ISM Services Survey Surged In July

After the shitshow of Soft Survey data on the Manufacturing sector last week, analysts are hoping for some heroics from the Services sector. Amid the collapse in 'hard' data, soft survey data remains the last great hope for saving Bidenomics (with all hopes on a big rebound in ISM from last month's plunge)...

- S&P Global US Services PMI dropped from 55.3 to 55.0 (below 56.0 expectations)

- ISM Services PMI surged back from 48.8 to 51.4 (510.0 exp)

Source: Bloomberg

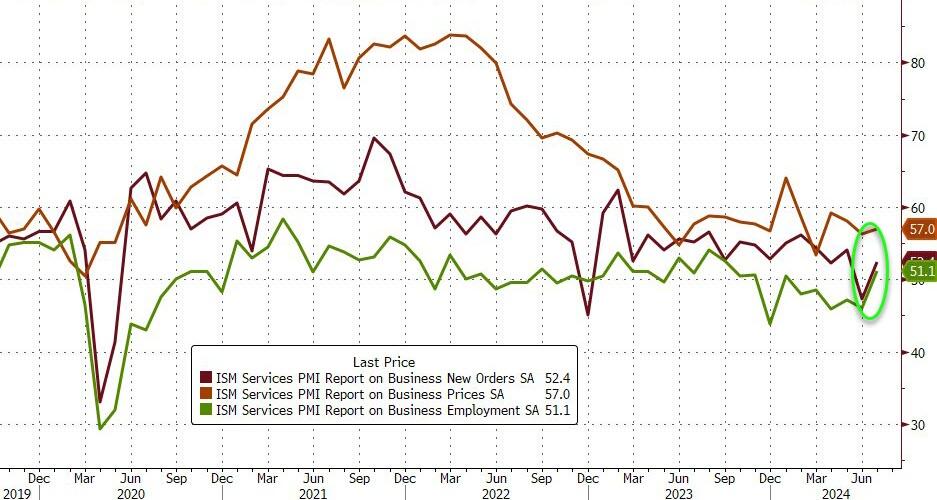

And while payrolls and orders hard data have been a disaster, the soft-survey data shows orders and employment rising...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

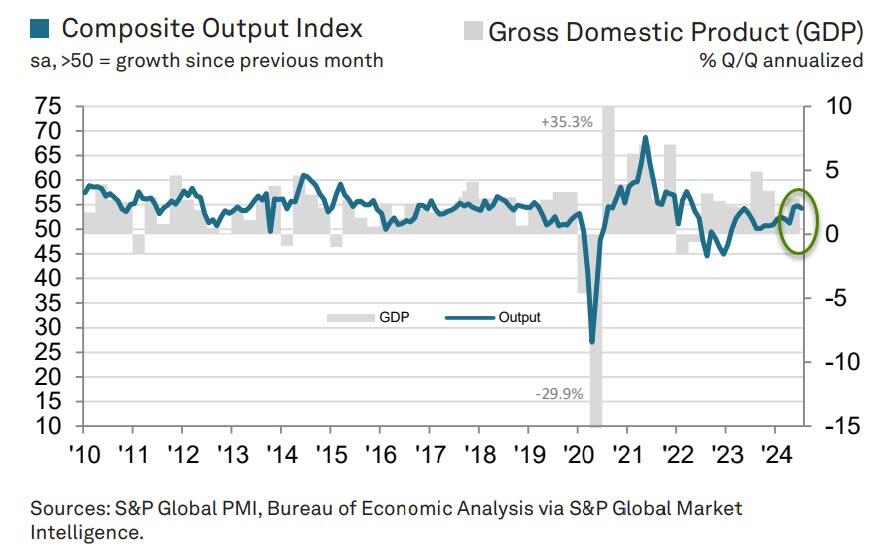

“Another strong expansion of business activity in the service sector, which over the past two months has enjoyed its best growth spell for over two years, contrasts with the deteriorating picture seen in the manufacturing sector, where output came close to stalling in July.

“While manufacturers are reporting reduced demand for goods, this in part reflects a further switching of spending from consumers towards services such as travel and recreation. However, healthcare and financial services are also reporting buoyant growth, fueling a wide divergence between the manufacturing and service economies.

“Thanks to the relatively larger size of the service sector, the July PMI surveys are indicative of the economy continuing to grow at the start of the third quarter at a rate comparable to GDP rising at a solid annualized 2.2% pace.

Finally, and certainly not inconsequential, service providers signalled a further sharp rise in input costs, with the rate of inflation quickening to a four-month high.

The latest increase was also sharper than the series average. Respondents indicated that higher wage and transportation costs had been the main factors pushing up input prices.

So take your pick - Services growth slowing (S&P Global) or surging (ISM) with prices rising sharply (S&P Global) or not much at all (ISM)...

More By This Author:

Black Monday: Futures Plummet As VIX Hits 62, Japan Suffers Worst Point Drop In HistoryNew IRS Rules Create Headaches For Post-2019 IRA Inheritors

Goldman Says Mid-Atlantic Power Prices "Finally Caught Up To AI Data Center Load Growth Story"

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more