Preserving Optionality And Other Things

So - the economy.

What’s going on?

-

The way things have always worked isn’t working

-

The Fed skipped, but this is not a bouncing through a field of daisies skip, this is a skip that you might do to avoid a mysterious puddle in the middle of the sidewalk

-

Money is not a moral compass (we all know this)

The Fed ‘Skips’

I really liked this from Sherry Ning

One way to build up confidence is by keeping promises you make to yourself. If you always let yourself down, you’ll start feeling like there’s nothing stable to depend on internally. Confidence boils down to having trust in your own abilities. That’s the antidote to insecurity.

-

It’s really good just for personal reflection (like if you keep saying you’re going to do something, you should do it)

-

It’s also a good framework for how we think about the Federal Reserve! They are trying to keep promises that they made (mostly to the market) but it’s also about maintaining Fed Cred™️.

So the Fed used this last meeting to communicate -

They wanted to preserve optionality. Hike if they need to. But the Fed is also projecting a soft landing, meaning that they see an improvement in the vibes.

-

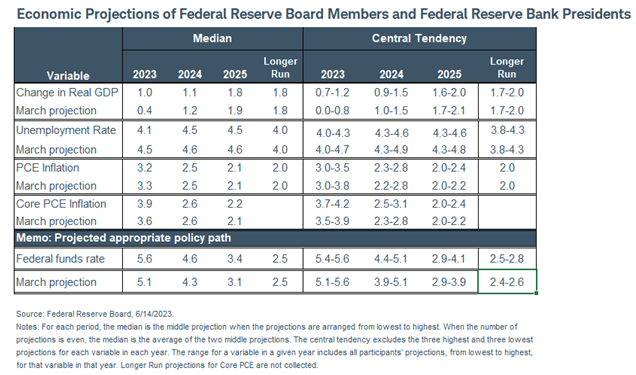

In their group forecast, they are no longer saying ‘yikes here comes the recession’. They are expecting stronger GDP growth, lower unemployment, as well as higher core PCE. They plan to hike rates two-ish more times to get the fed funds rate to 5.5-5.75% by the end of this year.

And it’s funny, because within the last few months, inflation, this big monster thing that we’ve been trying to manage, is still a big question mark. The Fed is like '“maybe everything we thought about wage-price spirals is actually wrong… and workers aren’t driving inflation.”

We kind of don’t really know what’s causing inflation?

The whole thing is like “well is it corporate greed or is it workers or what” and there is a great piece by Brian Callaci in Jacobin that talks about the ‘moral economy’ of price setting (excuseflation, or the idea that companies will raise prices if they can).

-

As he writes about the recent price hikes by some corporations - “Firms with preexisting, but unexercised, market power saw the sudden softening of the moral economy constraint as an opportunity to exercise latent market power that they had all along.” It ties into the work that Isabella Weber has been doing and this idea that - welp companies love a good opportunity.

Inflation is, of course, a lot of things - as Skanda Armarnath from Employ America said

It’s not just used cars, it’s not just rent. Need to look at component level across all components and think hard about supply- and demand-driven causes. And the assortment of methodological weeds that inevitably matter.

And a lot of recent papers and ideologies are like “well it isn’t really the labor market” -

-

It’s not labor costs: The Chicago Fed published a paper that came a conclusion that labor costs really don’t drive inflation, but inflation does drive labor costs!

-

Again, not labor costs: The SF Fed also published a piece finding that labor-cost growth has virtually no impact on inflation - “responsible for only about 0.1% of recent core PCE inflation”

-

But as an aside - rents are finally slowing down - Overall, 48 of the 100 largest U.S. cities are posting negative rent growth for new leases, measured on an annual basis, according to analysis in the WSJ. That should help tame inflation too.

But the confusion is confusing. Even to economists. As Jeet Heer wrote

A lot of economists are very mad heterodox ideas (MMT, greedflation, neobrandeis antitrust, industrial policy) are gaining traction. What's telling is these economists blame this on journalists & social media, which is really proof of how disconnected from reality they are

Like it’s all weird. Beyoncé caused some inflation (rising hotel prices!) in Sweden and Taylor Swift boosts GDP [2]. That’s wild! Things are wild!

I think the most important thing is how people are feeling (of course).

-

Fed’s May Survey of Consumer Expectations shows that inflation expectations are chilling out! People are worrying a bit less about inflation, which is very important for the whole ‘rational inattention’ thing that Powell talked about.

The main thing here is that Taylor Swift is an economic unit and also that the Fed is managing the economy really well, all things considered.

-

The labor market has been incredibly resilient. There’s a world where the rate hikes would have obliterated it - but it’s been mostly okay

-

Of course, the obvious caveat of so far - things can change, and that’s largely why the Fed skipped

It’s about making people feel okay, mostly.

Feelings, Again

I know I talk a lot about feelings but there are two examples that are important -

-

Wealth as a Social Function: Bloomberg published a piece stating that Americans Say They Need $2.2 Million to Be Considered Wealthy. But not really. It’s a comparison game. It’s keeping up with the Joneses. 70% of people said that wealth is more about not having to worry about money, versus having a lot of money. It’s about how we feel, relative to how those around us are seemingly feeling.

