Silver Whip-Saw; The Great Divorce Is Here

Image Source:Bawden Capital

Are You a Silver Gambler or a Silver Landlord?

Summary

- Friday, January 9, 2026, was a historic day for silver as it beat a volatile two-day losing streak with a massive rebound. The highest price silver spot traded on Friday was approximately $80.47 per ounce the Closing Price: $79.92 (XAGUSD:CUR)

- The CME Group’s recent margin hikes are a classic "Kill Switch" designed to protect trapped bullion banks. A dive into how their manipulation works and how long it can last.

- The Great Wall Street Miss: While silver delivered a historic 147% rally in 2025, the world's largest bullion banks were busy telling you it would "average $32." They didn't just miss the boat; they were in the wrong ocean while the metal surged from $28 to a peak of over $83.

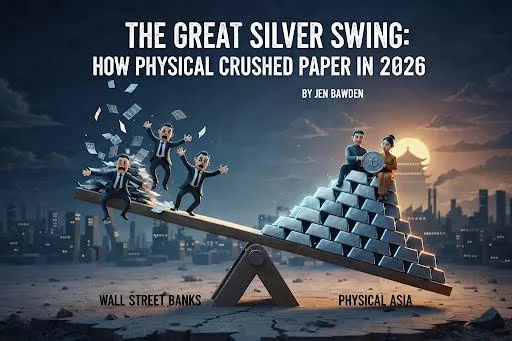

- A massive unprecedented "Great Divorce of 2026" has emerged between artificial N Y paper prices and the physical reality in the East. Paper prices were pushed to $70 this week, physical premiums in Shanghai hit $8 per ounce.

- 44 trading firms in India are dominoes paying the price of the paper "Wack-a-Mole" game.

- As the Casino protects the House, Silver’s volatility (60%) actually overtook Bitcoin’s on Friday. The "boring" metal is now the most exciting trade on the planet.

Image Source: DepositPhotos

The Paper Retching: That’s Bank-Speak for "We Are Trapped"

The Paper Silver system is currently "retching." To the average observer watching a Bloomberg terminal, it looks like a "natural correction." But to those of us who understand Casino Mechanics, it looks like the House is frantically trying to change the rules before the Landlords take over the building. The recent 5-10% swings are far from "natural technical corrections." It's clear the House is changing the rules mid-game. When you hear the big banks using sophisticated jargon, you need to understand the translation. It isn’t just market commentary; it’s a survival tactic. Talking about "mean-reversion" and "index rebalancing," translates to “ the Landlords in India and China are busy actually taking delivery of the metal at a much higher price so we need to play aggressive Wack-a-Mole! The “retching” is the groans of a Casino in crisis.

1. Citigroup: Winner of The "Rebalancing" Mugging and Moving Goalposts" Award

The Global Head of Commodities at Citi (C), Max layton in Early 2025 set a target of $32.00 Silver. They later revised it up to 38 then later in the year to 40. What happened? Silver smashed through $32 in March and never looked back, hitting $84.00.

Quote Jan 8, 2026: Headline: Mining.com: "Citigroup estimates that about $6.8 billion in silver futures could be sold... as investors brace for an annual rebalancing. Jen’s Translation: that’s bank-speak for "We’re holding a fire sale during a quiet week to scare you into selling your bars". The Reality: They call it "rebalancing" because "mass liquidation of the little guy" sounds too aggressive in a press release.

Citi recently said: "We maintain a bullish 6-36 month view, but near-term, silver looks fundamentally overvalued above $70. We see silver averaging $70 for 2026, which acts as a future floor, not a target." Jen’s Translation: That is bank-speak for "Please stop buying so we can cover our shorts". Now that they missed the 147% rally, they are calling $70 Silver the "new normal" only after they tried to crash it from $84? They want you to think $70 is the "ceiling" so you don't notice the physical bars are disappearing. When a major bullion bank like Citi puts a "sell" target near $70, it acts as a magnet for stop-loss orders. City Bank missed the bus at $30, and now they want you to get off the bus at $70 so they can finally get a seat. Or perhaps they are massively underestimating again.

