Is Your Portfolio Suffering From The Coronavirus Outbreak?

Among other things, the outbreak of the Coronavirus has re-introduced volatility back into the market and back into most investment portfolios.

Idiosyncratic shocks can be challenging to deal with. There is no way to predict when the virus outbreak will be contained, and when asset prices will stop declining. Human emotion is also nearly impossible to model. The negative hit to economic growth globally is nothing but speculation at this point.

Without a balanced portfolio, it becomes a great challenge to make good decisions with so much uncertainty. More often than not, periods of uncertainty and heightened volatility create the most significant investment mistakes.

At EPB Macro Research, we take a different approach to portfolio strategy and actually thrive during market turbulence.

We start with a portfolio that is balanced based on risk and simply "tilt" the portfolio in the direction of the assets that have the best risk-reward profile for the coming economic environment.

This strategy has allowed the EPB Macro Research portfolio to maintain an extraordinarily low level of volatility, even during uncertain times such as this recent virus outbreak.

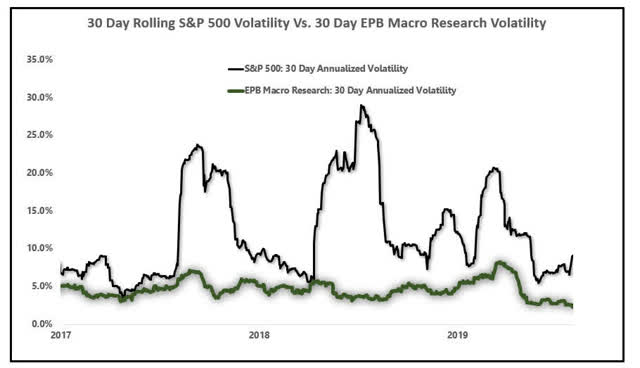

The chart below shows the rolling 30-day volatility of the EPB Macro Research model portfolio and the S&P 500.

The EPB Macro Research portfolio consistently posts volatility under 5%, less than 1/3 of the average stock market volatility.

Rolling 30 Day Portfolio & S&P 500 Volatility:

Source: EPB Macro Research

Each time volatility in the marketplace spikes, but your portfolio continues to move higher, you put yourself in a position to capitalize on large market mispricings.

Most investors always miss significant dislocations in the market because their portfolio volatility swings wildly with the market at the most critical times.

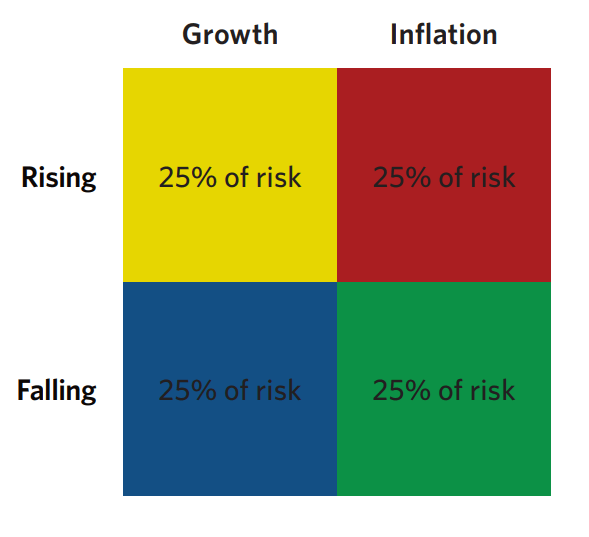

As mentioned, we start with a portfolio that is balanced based on risk with assets that benefit from prosperity, recession, inflation, or deflation.

Allocation of RISK or Volatility:

Source: Bridgewater

The "All Seasons" portfolio, made popular by Ray Dalio, is a great starting point that allocates "risk" or volatility to all four possible economic scenarios outlined above.

From the starting point of a portfolio with stocks, bonds, gold, and commodities, we can then "tilt" the asset allocation towards the asset class that has the most favorable risk-reward profile.

Given the secular decline in economic growth and the cyclical downturn spilling over from 2019, the model portfolio at EPB Macro Research "tilted" more heavily towards Treasury bonds, which generated amazing risk-adjusted returns.

As stock market volatility increases rapidly, the EPB portfolio has seen volatility decrease while returns have continued to move higher, a great position to be in to make sound decisions when volatility is high.

From a humanitarian standpoint, the Coronavirus is very concerning, and a speedy solution is clearly hoped for.

In regards to our portfolio, more volatility is better as our allocation has assets that benefit from all the zigs and zags of the day to day market.

The EPB Macro Research Model portfolio is updated one time at the end of each calendar month. With just several updates, the EPB portfolio has achieved a higher risk-adjusted return than the S&P 500, 60/40 portfolio, and bond market aggregate since inception in 2017.

With a firm grasp on secular economic conditions and fully equipped with leading indicators of growth/inflation, we can make the best assessment of the economy and where to allocate extra risk. The portfolio construction, which should be taken as a whole rather than a basket of individual ideas, will guard against shocks and keep portfolio volatility down.

The portfolio "tilt" that comes from the economic cycle analysis is where you generate alpha.

The global industrial economy is starting to recover. Typically, this bodes well for emerging markets (EEM). Emerging markets have been punished in recent trading sessions, down over 8% since the middle of the month in response to the viral outbreak.

Proper portfolio construction can enable more risk-taking with certain beaten-down sectors as long as your overall portfolio keeps a balanced allocation of risk to various economic outcomes.

Our next Portfolio Update report will be published this Saturday.

Start your two week free trial of EPB Macro Research.