Bitcoin And The Tether Liquidity Risk

The market capitalization of Bitcoin hit $1 Trillion and sceptics such as Nouriel Roubini have so far been made to eat humble pie, Today Bitcoin is trading at $56,000 and if you had invested $1000 back in 2010 it would be worth a staggering $560 million today. At Businesseconomics.com we have always looked at Bitcoin as a tradeable asset. much like rare stamps -- if people are happy to trade them amongst themselves then they have value. However, we have become increasingly concerned about the relationship between the so called stable coin Tether and whether it is actually being created out of thin air and is really backed by the equivalent in dollar reserves, this point has been extensively examined on other websites .

Furthermore I am not too sure I would want billion of reserves being with a bank managed by Deputy CEO Gregory Pepin -- he looks like he enjoys doing gaming during his spare time. I would like to see a psychologist comment on his body language. Even if Tether is not being created out of thin air it seems that someone did actually create $5 billion worth that got called back; that alone is a warning sign. We are also concerned that the daily value of trading in Tether of over $100 billion is now substantially more than the supposed market capitalization of of Tether of $33.5 billion. This means each Tether is being traded no less than 3 times per day on average. This all sounds great for liquidity but if the whole crypto market depends on Tethers then this creates a systematic risk to the whole crypto currency market. However a concern which we would like to highlight is the liquidity risk associated with Tether, you only have to go to their website to see this.

The problems are crystal clear:

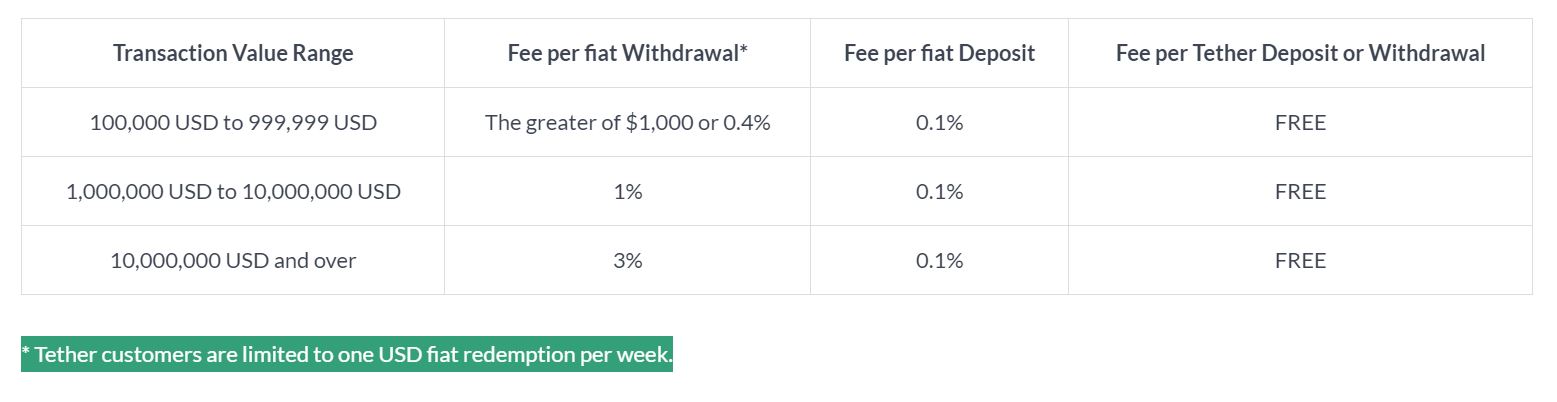

1) you can only convert from Tethers to US dollars if you have at least $100,000 so anyone with say $50,000 will not find it easy to convert in a falling market.

2) There are conversion fees that could in theory change overnight in a collapsing market. The 1% could become 20% overnight. I recall real currencies having 10% bid offer spreads during the Asian financial crisis.

3) Most important however if the footnote that shows only one conversion per week is allowed. That means if the price is collapsing and you want to get out you may find it very hard to do.

4) I presume these terms and conditions could be changed overnight as well and in a falling market they will only be changed to make it harder to cash out.

So even if Tethers are fully backed which seems to me to be unlikely as Tether made a legal claim they were only 74% backed some time ago the liquidity risk in a falling market is enormous within weeks prices could easily crash 90% and investors find it very difficult to get out. Given that Tether is now the most traded coin of all in the crypto market I would be very concerned. Others may disagree with me on this point but there is an old adage if it looks too good to be true, it probably is. I am also not reassured by the Transparency statement with a letter from some FSS organsation referring to $2.5 billion of assets but dated June 2018it is very wordy and they are just relying on statements given to them and it explicitly says "The above confirmation of bank and tether balances should not be construed as the results of an audit and were not conducted in accordance with Generally Accepted Auditing Standards."

Finally just read their terms of service they can stop you converting your Tethers into dollars at their sole discretion.

" In order to cause Tether Tokens to be issued or redeemed directly by Tether, you must be a verified customer of Tether. No exceptions will be made to this provision. The right to have Tether Tokens redeemed or issued is a contractual right personal to you. Tether reserves the right to delay the redemption or withdrawal of Tether Tokens if such delay is necessitated by the illiquidity or unavailability or loss of any Reserves held by Tether to back the Tether Tokens, and Tether reserves the right to redeem Tether Tokens by in-kind redemptions of securities and other assets held in the Reserves. Tether makes no representations or warranties about whether Tether Tokens that may be traded on the Site may be traded on the Site at any point in the future, if at all."

There is an ongoing investigation into Tether by the New York State Assistant General office which could lead to real problems for the Tether organization and therefore the crypto market in general. The there is the additional risk that the Bahamas based bank Deltect hat presumably makes payments on behalf of the Tether organization gets its licence suspended which is another risk worth highlighting. As they say in finance caveat emptor which means buyer beware. I wish all bitcoin holders continued success but one thing I have learnt in finance is it is often best to get out before the party ends!

Disclosure: None.