Citigroup research estimated that $6.8 billion in silver futures would be sold during the first two weeks of January 2026. The selling was tied to the annual Bloomberg Commodity Index (BCOM) rebalancing. Because silver surged over 140% in 2025, its "weight" in the index became too high. Citi’s strategists, led by Kenny Hu, publicly stated they had "never seen any outsized flow like this one" in years of running the process. By calling the move "unprecedented" and "outsized" they helped start the selling stampede.

2. JPMorgan: The Mean-Reversion Trap or “The Miss of the Century.”

In Jan 2025 They Forecasted Silver would average $36.00/ $38.00 for the year. Silver soared 147%, peaking at $83.64 in December 2025.

JPM Jan 2, 2026 Greg Shearer: Head of Precious Metals at JPMorgan (JPM) "Programmatic mean-reversion and index rebalancing will likely exert downward pressure on silver as it tests the $65-$68 support levels." Jen’s Translation: That is bank-speak for "The Banks are Trapped". Translation: "Programmatic mean-reversion" is just a fancy way of saying, "We’ve programmed our computers to sell silver until the price hits a level where we don't lose billions, but the problem is there's no metal left at those prices. Despite the banks best efforts to force a 'mean-reversion' sell-off, silver laughed at the $75 support levels on Friday and surged back to an intraday high of $80.47, eventually settling at a rock-solid $79.92.

Quote Jan 5, 2026: The Headline: "Silver's outperformance... warrants mean-reversion pressure to reach 2026 target weights." (JPMorgan Global Research) Jen’s Translation: JP Morgan is trying to play musical chairs, but the physical Landlords just took all the seats. The silver price is so high ( up 147 %) it’s breaking our computer models and threatening our short positions, so we need to force it back down to where our spreadsheets and bonuses feel safe.

Important to note that JP Morgan has spent many years building what many analysts call the "Greatest Silver Hoard" since the Hunt Brothers. So when I say they don’t have the seats now due to their shorts they are the 100 pound gorilla of the future. Estimates now put JPMorgan’s physical silver stockpile at over 750 million ounces. Much of this was accumulated between 2012 and 2019, when silver was stuck between $14 and $20. Their cost basis is a fraction of today's $80 price. It helps explain why the price is finally breaking free, because the biggest silver bully on the block has switched sides. They’ve moved from being the 'Price Suppressor' to the 'Ultimate Profiteer.' They are waiting for the Great Divorce just like we are. They are caught in the middle for now, waiting for the long game for the casino to fail so their physical hoard becomes the only game in town.

3. Bank of Montreal (BMO): Living in a completely different universe!

BMO Capital (BMO): Forecasted an average of $26.50 for 2025 versus an $83.64 peak, the widest miss on the board at 215%. Silver didn't just beat that; it essentially tripled it. It’s hard to chase a rocket ship with a bike.

What makes this so shocking is that BMO is the 100 year old architect of the mining industry. They fund the mines, advise the CEOs, and host the industry’s most powerful summit. When the world’s Top Metals Bank misses the silver rally it is the ultimate proof that the old models are broken. They are looking at spreadsheets while the world is looking for silver bars. Even the people who fund the mines have lost touch with the new reality of the physical shortage.

4. Goldman Sachs (The "Conservative" Contributor)

In Feb 2025: Predicted Silver at $35.00. It more than doubled. Even the Masters of Macro at Goldman (GS) seemed to be watching a different movie last year. They are currently telling you to "rebalance" (sell) your silver because it's too high. Jen Translation: that's probable bank-speak for "Our index is broken and we're losing billions".

The Body Count: The India "Whip Saw"

This isn't a theoretical game of words; it’s a game with a body count. The "whip saw" of paper price manipulation is deadly for those without physical metal. Just this week, a financial crisis erupted in the heart of the global silver trade in Rajkot, India, proving that the paper price is a lethal illusion.

