ISM Manufacturing Tumbles To Post-COVID Lows, Employment Slumps

US 'hard' macro data has continued to surprise the upside in the last month (despite 'soft' regional Fed survey data fading), and consensus expected both ISM and PMI Manufacturing surveys for March to show another month of contraction.

- S&P Global US Manufacturing PMI Final March 49.2, down from flash print at 49.3, but up from the 47.3 in Feb - that is the 5th straight month of contraction (sub-50)

- ISM Manufacturing March dropped to 46.3, from 47.7, and below 47.5 expectations - that is the 5th straight monthly contraction to the lowest since May 2020

(Click on image to enlarge)

Source: Bloomberg

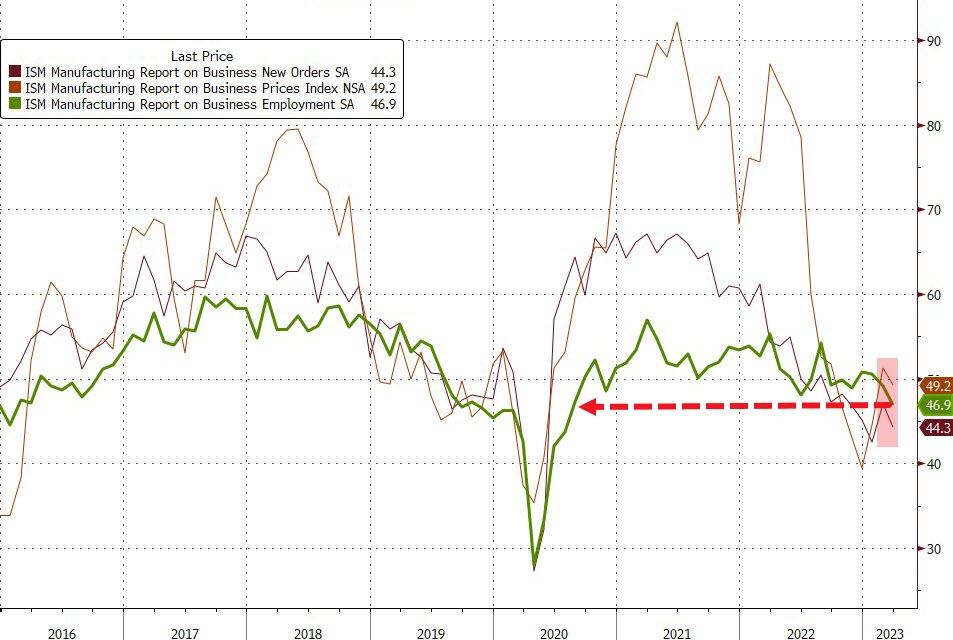

Under the hood, ISM is ugly with employment weakest since July 2020...

Source: Bloomberg

New Orders/Inventories have stopped improving as the signal remains deeply in recession-signaling territory...

(Click on image to enlarge)

Source: Bloomberg

Siân Jones, Senior Economist at S&P Global Market Intelligence, said:

“The US manufacturing sector continued to signal concerning trends during March. Although output rose for the first time since last October, growth was fractional, and largely supported by ramping up production following an unprecedented reduction in supply chain pressures. "

"The timely delivery of inputs allowed firms to work through backlogs, but sparse demand amid pressure on customer spending due to higher interest rates and inflation spoke to challenges ahead for goods producers if there is little change in domestic and international client appetite. "

"Weak demand for inputs resulted in some relief for manufacturers as input cost inflation slowed again. A paucity of new orders sparked efforts to entice customers, however, as selling price inflation eased notably to the weakest since October 2020. Nonetheless, inflationary concerns weighed on business confidence once again amid pressure on margins.

"Encouragingly, firms were able to expand factory workforce capacity again, albeit at only a marginal pace, as skilled candidates for long-held vacancies were found."

Finally, here's how S&P Global describes the way forward:

Goods producers remained strongly upbeat in their outlook for output over the coming year in March. Hopes of greater client demand drove optimism. Confidence slipped to the lowest level in three months amid inflation concerns, however.

Confused?

More By This Author:

Banks Bust As Big-Tech Booms In Q1, Gold & Crypto Soar As Dollar DumpsLarge US Banks Saw Record Deposit Outflows Last Week, Small Bank Outflows Stall

"Recession Ahead" - UMich Consumer Sentiment Slides For First Time In 4 Months

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more