Dumb Questions Everyone Should Ask...

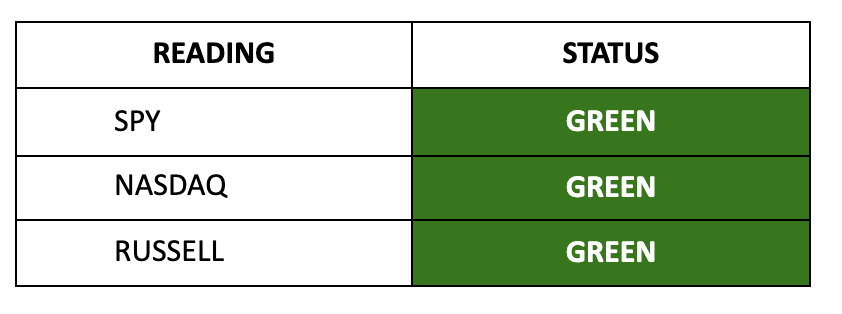

Market Update: We're still green, but the CPI figure was hotter than expected. According to Ed Yardeni, the Fed could be done cutting rates for the rest of the year. Meanwhile, interest rates are moving up, impacting collateral quality in the markets. It's getting a bit dangerous again, but China may be moving to provide even more stimulus this weekend. All eyes are on central banks—the same as they ever were.

Why…

Why…

WHY…

Those three letters that every child under 8 loves to string together.

Except last week, Amelia did stump me…

“Daddy, why do they call it a driveway… when all we do is park there…” she asked.

Oh… Amelia.

Let that be the first of many questions that you ask about this nation and the things we do with the English language.

When she asks me questions that I can’t answer…

I always reply with questions that I know she can’t answer either…

Recently, when she asked a question about how to play a video game that I’ve never seen or played… I replied…

Why is it called a "bull market" and a "bear market"?

Do you think animals run the economy?

She looked at me funny… and just said… “What? You're ridiculous...”

But there are questions in economics that people should ask…

They might sound like six-year-olds frame them…

But they’re important because they shape policy today.

We have to go back to basics sometimes.

So, let’s get to six questions everyone should know the answers to in this world.

Question 1:

Why can't the government just print more money so everyone can have some?

Doing so creates inflation.

The supply chain of inflation STARTS at the creation of capital and credit.

Now, here’s the problem. They already do print more money so everyone can have some.

It’s called “Hush Money Stimulus,” which they’ll send to us during liquidity crises while they’re bailing out Wall Street and their donors.

Question 2

Why does the bank give me interest for my money but charge me more interest when I borrow theirs?

It takes money to run a bank, and they need to run a profit.

Question 3

Why do things cost more money over time? Can't the government make sure that prices stay the same?

They tried this. It’s called price fixing. It leads to shortages.

Economists are worried that the government will try this again to “control” grocery prices. In Maryland, Senate candidate Angela Alsobrooks is campaigning that she will pursue “price gouging” at grocery stores to control prices.

This candidate graduated from Duke University yet has zero economic wherewithal.

Inflation is caused by money printing.

Money printing incentivizes price increases.

Full stop.

Question 4

Why do we pay taxes if the government can print money whenever it wants?

Um… I don’t know anymore. I thought I did… but I have given up because the new Modern Monetary Theorists who advice our White House believe that you can just print money.

And they think they can do so without causing inflation.

Which is insane.

So, I’ll reply by asking you… “Why is it called a "bull market" and a "bear market"? Do they think…”

Question 5

Why do people say money doesn't grow on trees when paper money is made from trees?

Modern currency is typically made from cotton fibers or synthetic materials, not wood pulp from trees.

Which brings me to my final question…

Why is a dime smaller than a nickel even though it's worth more?

This is one of the most important questions in all of economics.

Because it showcases one of the biggest problems we have with our money.

The reason a dime is smaller than a nickel, even though it's worth more, dates back to the history of U.S. coinage.

Originally, coins were made from precious metals, and their sizes were based on the value of the metal they contained.

The dime was made of silver, which was more valuable, so it could be smaller and still represent 10 cents worth of silver.

The nickel, introduced later, was made of less valuable metals like nickel and copper.

To make the coin practical in size and weight, it was made larger than the dime.

Here’s the issue.

Dimes aren’t made of silver anymore.

Why?

Because the value of silver became higher than the nominal value of the dime itself.

What happened is something called Gresham’s Law – a phenomenon where people hoard these coins, remove them from circulation, and may melt them down to sell the metal for a profit.

Gresham’s law states that "bad money drives out good money."

In other words, people tend to spend currency that is less valuable in terms of metal content and keep the more valuable coins out of circulation.

Today… our currencies aren’t made with precious metals anymore.

Because of hoarding.

There are multiple periods where the mint has pivoted, especially during the Civil War when pennies shifted to bronze.

In 1965, the U.S. Coinage Act eliminated silver from dimes and quarters due to hoarding during a surge in silver prices. They changed them to a copper-nickel clad composition. The half-dollar's silver content was slashed from 90% to 40%.

As Nixon removed us from the Gold Standard, the U.S. mint eliminated all silver in those coins. People were still hoarding the 40% silver coins, which you can still buy in bulk from private dealers today.

In 1982… the cost of copper increased sharply, making the penny’s physical conten worth more than the coin itself. So… the copper went away… and today’s pennies are now 97.5% zinc.

Today, I’d calculate that the actual value of the zinc-copper in the penny itself if worth about 0.78 cents (or 78% of a penny).

Don’t worry.

The price of Zinc will eventually surpass the value of the penny.

And people will probably hoard them.

What will we use after that?

It would be the end of the penny unless they're able to find something that is worth less in real terms. If we had to ditch zinc for our other coins, alternatives are tough.

One idea is to use steel. But steel is magnetic, which could impact vending machines.

And steel rusts.

What about aluminum?

It's cheap. But it's really light and could feel "weird" to users. It also breaks down quickly.

Copper-plated steel? Plastic? Stainless steel?

There are pros and cons...

But the fact that I'm talking about this speaks to the concept of “sound money” – which America doesn’t have.

The faith of the dollar itself is based on trust and the belief that it is worth WHAT IT SAYS it is.

Unfortunately, the purchasing power of that currency has eroded by 99.9% since its inception in 1913, and has dropped 52% in the last 30 years.

So, what is one to do?

Stay positive,

Garrett Baldwin

Secretary of Defense

More By This Author:

Beginner's Luck Or The Best Trade Ever?Things I Think Before Happy Hour

You Party, I Party, Chart Party

Disclosure: None.