In Rajkot, 44 silver trading firms officially declared insolvency with liabilities close to $425 million. These were "Gamblers" who bet on the banks' promises on silver. When the global physical demand surged and the CME (The CME Group includes the COMEX exchange and is the world's largest silver marketplace and regulator) they pulled the "Kill Switch." Many were caught on the wrong side of the Casino’s margin hikes. These Indian companies held paper bets, not bars. When the Casino moved the goalposts, they were wiped out in hours.

Who Gave the Casino This Power? The Referee is the Bodyguard for the losing team!

CME GROUP on Jan 7, 2026 announced it raised silver maintenance margins to $32,500... a 47% increase... as a standard response to volatility." Jen’s Translation: That bank-speak for "We’re changing the rules because we’re losing". Translation, We hiked the cover charge at the Casino specifically to kick out the players who were winning.

- Who they are: The CME Group (CME) is the world’s largest financial "Referee" and the owner of the COMEX, the main warehouse and digital marketplace where global silver prices are set every second.

- Why they matter: They don't just watch the game; they own the stadium. They have the power to change the cost of playing mid-game by raising "margins" (the deposit required to own a silver contract).

- The "Kill Switch": When the price of silver goes up too fast and threatens the big banks, the CME can hike these margins instantly. This acts as a "Kill Switch," forcing smaller traders to sell their silver contracts immediately because they can't afford the new, higher deposit.

You might ask: “How is this legal?” How can the CME in Chicago control buyers in India while we sleep? I found the answer in the CME Group Rulebook. The CME is not a government agency; it is a for-profit corporation (Nasdaq: CME). Its "Clearing Members" are the very same bullion banks (JPMorgan, Goldman Sachs) that are currently "short" silver. The Conflict: If a bank defaults, the CME is on the hook. Therefore, the CME’s "Risk Management" is actually "Bank Protection." They aren't a neutral referee; they are the bodyguard for the House.

Under CME Rule 802 and Chapter 7, the board has the absolute right to change margin requirements (performance bond) "at any time, without notice." On January 7, 2026, they raised the silver margin to $32,500—a 47% increase in a single week. Jen’s Translation: The referee isn't just watching the game; he’s protecting the losing team. They use margins to create a "False Bottom," hoping to trigger one last panic so they can buy back your silver for $65 before the world realizes the vaults are empty.

Yes, they have a lot of power. They have the "Kill Switch" (margins), they have the "Paper Printer" (shorting), and they have the "Bullhorn" (Bloomberg). But even a Casino has to follow the laws of physics eventually. The "Kill Switch" triggered a liquidation and worked for 48 hours but Silver screamed back up towards $80 despite CME draconian measures to push it down. The gamblers are fighting for survival. The landlords are waiting for the keys. There is currently a $8.00 to $15.00 spread between what you pay for silver in London/NY versus what you pay in Shanghai or Dubai. Don’t worry about the referee - just keep buying pieces of the stadium.

The Different Universe and The “False Bottom Trap”

Look at the big banks predictions from one year ago. They weren't just wrong; they were living in a different universe. The "experts" missed the biggest rally in 45 years.

The 'boys' are currently trying to convince you that $70 is the new ceiling. They missed last year's rally by over 100%, and now they are using 'False Bottoms' to shake the metal out of your hands. They will let the price hit $72, call it “support” and then hit the margin 'Kill Switch' again on a Sunday night to see if they can trigger another panic.

Why? Because the tide is against them and the smartest boys on the street hate to be naked and embarrassed. They promised their clients silver would be $36, and it went to $84. They need your physical bars to fill the hole in their balance sheets before Silver continues its climb over the next few years to $200.

The Infinity Loop Of Suppression: Why They Can't Do This For Long

The billion dollar question for landlords is how long will they keep this Wack-a-Mole up? The answer is until the "Great Divorce" becomes a permanent separation.

