Is Adobe Losing Its Competitive Advantage?

Recently, Adobe Systems (NQ: ADBE), which has the largest capitalization in the SaaS industry, tumbled after the company released its first-quarter figures. From its peak in 2021, the share price has slumped by nearly 40%.

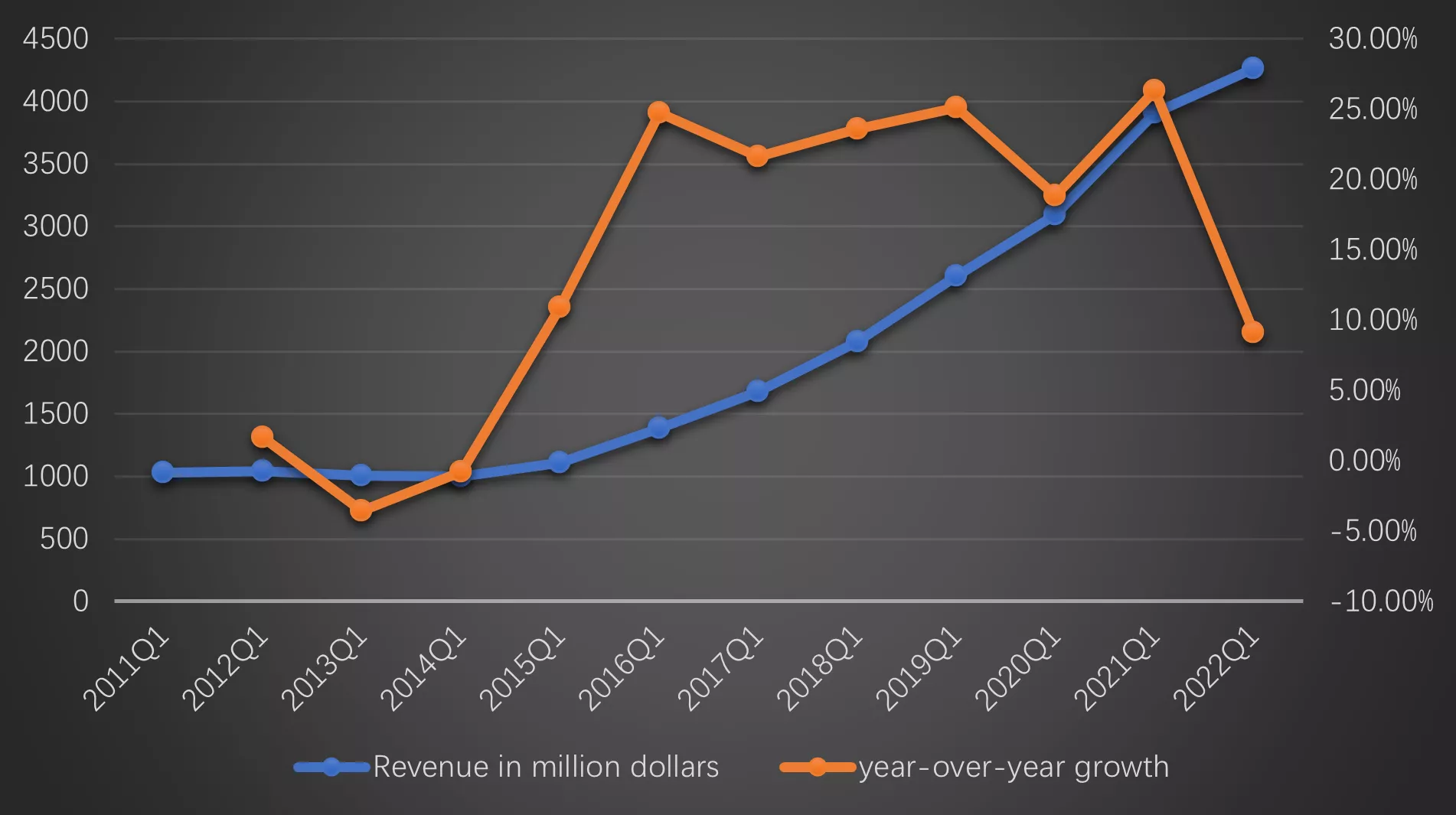

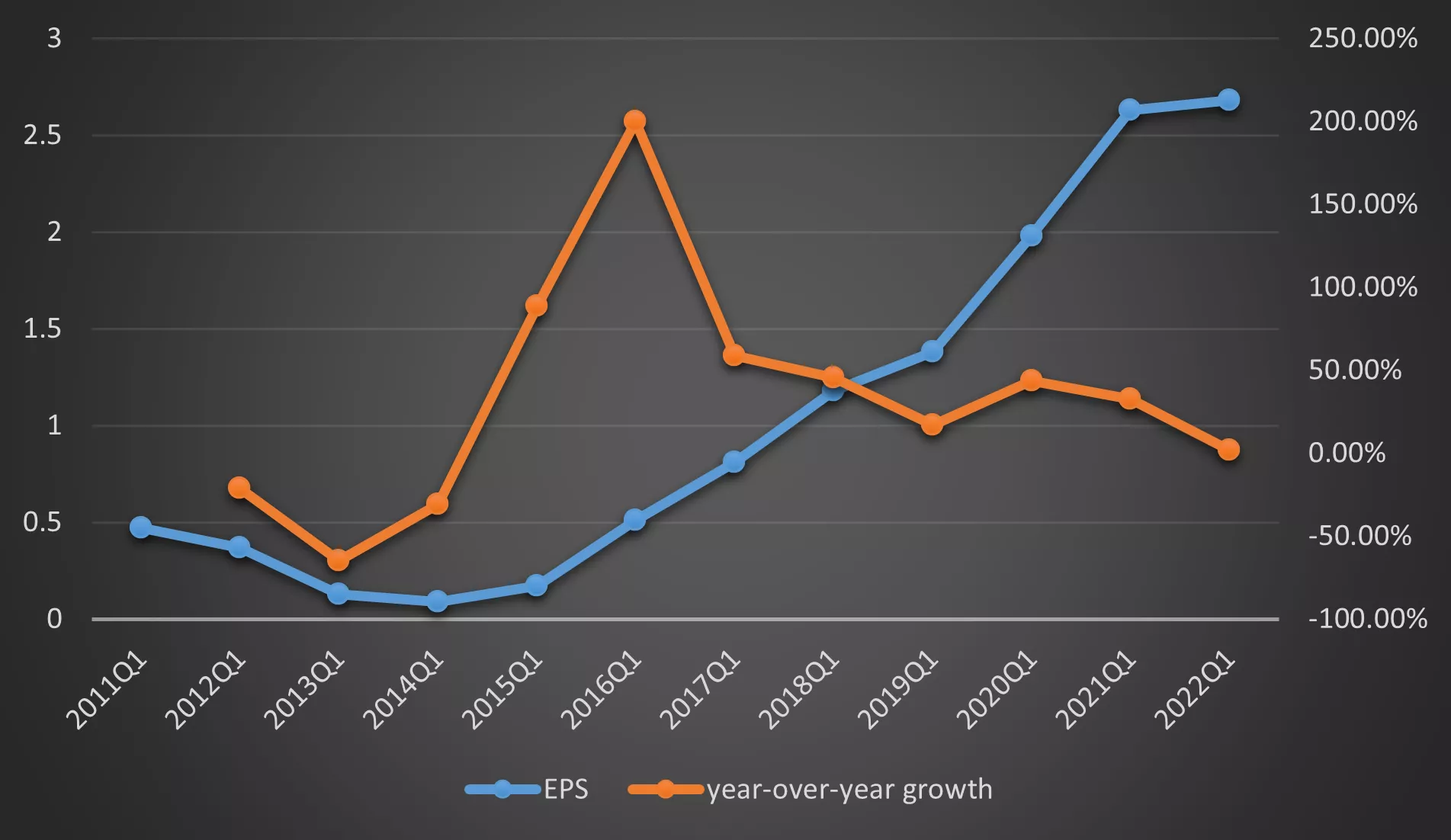

According to the report, Adobe achieved revenue of $4.26 billion in the first quarter of 2022, which is higher than expectation of $4.24 billion, representing 9% year-over-year growth (after-adjustment revenue year-over-year growth was about 17%). And Adobe's earnings per share was $3.37, also exceeding the expectation of $3.35.

Although the revenue touched a peak, the market reckons revenue should be higher given such a high valuation. The slowdown of the year-over-year growth rate also brought some concerns to investors. Since Q1 of 2017, the EPS growth rate of Adobe has seen significant decline, while the revenue growth rate has decreased in 2022Q1 after experiencing fluctuation from 2016Q1 to 2021Q1.

In addition, at the financial report meeting earlier this week, the management said that the company would lose about $75 million in the future due to the suspension of business in Russia and Belarus, which led to a worse negative sentiment than before, and it might be the main reasons for the decline in share price.

After all, the Ukraine conflict might be a short-term issue, and Adobe's business in Russia will be eventually reopened. The negative impact from the Russia-Ukraine issue reflecting on revenue will not last a long time. What investors need to really worry about is whether Adobe is losing its competitive advantage, given the unsatisfactory figures, and whether the contractionary monetary policy will lead to the undervaluation of all risk assets.

Disclosure: None.