-

Framing: ZeroHedge is just… so harmful. But this headline is funny because it’s like '“well if things are okay, no, they aren’t.” Which is bizarre. But if you subscribed to the ZH Ideology, you’ll shake your fist and say “yeah! Things are okay! And I am mad about that!”

Wealth is based around how others around us are doing. How things are framed matter for how we see the world around us.

VC has always been stupid

I think the VC industry is a prime example of this weirdness and framing and narrative:

-

Sar put together these charts showing that VC has always just been dumb money in a large sense - largely chasing whatever everyone else is doing. Social signaling, herd mentality, whatever. Chris Paik argued that “this is actually just how VC works: something becomes possible, money and talent flood the market, then the invisible hand compresses and the opportunity goes away. This is working as intended.”

-

And okay, sure! Maybe that's how it has always been but maybe we should really sit back and reflect on the capital burn that is happening here. The intention and the impact are completely misaligned, and the money that could be going towards Making Things Better (think climate, health, etc).

-

But of course, the problem with investing in Things That Make the World Better is that they often don’t have a high multiple! Therefore, the VCs often choose not to invest in it, because no money can be made! There are returns to generate! People to pay. Hypothetically.

-

CalPERS, the $444b fund that manages California’s pension for state, school, and public agency employees, can attest to this with their 0.49%[3] annualized return on their VC portfolio from 2000 - 2020.

So it isn’t working. It does not work. And it’s a loop that will beat on into infinity.

Reddit and Streaming

So I’ve been obsessed with the nostalgia cycle loop too and what that means for cultural production - if we are constantly exposed to the same ideas, how do we ever move forward? And of course, stories are always structurally the same, but the ideas posited in them tend to vary across time.

Streaming (Netflix etc) as Vulture highlighted, is part of the problem-

“The entire industry… has moved from a world of Newtonian economics into a world of quantum economics, where two things that seem to be in opposition can be true at the same time: You can have a massive hit on your platform, but it’s not actually doing anything to increase your platform’s revenue. It’s absolutely conceivable that the streaming subscription model is the crypto of the entertainment business.”

It’s much more profitable to play into the nostalgia cycle. And it makes sense to focus on profit because that’s how you survive the howling jaws of the stock market. But at what cost, beyond just dollar signs?

This gets into what is happening with Reddit too.

-

Reddit is trying to IPO.

-

The CEO wants the company to look really great.

-

So they made API access like a bajillion dollars and it’s vaporizing third party apps.

This made the Reddit users very mad.

The users of Reddit (who really love Reddit) are peacing out. They are shutting down subreddits, user-created communities moderated by users, which is like the core of the site. Alex Pareene wrote a brilliant article for The Defector on it -

The internet’s best resources are almost universally volunteer run and donation based, like Wikipedia and The Internet Archive. Every time a great resource is accidentally created by a for-profit company, it is eventually destroyed, like Flickr and Google Reader… We are living through the end of the useful internet... The decades of real human conversation hosted at places like Reddit will prove useful training material for the mindless bots and deceptive marketers that replace it.

And like, this is nothing new. Good things are usually sort of skewed by money. Money is important, but money is not a moral compass.

Like Instapot (Instapot!?) is declaring bankruptcy largely because of private equity.

-

There was a post in Debtwire in September 2022 that explained the horrific financial situation - “in April 2021, Instant Brands issued a new USD 450m first-lien term loan in large part to fund about USD 245m of dividend distributions.”

-

The guys wanted to pay themselves! The company was faltering and they said “what if we made that so much worse… and then profit.”

And it’s really one of those times where we should sit back and say “how do you mess up a pot” and then, subsequently ask - “what are we doing here?”

Final Thoughts

And so going back to feelings and whatnot, I think when we see VCs throw billions of dollars into AI wrappers, see things like Instapot blowing up because some PE guys wanted a big old dividend [4] and a site like Reddit become sort of lost in the sauce (as a cornerstone of the Internet and a lot of the data for our sashay into the AI world)… it’s a bummer.

Structurally, things are designed around money and the idea is that money will be Efficient and Markets will Make it Work, but I think that it’s increasingly clear that this is funky.

Like money itself is not bad! If we shifted VC incentives towards climate and health, that would be a really good use case! If Reddit was like “yo our users are sort of the whole site and we should respect that” that would be really awesome!

It’s framing and social functions and the narrative, all of those things. If we shift the frame (doing okay is not bad, actually) and realign the social function to focus on forward looking moments rather than just the past (nostalgia is useful, but maybe not always productive), I think it would be a great thing. But of course -

Thanks for reading.

2 As Maia explained - “taylor swift is producing an increase in gdp because it's increasing spending in a developed country with a stable currency, while the influx of hard currency (usd and euros) is destabilizing the underdeveloped swedish economy”

3 may i say >:-(

4 I am being reductive here, but you get the point.

More By This Author:

"Everyone Is Frolicking But Me"

The Time Premium

Common Misconceptions About The Debt Ceiling

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

more

Excellent as always.