job openings remained near the post-covid cycle lows, rising just 2k from 94K to 96K.

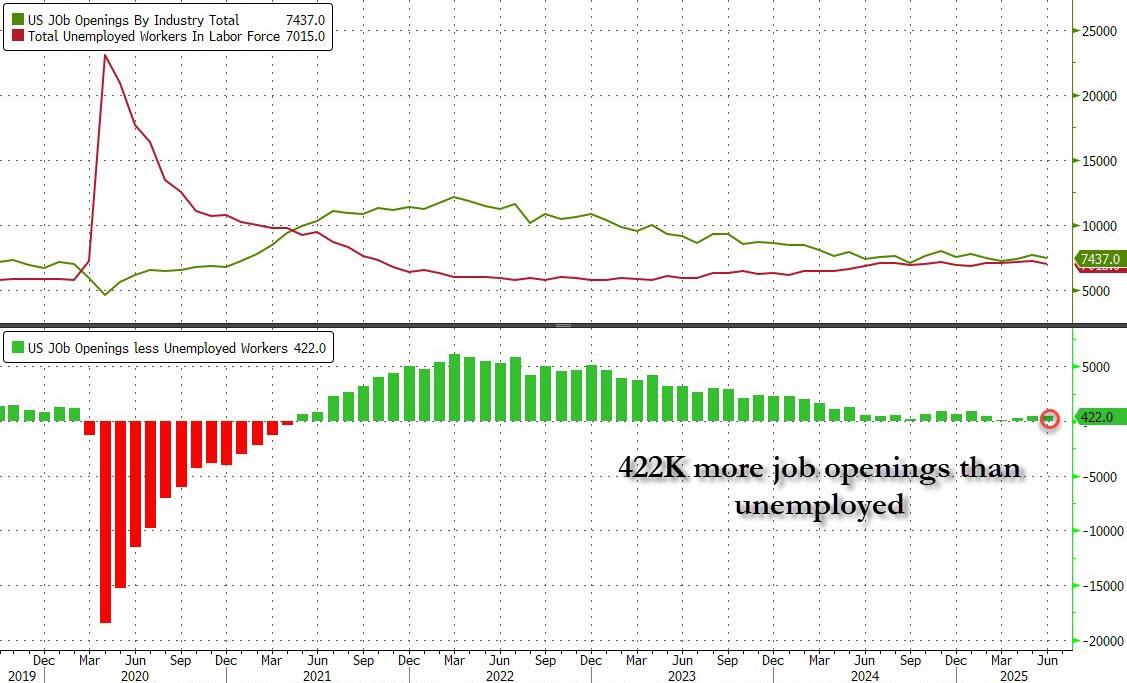

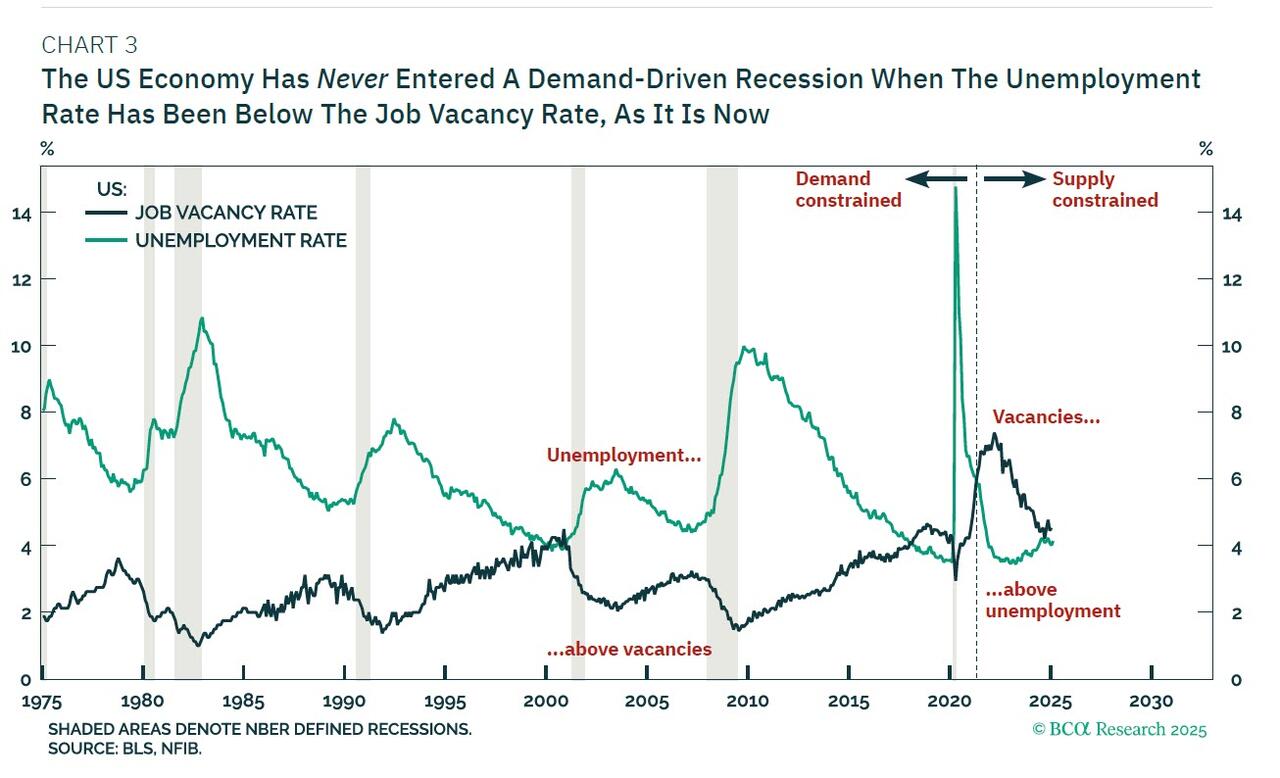

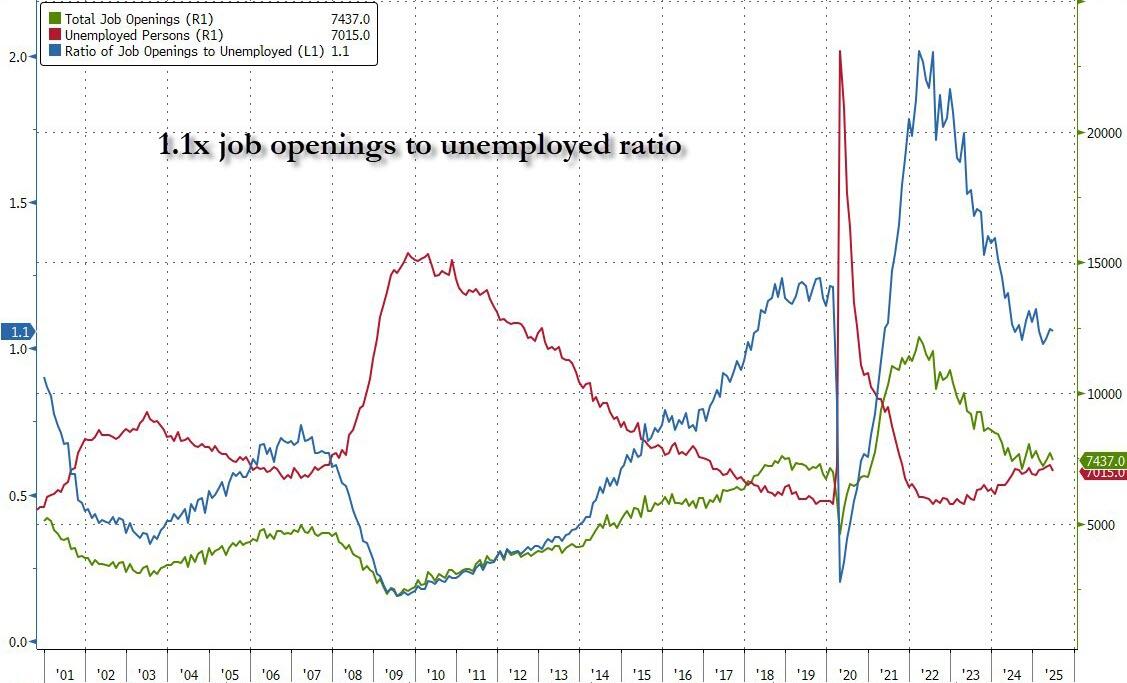

In the context of the broader jobs report, it appears the US labor market may have dodged a bullet because whereas in March the labor market was almost demand constrained, when there were just 117K more openings than jobs in the US, since then the differential has risen and in June the number of job openings was 422K more than number of employed workers, suggesting the onset of a labor recession has once again been punted.

As noted previously, until this number turns negative - which it almost did but may have now averted for the foreseeable future - the US labor market is not demand constrained, and a recession has never started in a period when there were more job openings than unemployed workers.

Said otherwise, in June the number of job openings to unemployed was pretty much flat sequentially at 1.1x.

While the job openings data was in line - the drop was to be expected and the miss was modest - it was far uglier on the hiring side where the number of new hires unexpectedly plunged by 261K...

... to just 5.204 million, the lowest in a year, and the second lowest since covid, raising questions about the stability of the US labor market. Meanwhile, the number of workers quitting their jobs - a sign of confidence in finding a better paying job elsewhere - also unexpectedly slumped by 128K to 3.142 million, also one of the lowest prints since Covid.

How to make sense of this sudden improvement in the labor market?

It likely has to do with the DOL starting to factor in the collapse in the shadow labor market - the one dominated by illegal aliens - and the replacement of illegals with legal, domestic workers. The question is how long until this appears in much weaker-than-expected payrolls prints - we may find out as soon as this Friday when we get the full jobs report for July. And since this will surely lead to higher wages, we doubt many Trump supporters will hate the development, even if it means an increase in inflation down the line.

More By This Author:

US Goods Trade Deficit Shrinks More Than All Expectations In JuneTreasury Boosts Q3 Debt Borrowing Estimate To $1 Trillion From $554 Billion To Replenish Cash Balance

Ugly, Tailing 5Y Auction Sees Lowest Foreign Demand In 3 Years

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more