ISM Services Survey Explodes To Record High (And So Does Cost Inflation)

After the mixed final data for US Manufacturing in November (Markit PMI down, ISM up), expectations were for both Markit and ISM to show the Services sector weakened modestly in November.

- Markit US Manufacturing dropped from 58.4 to 58.3

- Markit US Services dropped from 58.7 to 58.0 (better than the 57.0 flash print)

- ISM Manufacturing rose from 60.9 to 61.1

- ISM Services exploded higher from 66.7 to 69.1

Spot the odd one out...

(Click on image to enlarge)

Source: Bloomberg

That is the highest ISM Services print... ever...

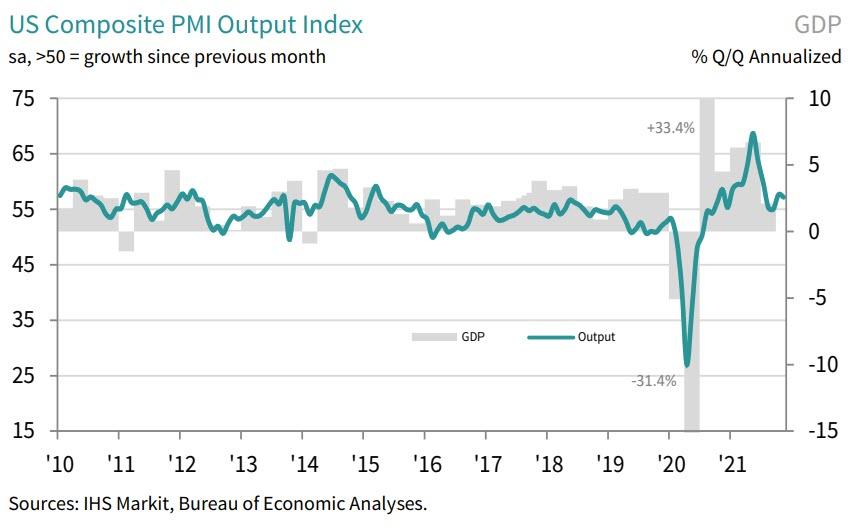

The IHS Markit US Composite PMI Output Index posted 57.2 in November, down from 57.6 in October but still signaling a marked overall expansion in private sector activity. Output was led by the service sector as factories were hampered by supply chain disruptions.

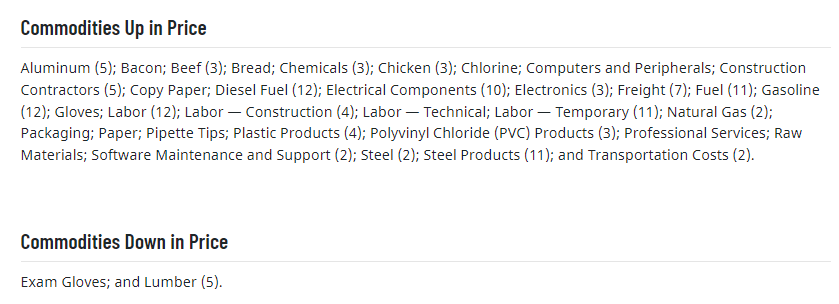

Sharper increases in manufacturing and service sector input prices led to the fastest rise in cost inflation on record (since October 2009). Alongside greater fuel and material costs, firms noted a steeper uptick in wage bills. Although the rate of charge inflation softened from October, it was the second-sharpest on record as firms sought to pass on higher costs to customers.

On the bright side, 'Exam Glove' prices are down (so let's all rush out and get our prostate tests!!)

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

“US business activity continued to grow at a solid rate in November, adding to signs that the pace of economic growth is accelerating in the fourth quarter after the Delta-wave induced slowdown of the third quarter. While growth is not matching the surge seen earlier in the year when the economy reopened, the fourth quarter expansion should be well above the economy’s long-run trend to mark a solid end to the year.

“Growth is lopsided, however, being led by the service sector as manufacturing remains heavily constricted by supply shortages and, in some cases, labor supply issues. These constraints are also increasingly affecting service providers, as evidenced by the service sector reporting a near record build-up of uncompleted orders during November as companies often lacked the capacity to meet demand. Cost pressures in the service sector also spiked higher in November, generally linked to higher prices paid for inputs and staff due to shortages, the rate of inflation running just shy of May’s all-time peak.

“While business expectations for the year ahead rose in November, the vast majority of the survey data were collected prior to the news of the Omicron variant, which casts a renewed shadow of uncertainty over the outlook for business and poses a downside risk to near-term growth prospects.“

Just as a reminder, with regard to ISM Services' outlier move, ISM's index of supplier delivery times held at the second-highest on record, indicating delays are still well-extended... and this 'disruption' in the supply chain is integrated entirely bullishly into the headline index (reflecting record demand as opposed to disrupted supply chains and many points of failure around the world).

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more