Sell These Five High-Yield Closed End Funds

Many closed-end funds pay very high yields, so the conflux of my focus on high yield and investors discovering closed-end funds (CEFs) leads to many questions from my readers about specific funds. Let me share what I think about the largest portion of the CEF universe.

I often share my opinion that the CEF universe operates as the junkyard for the financial services industry.

By this, I mean if you look through the holdings of many closed-end funds, you will find financial products developed by Wall Street that they could not sell to more mainstream investors, such as pension funds and actively managed mutual funds or ETFs. I can easily see how the holdings of some CEFs could quickly “blow up” if the economy takes a wrong turn.

In fact, out of 468 publicly traded closed-closed end funds, only two make my current recommendations list. And trust me, I look at a lot of CEFs.

Now that you know my feelings about the CEF universe let’s have some fun with CEFs. Here are five very high yield funds, with a short discussion of how each operates.

I want to emphasize these are not investments I recommend to my readers however they may be ones you’re likely to come across while searching out high-yield investments.

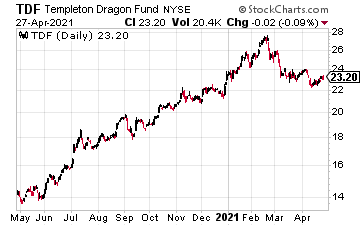

According to the CEFConnect website, Templeton Dragon (TDF) has the highest current yield at 27.9%. With a goal of long-term capital appreciation, the fund invests at least 45% of its total assets in equity securities of Chinese companies. The fund may also invest up to 20% of its total assets in equity securities of Japan and 35% across the rest of Asia. Distributions are variable and appear to be mostly comprised of realized capital gains.

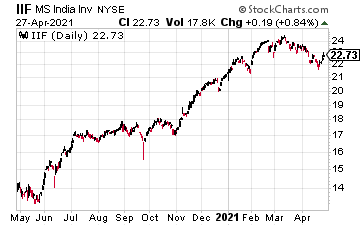

Up next, the Morgan Stanley India Investment (IIF) has a listed yield of 20.7%. Again, distributions are highly variable, and a look at the payout history shows quite a few years when IIF paid zero in distributions.

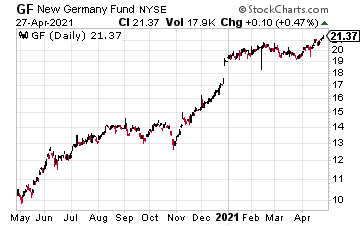

These high-yield funds follow a trend, and in third place with a 20.3% listed yield is the New Germany (GF) fund. The story here remains the same, with highly variable distributions derived primarily from realized capital gains.

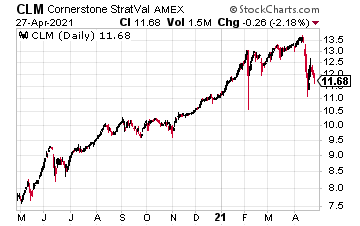

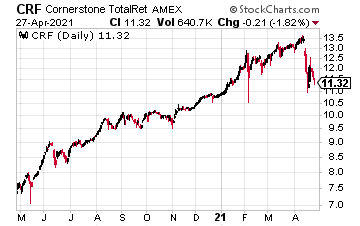

Finally, we have the closely related Cornerstone Strategic Value (CLM), yielding 15.7%, and Cornerstone Total Return Fund (CRF), paying 15.3%. Unfortunately, both funds do not come close to earning the cash paid as dividends, and about half of those big yields are just a return of investor capital.

Well, that was fun. Five more CEFs I can cross off my list to research.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more

Not much "meat" here. Still not convinced these stocks need to be sold.