Is Bitcoin Set To Rip In October? History Says Yes

Image Source: Unsplash

After a month of turbulence, crypto traders are now eyeing October with new expectations. September lived up to its “Redtember” reputation as the total crypto market capitalization dipped by nearly $80 billion last Monday, according to CoinMarketCap, dragging Bitcoin (BTC) to a twelve-day low near $114,270 and pushing Ethereum (ETH) below $4,300.

The sell-off was driven in part by $1.7 billion in leveraged liquidations across major exchanges. Such volatility reinforced September’s track record as one of the weakest months for crypto. It is often marked by sharp downturns and heavy derivatives wipeouts.

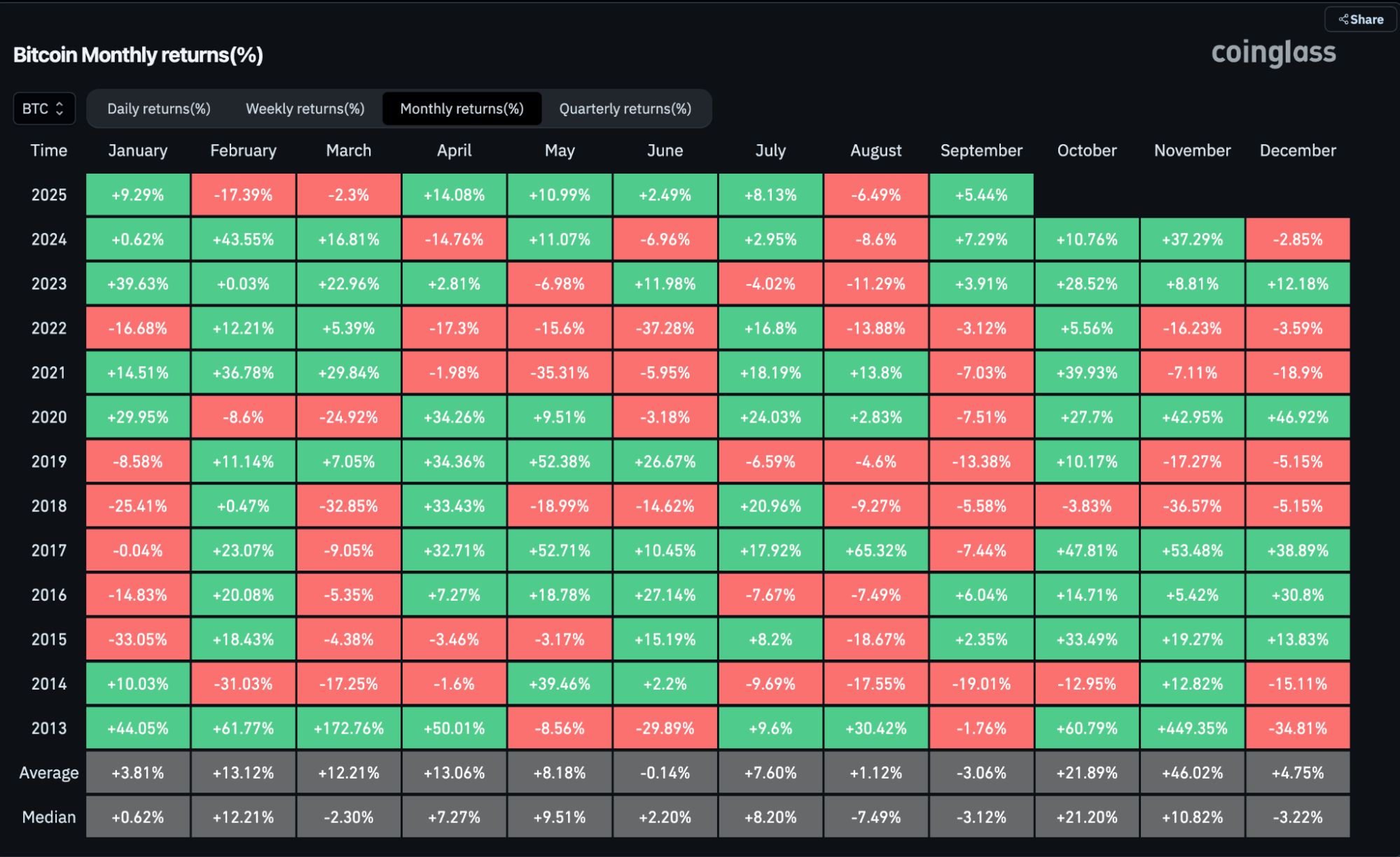

As September fades, attention now turns to October. Historically, it is one of the most bullish months for Bitcoin and other majors. CoinGlass data shows that since 2013, Bitcoin has closed October in positive territory in ten of twelve years, giving rise to the nickname “Uptober.” According to a QCP Group report, traders are already rotating back into Bitcoin after last week’s flush, with altcoin speculation cooling.

(Click on image to enlarge)

Source: CoinGlass

That shift is visible in market share. The altcoin season index, which hit 100 on September 20, has since slipped to 65. Bitcoin dominance has since climbed above 57%, while Ethereum’s share hovers around 13%.

The table below shows how October has played out for major tokens in recent years:

Major Cryptos (BTC, ETH, SOL) in October

| Year | BTC October Performance | ETH October Performance | SOL October Performance |

| 2020 | +28% (closed near $13,800) | +7% (closed near $385) | +75% (closed near $2.2) |

| 2021 | +40% (closed near $61,000) | +43% (closed near $4,400) | +30% (closed near $200) |

| 2022 | +5% (closed near $20,500) | +19% (closed near $1,580) | +11% (closed near $33) |

| 2023 | +28% (closed near $34,500) | +7% (closed near $1,800) | +62% (closed near $39) |

| 2024 | +11% (closed near $70,500) | +9% (closed near $3,050) | +16% (closed near $155) |

BTC, ETH, SOL performance for October over the last five years. Note that there have been no negative returns in October in that span.

Crypto braces for ETF decisions, Fed signals as October kicks off

October is shaping up as a decisive month for digital assets. The SEC is scheduled to review 16 spot crypto ETF applications, spanning tokens like Solana (SOL), XRP, and Dogecoin (DOGE). These rulings could draw new institutional flows, especially after the agency shortened the review window from 270 days to just 75.

On the macro front, Federal Reserve Chair Jerome Powell is set to speak on Wednesday, with core PCE inflation data due Friday. Futures markets show a 92% chance of another Fed cut, with analyst Kyle Chassé noting the easing cycle is “basically priced in.”

Still, caution lingers. Analyst “Sykodelic” predicted on Monday that markets would sink lower before surging in October, while QCP Group argued steady inflation could extend liquidity into Q4.

Furthermore, BitMEX co-founder Arthur Hayes stated that crypto will switch to “up only mode” once the Treasury completes its liquidity drain.

TGA refill almost done - target is $850bn. With this liquidity drain complete, up only can resume. pic.twitter.com/LSVieKX2J8

— Arthur Hayes (@CryptoHayes) September 20, 2025

As Uptober begins, history faces a new test.

More By This Author:

3 Top ETFs For Lower Interest RatesMajor Shakeup At Spotify Sends Stock Price Lower

Carnival Stock Sinks Despite Record Earnings – Should You Buy?