IRobot Attempting A Breakout After Short Interest Spike

The hype that has been created by the short squeezes on GameStop (GME) and AMC Entertainment (AMC) has caused some interesting patterns on various charts. So many stocks that had high short interest saw big spikes in their price and we saw jumps of 50%, 75%, and even some over 100%.

Some of the stocks that jumped didn’t have a fundamental foundation to justify the high prices and many of those stocks have dropped back down, including GameStop and AMC Entertainment. On the other hand, there were some stocks that spiked which could justify the move with solid fundamental indicators. One such company is iRobot (IRBT).

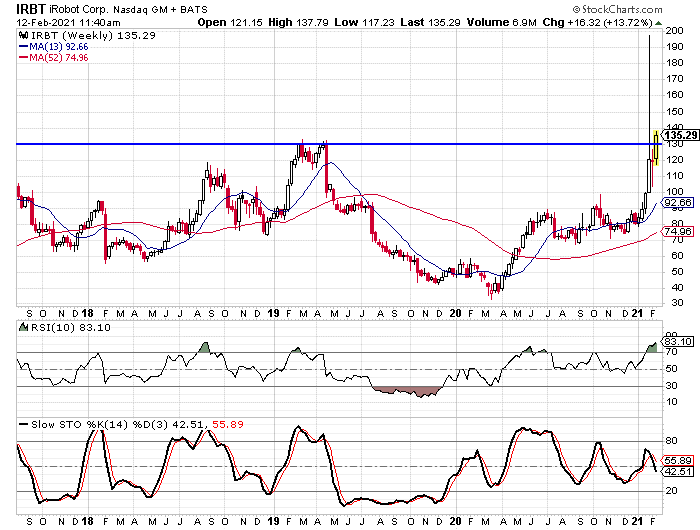

When the short squeeze craze hit, iRobot was trending higher but was trading just under $100. When investors realized the stock had a huge short position on it, they pushed the stock all the way up to $197.40, but it has since settled back and is now trading at $135.29. Even though the stock is well off its high, it looks to be breaking out with its move above $130.

(Click on image to enlarge)

We see on the weekly chart how the $130 area served as resistance back in the first half of 2019, but now the stock is moving above the former resistance level. The chart looks a little odd because of the huge spike a few weeks ago, but if we ignore that black swan event, this move seems to be more important.

Strong Fundamentals Make iRobot Different from GameStop and AMC

We pointed out earlier how GameStop and AMC Entertainment’s big spikes were based on a short squeeze without solid fundamentals backing them up. That isn’t the case for iRobot. The company has seen strong earnings and revenue growth over the last few years and has helped the stock garner a “strong buy” rating from Tickeron’s Scorecard.

Looking at Tickeron’s fundamental screener, iRobot scores really well in its Outlook Rating, the SMR Rating, and the P/E Growth Rating. The only area where the stock scores poorly is in its Seasonality Rating. The company has seen earnings grow by an average of 14% per year over the last three years and they jumped by 22% in the fourth quarter. The company just reported Q4 results earlier this week.

Revenue jumped by 28% in the fourth quarter and that was above an already solid trend. Revenue has grown at an average rate of 14% per year over the last three years. This particular indicator is one of the reason’s the stock scores well in the SMR Rating. The rating combines sales growth, income margin, and return on equity. iRobot shows an ROE of 16.3% and an income margin of 10.6% at this time.

Looking ahead to the first-quarter report, analysts expect the company to report a loss of $0.02 per share, but that is a vast improvement over the $0.32 per share loss the company posted in Q1 2020. Revenue is expected to jump by 25.2% in the first quarter.

The Spike Caused a Big Drop in Short Interest

When iRobot spiked at the end of January, it caused the total short interest to drop rather sharply as the short-sellers scrambled to cover their positions. That is one reason a high short interest ratio or a short-to-float ratio is a good contrarian indicator. But we prefer to find stocks that are in upward trends and have strong fundamentals to go along with the high short interest.

From January 15 through January 29, short interest dropped from 10.59 million shares to 6.52 million shares. The average daily trading volume jumped from 518K to 3.05 million during this same stretch. Between these two massive changes, the short-interest ratio dropped from 20.33 to 2.14.

(Click on image to enlarge)

The average short interest ratio falls in the 3.0 range, so the new reading is below average. However, the ratio is skewed pretty badly based on the huge trading volume two weeks ago. Over 26 million shares changed hands during the final week of January, but now the volume has dropped back down over the last two weeks. Volume for the first week of February was just over 5 million and it’s currently under 7 million for this week. This week’s volume is likely higher due to it being earnings week.

If we consider last week and this week, we are looking at average daily trading volume of 1.2 million. With 6.5 million shares still short, and the average trading volume at 1.2 million, the ratio is probably more accurately around 5.4. If the average daily trading volume drops back down to the pre-spike levels, the ratio would be over 10 again.

Whether the ratio is 5.4 or 10, both are higher than the average stock and if the stock continues to rally, the short-sellers could help push the stock higher as they have to cover their positions.

While the high short interest may have brought more attention to iRobot over the short term, the stock looks good for the long term. The company has been able to grow earnings and revenue and it has good profitability measurements too. The spike may have caused an odd pattern on the chart, but even when the stock settled back in, it was still in an upward trend. The odd pattern didn’t disrupt the trend and we look for that trend to continue over the next few quarters.

Interesting post. I never looked at this stock before. Maybe I will buy the stock before the product. The company seems to be in the news of late, though seems to have been a better buy last year.

Agreed.

Great article, thanks.

Thanks for the interesting post about Irobot.

I read about the robotics companies in the technical publications, where we we hear far more the details of the new releases and developments, What is very interesting is the fundamentally new applications that some of the new features allow. What all of this means is that some robot makers have created products that suddenly create a new market for their products. So there can be a large jump in company profits before the word even gets out. I believe that is what is the case with Irobot. It will certainly be interesting to watch.