Is The November Payrolls Report As Good As It Looks?

US companies hired substantially more workers than economists expected in November, providing an upside jolt to economic sentiment. From a monthly perspective, the 254,000 increase in private payrolls marks the best gain since January. No matter how you slice it, it’s a strong increase. But a closer look suggests that the slow-growth trend is still with us, even though a myopic focus on the latest employment number inspires thinking otherwise.

Let’s start with the obvious caveat: monthly data is noisy and subject to hefty revisions. For the same reason that you shouldn’t use yesterday’s poll to assess a politician’s overall electability rating, the data point du jour for any economic indicator can be misleading (and usually is by more than a trivial frequency). Revisions and other factors, in short, are a common hazard in looking in the rear-view mirror for the latest result.

Note, too, that today’s report reflects an upside skew due to a one-time event. As Bloomberg reports, November marks “the first full month that General Motors Co. workers returned to work after a 40-day strike, adding 41,300 to automaker payrolls following a similar drop the prior month.”

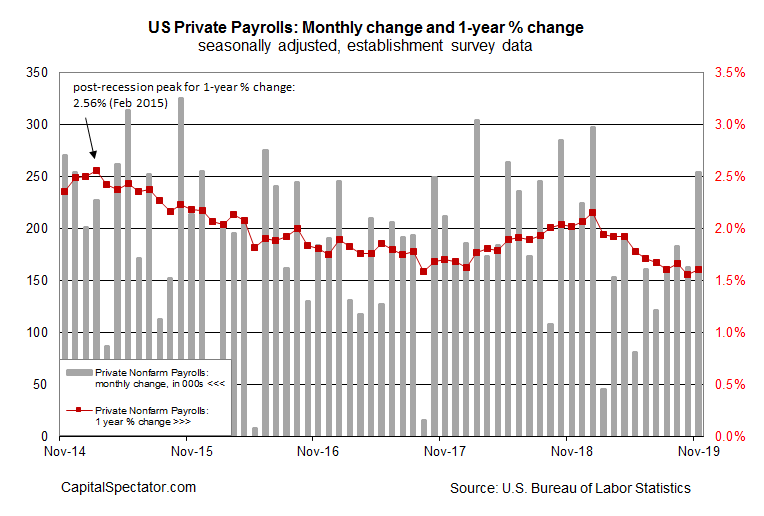

To smooth out some of the noise in search of a more reliable measure of what’s truly going on can be found in longer-term metrics—the rolling one-year trend, for instance. By that standard nothing, much has changed in today’s report. Private payrolls increased 1.6% last month vs. the year-earlier level – fractionally higher than The Capital Spectator’s average point forecast via a combination forecasting model.

A 1.6% annual gain in employment is healthy and it suggests that a recession remains off the near-term horizon – analysis that’s been supported by a broader reading of economic data recently. But a 1.6% increase is also relatively modest compared with recent history. The larger point is that the employment growth trend has materially slowed this year and that’s still true and so it’s the directional bias that’s relevant.

(Click on image to enlarge)

The optimistic view is that today’s rebound in employment growth marks the start of a re-acceleration in economic activity. Perhaps, although ADP’s estimate of US employment growth for November was dramatically weaker and so it’s premature at this stage to conclude that the government’s report is a game-changer.

What today’s results do show is that the slow-growth trend for the economy doesn’t appear to be deteriorating into something worse. Surprising? Not really. A few weeks ago that was a reasonable outlook via a broad set of indicators. As The Capital Spectator noted on November 20: “US economic growth has slowed but signs that the macro trend is stabilizing suggest that the recent downshift won’t lead to a recession in the immediate future.”

But with consumer sentiment remaining strong in today’s December estimate it’s not beyond the pale to wonder if the US expansion could strengthen in 2020. The odds are probably favorable if – a big “if” – the Trump administration solves, either partially or wholly, the trade battle with China.

Meantime, the econometric outlook for private payrolls still implies that the trend will gradually weaken in the months ahead. Using today’s figures, a fresh run of The Capital Spectator’s combination forecasting model for employment shows the one-year change ticking down in December to 1.5%, with a generally downside bias expected to continue in 2020.

(Click on image to enlarge)

Slow and slowing growth, in other words, still appears set to endure for the near term. As a result, expecting that today’s jobs report will quickly lead to a surge in economic activity looks more like wishful thinking than a clear-eyed view of the data and a forecast still in search of supporting data.

Disclosure: None.