My Trend Strategy: Process And Performance

My trend model invests in diversified stock index funds and seeks to avoid the severe losses associated with buy-and-hold stock investing. The model is based on Gary Antonacci’s published research but differs in its momentum and rebalancing criteria.

The core components of the trend model are:

- A relative momentum step to select the top-performing equity region.

- An absolute momentum step to reduce the probability of a severe loss.

- A rebalancing step to ensure the model’s stance reflects recent data.

Relative Momentum

Relative momentum compares the returns of different assets to each other. Think of relative momentum like a horse race – always investing in the top-performing asset. My trend model is applied to U.S. stocks and international stocks. I specifically uses Vanguard’s total market-cap VTI (for U.S.) and VXUS (for international) funds. This universe covers 100% of the global equity market and is extremely low cost, with an average fund expense ratio of 0.07%.

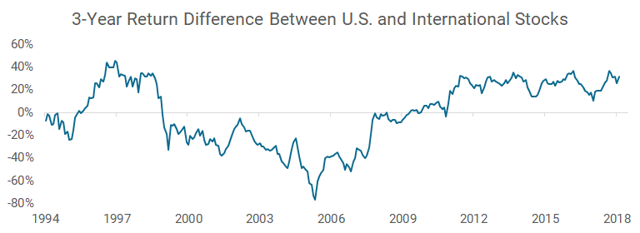

Relative momentum takes advantage of the fact that the performance of domestic and international stocks tends to ebb and flow in multi-year cycles. For example, if the line in the graph below is higher than 0%, it means that U.S. stocks have outperformed international stocks over the past three years.

The main input for the relative momentum step is the momentum calculation for each stock fund. The most common momentum time period is 12 months, meaning a fund’s performance is evaluated over the past year. For example, consider the following prices:

|

Date |

VTI |

VXUS |

|

12/31/2017 |

$134.68 |

$55.18 |

|

12/31/2016 |

$111.11 |

$43.71 |

For this data, the 12 month momentum is calculated to be +21.2% for VTI and +26.2% for VXUS. International stocks had higher relative momentum than domestic stocks as of 12/31/2017.

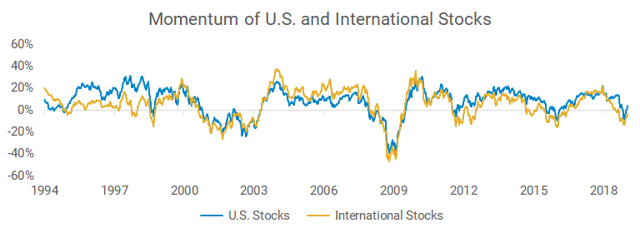

My momentum calculation is an average of five different time periods: 3 months, 6 months, 9 months, 12 months, and 15 months. The momentum effect has been shown to persist in all of these time windows, but not over very short or very long periods. I don’t use an average momentum metric to try to outperform the standard 12-month period. Rather, I do so to diversify the model and not rely on a single time horizon when calculating momentum.

The chart below shows this average momentum measure for domestic and international stocks. You can see persistent trends in performance, from U.S. stocks outperforming in the late 1990s to international stocks in the mid-2000s.

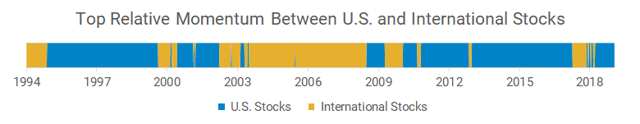

Below is a simplified view of the above chart, only showing the fund with the top relative momentum. There are a few periods of back and forth when each fund’s momentum was similar, but the relative momentum step typically stays in one region for years at a time.

