Japan: Data Points To Gradual Recovery, Raising Odds Of May Rate Hike

Image Source: Pexels

The latest data point to a gradual recovery in Japan’s economy, as industrial production, retail sales, and the labour market remain positive. The Tankan survey was mixed, but the overall tone was relatively upbeat despite concerns about US trade policy. This supports the BoJ delivering a 25 basis-point hike in May.

Service-sector-led growth is likely to continue

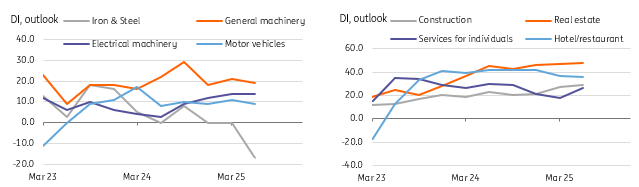

The Bank of Japan’s Tankan survey points to softening manufacturing sentiment. The large manufacturing index was down to 12 (vs 14 in the fourth quarter of 2024, market consensus 12). The outlook also was down to 9 (vs 12 in the fourth quarter of 2024, market consensus 9), but higher than market expectation. This seems mostly due to the rising threat from US tariffs. Yet, headline indices remain in positive territory. Sentiment among car manufacturers, meanwhile, hasn't dampened much. But we see a sudden drop in the iron and steel sector, on which tariffs have been already imposed.

For non-manufacturing, sentiment in construction and other key services sectors improved or stayed well above the neutral level. We interpret the strong confidence in non-manufacturing as mostly due to solid wage growth and an influx of foreign tourists into Japan. We expect that the BoJ will pay more attention to the relatively upbeat sentiment from the non-manufacturing sector, as it tends to trigger upside inflationary pressures.

Non manufacturing outlook more upbeat than manufacturing

Source: CEIC

Hard data also suggest a modest GDP rise in 1Q25

February's industrial production and retail sales, released yesterday, beat market consensus. There also was a significant upward revision to January's retail data. Markets had expected retail sales to drop amid high inflation during the month. Instead, we saw a modest gain. Meanwhile, today's labour data showed relatively tight conditions with the unemployment rate falling to 2.4% (from 2.5%).

Analysing both soft and hard data, first quarter GDP will grow modestly after a solid 0.6% quarter-on-quarter, seasonally-adjusted, pace in the fourth quarter of 2024. We expect 0.2% GDP growth in the first quarter, with upside risks rising. Forward-looking data suggest a moderation of confidence and activity as a 25% tariff on cars and other products may hurt growth from the second quarter onwards. However, the BoJ's main focus should remain on inflation for now. With inflation staying above 2%, backed by strong wage growth and consumption, we expect the BoJ to deliver a 25 basis-point hike in May.

More By This Author:

The Commodities Feed: Secondary Tariff Threats Push Oil HigherRates Spark: Market Rates Getting Tempted Lower

National Bank Of Poland Forced To Amend Hawkish Stance Amid Lower Inflation

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more