The Breaking Point: Every time they push the paper price down to $70, the physical buyers (industrial giants, India, China) back up the truck and buy everything that isn't bolted down.

The Inventory Drain: As of January 9, 2026, COMEX "Registered" inventories (silver available for delivery) have plummeted by over 70% since 2020. You can't print a physical bar of silver.

The "Cash-Only" Failure: If the banks push the paper price to $60, but nobody is willing to sell a physical bar for less than $90, the COMEX is forced to declare "Cash Settlement." This is the ultimate "Game Over." It’s the moment the world realizes the Casino is empty, the pool will finally run dry and the paper price becomes a total work of fiction. All the Casino players who thought they owned silver, but only owned a paper promise from a bank that was 160% wrong last year, will be left completely naked, embarrassed, and possibly broke. View this retching as the last Exit for the Banks. These margin-hike market induced crashes are actually their final attempt to buy back your silver before it goes to $100+.

Conclusion: No More Slip-Back Coupons

One day soon, this " Nasty Great Separation" will become a permanent divorce. There will be no more "slip-back coupons" where the paper price magically reunites with the physical. With China and India stacking the deck and locking their vaults, the rules of the Casino cannot be manipulated for long.

The Landlord's Secret: While they are playing "Wack-a-Mole" with the paper price, the physical price in Shanghai is staying at $85.00+. Once the physical metal is gone, the paper price becomes total fiction.

Index Rebalancing Smoke Screen

The banks Citi (C), JPM (JPM), and TD Securities (TD) are all pointing to the Bloomberg Commodity Index (BCOM) rebalancing as the reason for the $6.8 billion sell-off. (Because silver went up 147% last year, the index rules forced funds to sell silver to get back to their target weights.)

On Wednesday, January 7, the iShares Silver Trust (SLV) saw its largest one-day outflow of the year. But here is the catch: At the same time SLV was losing "paper" silver, the Sprott Physical Silver Trust (PSLV) saw a surge in volume. People aren't selling silver, they are fleeing the Casino (SLV) and moving their chips to a Physical Vault (PSLV).

If the index rebalancing was "routine," as the bankers say, why did the CME Group raise margins by 47% on the exact same day?.

How do you become a Silver Landlord?

Over the last few weeks when the world was calling the top of the silver market I saw something else. A great opportunity to buy what I believe will be some of the top winners over the next few years as this Silver momentum advances. My top picks are all up over 10 % in the last week. They are still a deal for prospective silver landlords to buy on dips. I bought:

- MTA (Metalla Royalty) - Landlords don't pay margin hikes.

- WPM (Wheaton) - Royalties aren't "bets" they're deeds.

- PSLV (Sprott Physical) - Allocated silver can't be "rebalanced" by Citigroup.

- SLVR (Sprott Miners & Physical Silver ETF) -The ultimate "Landlord" play.

Warning to Landlords: The Wack-a-Mole Strategy - Survival is Not a Straight Line

Expect the 'boys' to keep playing Wack-a-Mole. Their only tool is to suppress the paper price to discourage you. They want you to feel that their power is infinite. But remember: They are fighting for their survival; you are just waiting for your harvest. They can push the screen price down 10% in a day, but they can't force the miners to dig faster, they can't force China to lift its export ban and they can’t suppress global demand. Every time they Wack the price down, they are actually making the physical shortage worse by making silver even cheaper for the big industrial Landlords to scoop up. The more they push, the harder the eventual snap-back will be.

About the Author: Jen Bawden is a NYC based macro strategist, metals investor and 11 X bestselling author. She specializes in precious metals and global liquidity cycles. She predicted the Tech crash, gold's historic rise above 1000$ an ounce, the current silver bull market and the 2008 housing crash. Her analysis has appeared on TalkMarkets, CNBC, Seeking Alpha, Kitco, Zero Hedge, Investing.com and other leading financial platforms.

I am long MTA, WPM, PSLV, SLVR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company ...

more