Absolute Momentum

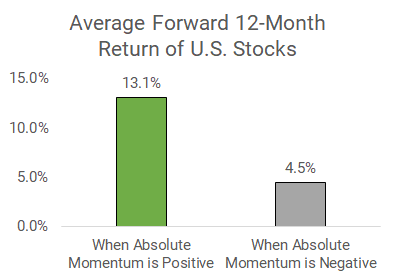

This step takes the stock fund with the highest relative momentum and makes sure that its momentum is positive, not negative. Negative momentum has historically led to a higher probability of a large future loss.

The main step in calculating absolute momentum is comparing the top relative momentum fund to a “hurdle” asset. The hurdle asset is a conservative security that represents a risk-free investment. The trend model uses SHV as the hurdle asset since it only owns short-term U.S. Treasury bills.

For example, the chart below calculates the average 12-month future return of U.S. stocks since 1994 based on two different scenarios: one where the average momentum metric was positive and another where the average momentum metric was negative. You can see that periods of positive momentum were typically followed by stronger returns.

This behavior isn’t unique to U.S. stocks.

that negative momentum has historically been associated with lower returns (and higher volatility) in all major asset classes over the past century.

Referring to the above relative momentum example, international stocks were outperforming U.S. stocks as of 12/31/2017. The +26.2% average momentum of international stocks was also higher than the +1.5% average momentum of SHV (the hurdle asset), meaning international stocks had positive momentum. In this scenario, the trend model would be invested in international stocks.

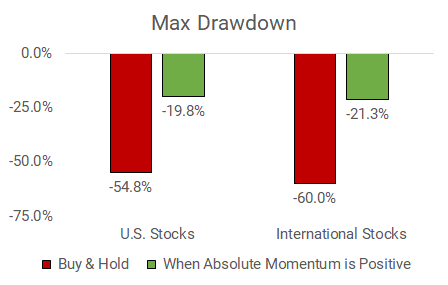

The main goal of the absolute momentum step is to lower the probability of experiencing a large drawdown. Drawdowns measure the max peak-to-trough loss of an investment. Large drawdowns are both emotionally painful and capable of derailing retirement portfolios. The chart below shows historical drawdowns for U.S. and international stock funds since 1994:

When absolute momentum turns negative, the trend model rotates from a stock fund to a bond fund. The bond fund depends on an investor’s account type. If the account is tax deferred (like an IRA), I use VGIT, an intermediate-term U.S. Treasury fund. If the account is taxable (like a brokerage account), I use VTEB, an intermediate-term municipal bond fund.

I use these funds, rather than a blended fund that tracks the popular Bloomberg Barclays Aggregate Bond index, to avoid taking credit risk when the trend model avoids stock exposure. I also uses intermediate-term funds (rather than short-term or long-term bond funds) to avoid taking an active stance on the future direction of interest rates. I’ll expand on this bond approach in a future article.

Rebalancing

The final step in the trend model is to rebalance the model to reflect recent data. Most active investors run monthly models, meaning the models are rebalanced based on data at the end of the month. My approach is different for two reasons: 1) monthly models implicitly bet on the last day of the month to be the best day to rebalance, and 2) monthly models tend to underestimate true volatility.

The first reason is called timing luck and represents the amount of potential over or underperformance of a strategy solely due to its rebalancing date. The second reason why I don’t rebalance monthly is because monthly observations don’t capture volatility that happens during a month. For example, the max drawdown of international stocks in October 2008 based on monthly data is -22%. The drawdown when calculated with daily data is -34%. Monthly models observe fewer data points and underestimate volatility.

My solution is to rebalance the trend model once a week but freeze the model’s stance for thirty days after a new position is initiated. This helps avoid wash sales in taxable accounts and also reduces back-and-forth trading.

The trend model is now complete. It measures relative momentum between domestic and international stocks, chooses the top performer, ensures that it has positive momentum, and then rebalances once a week.

It’s also important to understand the probabilities and payoffs of trend strategies, something I recently wrote about.

