Is The US Dollar Losing Its Reserve Currency Status Right Before Our Eyes? - Part 1

Read More: Is The US Dollar Losing Its Reserve Currency Status Right Before Our Eyes? - Part 2

Something major is brewing in the currency markets.

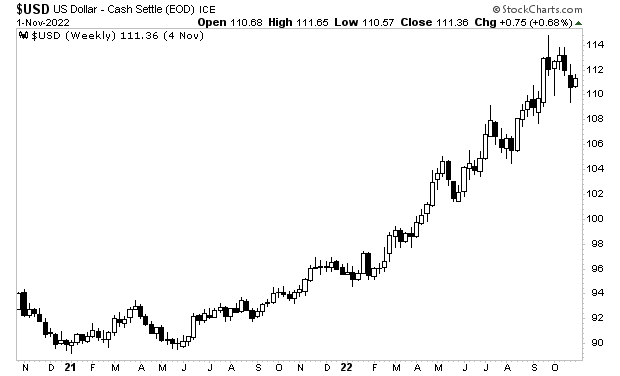

Throughout much of 2021 and 2022, the USD rallied aggressively, rising from 90 to 112. The driving force behind this move was the Fed’s tightening of monetary policy: the USD was becoming increasingly attractive relative to other currencies based on higher rates.

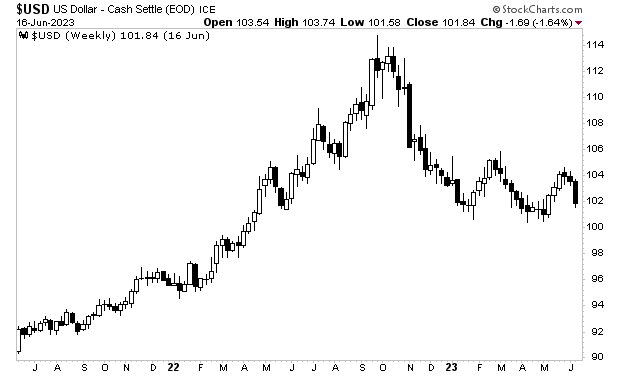

However, something changed in October of 2022. The USD began to break down. And not just a little. The greenback dropped violently from 112 to 100 in the span of a few months.

Since that time, the USD has struggled to catch a bid against every major currency.

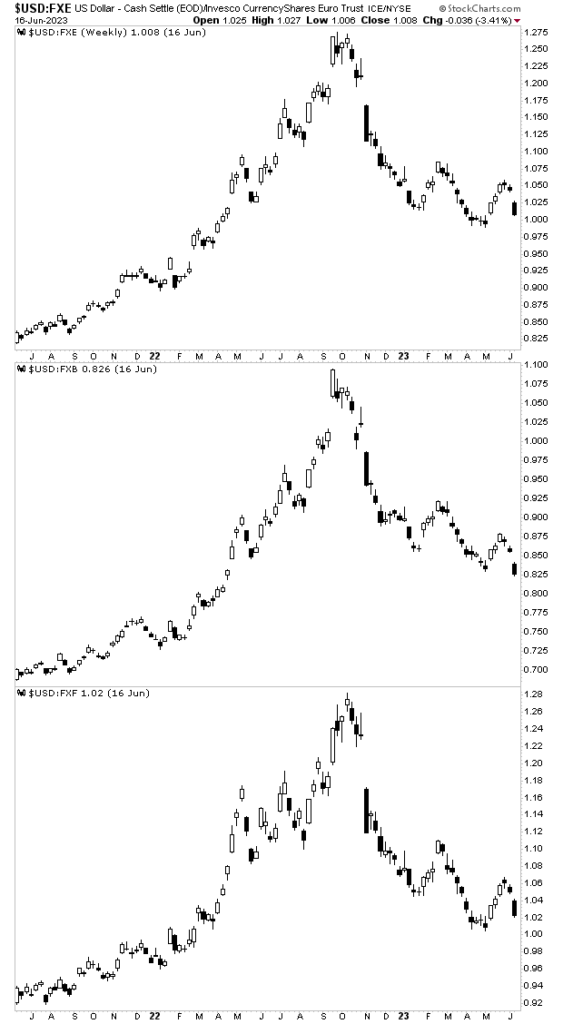

The USD has been dropping relative to the Euro, the British Pound, and the Swiss Franc. And it is doing this despite the fact that rates are higher in the U.S. than in any of the countries that issue these other currencies.

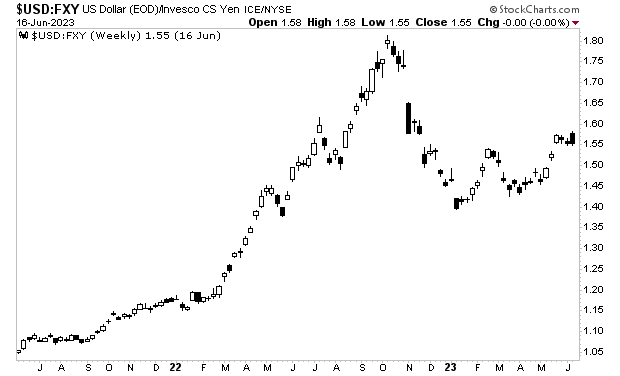

Indeed, the only currency against which the USD has demonstrated any strength is the Yen… and that’s only in the last few months as it became clear that the Bank of Japan would continue to printing money/ maintaining its easy monetary policies.

As I mentioned earlier in this commentary, something MAJOR is brewing in the currency markets. Currencies go up and down all the time… but when you see a currency dropping like a stone against every major currency, you know something BIG is happening.

Yes, it is. Bearish.