Medallia Could Falter When Lockup Expires

Significant sales of currently-restricted shares could flood the market when the lockup expires and cause a sharp downturn in share price.

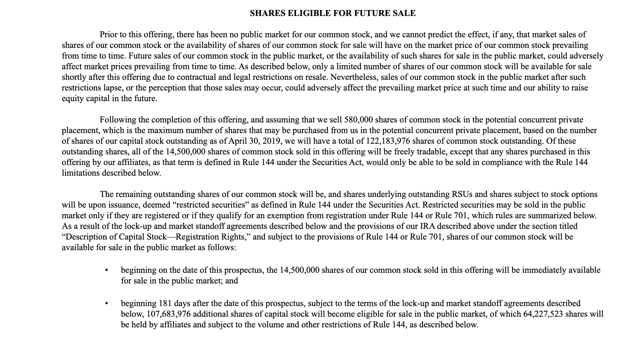

When the 180-day lockup period for Medallia Inc. (MDLA) ends on January 15, 2020, pre-IPO shareholders and company insiders will be able to sell more than 107 million shares of currently-restricted stock in the open market. This number of currently-restricted shares dwarfs the 12.5 million shares trading pursuant to the IPO. When the lockup expires, significant sales of these currently-restricted shares could flood into the secondary market for MDLA and cause a sharp, short-term downturn in share price.

(Source: S-1/A)

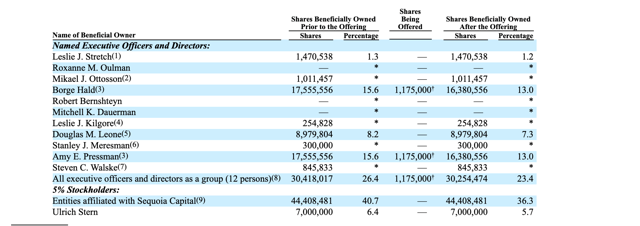

This group of pre-IPO shareholders and company insiders includes numerous individuals and VC firms.

(Source: S-1/A)

We believe that pre-IPO shareholders and company insiders may be particularly interested in cashing in on some of their gains. Despite choppy trading, MDLA still has a gain of 46.2% from IPO. Aggressive risk-tolerant investors should consider shorting shares of MDLA ahead of the IPO lockup expiration.

Business Overview: Provider of SaaS Platform for Experience Management

Medallia Inc. offers it enterprise software designed to provide superior experience management. Medallia notes in its SEC filings that its SaaS platform, the Medallia Experience Cloud, is the market leader. The platform captures experience data and analyzes the massive quantity of information to improve omni-channel experiences by using its proprietary AI technology that draw data from across digital, human, and IoT interactions. The company advertises its platform as capable of reducing churn, improve cross-sell and up-sell opportunities, converting detractors to buyers and promoters, and providing tangible ROI.

(Source: MDLA website)

The Medallia Experience Cloud captures more than 4.9 billion experiences on an annual basis and performs approximately 8 trillion calculations every day. More than half of Medallia’s clients are enterprise level organizations with over 1,000 employees. In addition, Medallia is used by 8 of the top 10 global media and communications organizations, 7 of the top 10 enterprise hospitality organizations, 6 of the top 10 global banks, 5 of the top 10 automakers, and 5 of the top 10 enterprise insurance providers.

The company defines its experiences in four areas: customer experience, business experience, employee experience, and product experience.

Their clients include Airbnb, Best Western, Cox, Delta, Electrolux, Farmers Insurance, Four Seasons, Frontier Airlines, Hilton, H&R Block, IBM, Joann, LEGO, Marriott, Mazda, Mercedes Benz, PayPal, Samsung, and Western Union.

The company has approximately 1,260 employees and maintains its headquarters in San Francisco, California.

Company information sourced from the firm's S-1/A and website.

Financial Highlights

Medallia Inc. reported the following highlights for the end of the third quarter for fiscal 2019 ended October 31, 2019:

- Revenue was $103.1 million representing an increase of 27% versus the same period the prior year.

- Loss from operations was $41.7 million versus a loss of $16.5 million for the same quarter last year.

- Net loss was $39.6 million versus a net loss of $16.6 million for the same quarter last year.

- Cash and cash equivalents were $319.3 million at the end of October 2019.

Financial highlights were sourced from the company's website.

Management Team

President, CEO and Director Leslie Stretch has served in his position since August 2018. He has previous executive level experience from Callidus Software, where he served from November 2005 to April 2018. He earned a B.A. from the University of Strathclyde in Industrial Relations and Economic History and a postgraduate diploma from the University of Edinburgh in Computer Systems Engineering.

CFO and EVP Roxanne Oulman has served in her positions since November 2018. Her previous experience comes from CallidusCloud, Thoratec Corporation, and CalAmp Corp. She earned a B.S. from Minnesota State University in Accounting and an MBA from the University of the Pacific.

Management bios were sourced from the company's website.

Competition: SurveyMonkey, Confirmit, and Qualtrics

Medallia faces competition from a variety of companies including Qualtrics (XM), Confirmit, SurveyMonkey (NASDAQ:SVMK), Inmoment, Clarabridge, Maritz, Nice (NICE), Satmetrix, and Verint.

Early Market Performance

The underwriters for Medallia priced its IPO at $21 above its expected price range of $16 to $18 per share. MDLA has a first day return of 76.4%. The stock has had a mixed performance since then, reaching a high of $43 on July 26, and declining to a low of $24.24 on October 22. MDLA currently has a return from IPO of 46.2%.

Conclusion

When the IPO lockup for MDLA expires on January 15th, pre-IPO shareholders and company insiders will be able to cash in on their gains from IPO by selling more than 107 million shares of currently-restricted stock. If just some of these shareholders make significant sales, these currently-restricted shares could flood the secondary market for MDLA and cause a sharp, short-term downturn in share price.

Aggressive, risk tolerant investors should consider shorting shares ahead of the January 15th IPO lockup expiration. Interested investors should cover short positions during the January 16th and January 17th trading sessions.

Interested in learning more about IPO Lockup investment opportunities? Check out our subscription service, IPO Insights. We update subscribers with actionable investment opportunities that follow the debut of select companies on U.S. exchanges.

Disclosure: I am short MDLA.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more