When To Invest In Unicorns

Another day, another Unicorn…

I just ran across the latest member of the Unicorn club yesterday. It’s a food delivery startup from China called Ele.me. Translated from Chinese, it means “Hungry.”

It just raised $630 million at a valuation of $3 billion. (Remember, a Unicorn is any startup valuated at $1 billion or more.)

Unicorns now number 132. In late 2013 they totaled 39!

Some Unicorns are overpriced. But is this news? Every market has its complement of companies that are overpriced and underpriced.

Unicorns are no exceptions.

But investing in one is usually a smart move.

In fact, my co-founder Adam Sharp just gave a great presentation on “How to Bag a Unicorn” at the first Startup Investor annual conference we hosted last week in San Francisco.

Today, I’d like to address not the “how,” but the “when.”

Because when it’s not a smart move, the reason is usually timing.

Not All Unicorn Investments Are Created Equal

“All you need is one big winner – a Unicorn – to make serious money.”

I’ve heard this plenty of times.

It may be true, but it’s not the whole story.

The dirty little secret about a Unicorn is that it’s not the great investment it’s cracked up to be – at least not for venture capital firms. The numbers are revealing…

From 2004 to 2014, 62 startups had initial public offerings or were bought out, all for $1 billion or more, says NAV.VC (a venture capital firm specializing in seed-stage investing).

Seventy-four venture capital funds made 339 Unicorn investments. So, many of these VC companies invested in the same Unicorn more than once.

Almost all of them made the VCs money. But here’s the thing…

Only a few were difference makers.

The math behind early-stage and late-stage investing tells you why.

To get an 8X to 10X gain as a seed-stage investor, your $10 million company would have to exceed a valuation of $100 million.

To get the same profit as a late-stage investor, your $1 billion company would have to exceed a valuation of $10 billion.

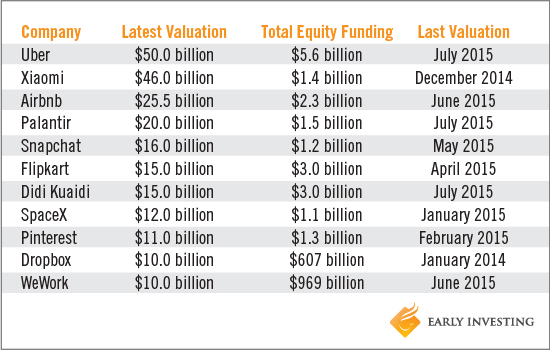

There are 11 companies with a valuation of $10 billion or more. That’s it. To go from $1 billion to $10 billion is rare and difficult.

But how about going from a $10 million valuation to a $100 million valuation?

That’s also not easy.

Thinning Ranks From Seed to Series D

A $10 million valuation is roughly what seed companies get these days. And $100 million is about what Series C/Series D companies get.

How hard is it to get from seed to Series C/D?

The numbers I’ve seen vary greatly. For example, the drop-off just from Seed to Series A is reported to be anywhere from 40% to 80%. Series B is just as difficult. So let’s take 60% as a compromise.

Then it gets slightly easier getting to Series C and Series D. Let’s take roughly 50% as our drop-off rate.

In 2014, a record $1.3 billion was invested in 1,000 seed companies. Good, 1,000 is a big round number. So let’s start with that: 1,000 startups raising successfully at seed.

That number is whittled down to 400 by Series A and 160 by Series B. Only 80 reach Series C and that $100 million valuation.

That’s less than 10% of the original group of 1,000 seed companies.

If a startup doesn’t reach a $100 million valuation until Series D, then those numbers are halved – to 40 and 5%.

Unicorns vs. Seed

Remember, 11 of the 132 Unicorns (or 8.3%) reached valuations of over $10 billion when they IPO’d or were bought out.

The probabilities at seed and Unicorn stage of approaching 10X are roughly the same. At best, you could say that Unicorn investors have slightly better odds.

But the math works much better for seed investors (angels and accredited investors) than for late-stage VC and institutional investors.

Here’s why.

Unicorn investors pretty much top out at 10X.

Look at the above table again…

Uber and Xiaomi are outliers. If a VC is lucky enough to hook up with the half dozen or so companies valuated between $15 billion and $20 billion, then congrats. It has probably exceeded 10X – even taking dilution into account.

That’s simply not good enough. Most large VC funds need bigger profits to make money for their limited partners.

It’s why only a quarter of the 62 Unicorns (mentioned above) returned an entire fund for any of their VC investors.

Sequoia Capital was the most successful by far. Here’s a chart showing how the VC companies did…

Source: John Backus, co-founder of NAV.VC and Hemant Bhardwaj, summer associate at NAV.VC.

Investors participating in the earliest rounds have a much higher upside. Going from $10 million to $1 billion increases valuation by 100X. From $10 million to $10 billion – by 1,000X.

Even taking into account dilution, your profits are huge.

Sure, it’s hard to do, but it does happen.

VC companies should invest earlier or place bigger bets on their potential Unicorn holdings.

Individual investors and angels should migrate to the later rounds for some of their investments because they don’t need 100X returns. Shooting for 5X to 30X would still give them exceptional returns.

Later-stage shares are available via portals like MicroVentures. By the way, early- and late-stage shares account for around 85% of the shares available online via the portals. (Mid-stage shares command just a small portion.)

I’ve always advocated diversification. Including late-stage investments with early-stage ones is a good way to diversify your portfolio.

Excellent, thank you.