Summary

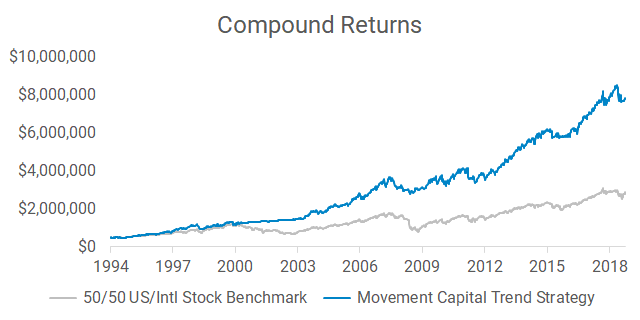

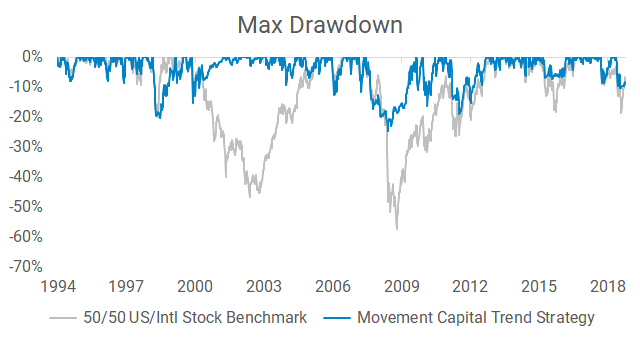

The graphs below show long-term simulated hypothetical data on the trend strategy relative to a passive benchmark. The benchmark is a 50/50 split between U.S. and international stocks, using the same funds from the trend strategy.

Data includes fund expense ratios, slippage, and trading costs. A flat annual management fee of $3,500 is deducted from the trend strategy. This is my firm's flat fee for investment management, which includes an investment plan, portfolio management, and regular conversations. This trend model is a small portion of the portfolio management component.

The table below contains summary statistics for the trend strategy and benchmark:

|

Statistic |

Strategy |

Benchmark |

|

Compound Return |

11.7% |

7.3% |

|

Max Drawdown |

-24.6% |

-57.2% |

|

Longest Drawdown |

31 months |

70 months |

|

Best Year |

+33.3% |

+37.9% |

|

Worst Year |

-17.3% |

-42.9% |

I’ll be the first to say that investors should not expect 11.7% from this strategy (or any other) in future years. It’s important to not look in the rear-view mirror and extrapolate recent returns. Stock valuations are high on most metrics and future stock returns will likely be lower than what the most recent cycle provided. That being said, the trend strategy is prepared to navigate future stock market volatility in a low-cost and systematic way.

This trend strategy is one of the systematic models I use in client accounts, with trend allocations typically averaging 20%. I think it’s important for investors to not solely rely on one type of strategy (like trend), but rather be diversified across multiple approaches. I will outline the process and performance of other models in future articles.

Let me know if you have any questions in the comments below, I'm happy to help.

Disclosure: I am/we are long VTI, VXUS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: U.S. stock data is an interpolation of historical dividend adjusted data for VTI and VTSMX. International stock data is an interpolation of historical dividend adjusted data for VXUS, VGTSX, and OIEAX. Returns shown in the first, second, fourth, and fifth graphs are total returns and are net of fund expense ratios but do not reflect management or trading fees. The results are hypothetical simulated results and are not an indicator of future results. For the sixth and seventh graphs, returns shown are total returns that include dividend and interest reinvestment and are net of fund expense ratios and trading costs. Both examples start with $500,000. $875 is deducted from the Movement Capital trend strategy each quarter. The 50/50 benchmark is an interpolated series of returns based on VTI and VTSMX for U.S. stocks, and VXUS, VGTSX, and OIEAX for international stocks. The results are hypothetical simulated results, were not realized in an actual account, and are not an indicator of future results.

Disclosure: I am long VTI, VXUS.

Additional disclosure: U.S. stock data is an interpolation of historical dividend adjusted data for VTI and VTSMX. International stock data is an interpolation ...

more