Airline Stock Roundup: JBLU To Boost Workforce, ALK Gives Better Q1 Revenue View

Image Source: PixaBay

In the past week, Alaska Air Group (ALK) issued a view for first-quarter 2022 revenues, much better than the earlier expectation. The improved projection was owing to the upbeat air-travel demand scenario, despite the steep rise in fuel costs.

JetBlue Airways (JBLU) was another primary news maker in the past week when it announced plans to add 5,000 jobs in the New York City this year to meet the uptick in air-travel demand. In an encouraging update on the labor front, Southwest Airlines (LUV) announced inking a provisional pay-related deal with the union representing its customer service employees.

An expansion-related update was also available from Spirit Airlines (SAVE) in the past week. SAVE is constantly looking to add routes to meet the demand surge. Another expansion-related update from SAVE was also reported in the past week’s write up.

Recap of the Latest Top Stories

- For the first quarter, Alaska Air Group expects capacity to decline approximately 11-12% from the first-quarter 2019 level compared with the previous expectation of a 10-13% decrease. Total revenues are now expected to decline 11-12% from the first-quarter 2019 level compared with the 14-17% decrease estimated earlier. Revenue passengers are estimated to fall 17-18% from the comparable period’s level in 2019 (previous guidance: decrease of 19-21%). ALK predicts load factor (percentage of seats filled by passengers) to be 76-78% in the current quarter (previous guidance: 71-74%). Cost per available seat miles, excluding fuel and special items, is forecast to increase 18-19% in the first quarter from the comparable period’s level in 2019 (previous expectation: increase of 15-18%). Economic fuel cost per gallon is estimated to be $2.62.

- In a customer-friendly move, JetBlue, currently carrying a Zacks Rank #3 (Hold), aims to strengthen its existing partnership with Qatar Airways. The latest agreement will include more codesharing, enhanced benefits for JetBlue TrueBlue and Qatar Airways’ Privilege Club loyalty members and streamlined flight schedules across both airlines. Post materialization, this new deal will unlock more options to travel between JetBlue’s more than 100 destinations across North America and the Caribbean, and Qatar Airways’ global network of 82 countries. The two airlines have been partnering since 2011.

- In another update, JetBlue announced its intension to hire additional employees in the New York City this year, ranging from in-flight crew members and people for ground operations as well as information technology. The airline currently has around 8,000 crew members based in the New York City at airports and in its Long Island City support center.

- To meet the anticipated demand swell during the upcoming summer season, Spirit Airlines announced plans to expand its network. To this end, SAVE decided to add four routes from the Newark airport. Spirit Airlines will operate four non-stop flights daily to Indianapolis, Los Angeles, Oakland and Pittsburgh. The flights to the said destinations will be operational on May 5, Jun 22, Aug 10 and Jun 22, respectively. Following its expansion at Newark, SAVE will offer 24 departures on peak days this summer, thus doubling in size from the 2019 level.

- The tentative four-year agreement with the International Association of Machinists and Aerospace Workers (IAM) that got through after long-standing negotiations is meant to increase wages and other benefits for the 6000 plus customer service LUV employees, covered by the union. However, the new contract won’t be effective anytime soon. We note that tentative agreements do not necessarily mean that the deal will be functional. The provisional deal inked by Southwest Airlines will be voted upon by union members. The deal will be effective only if the voting result turns out to be favorable.

Performance

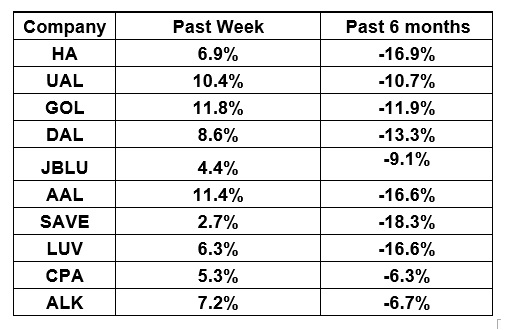

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that all airline stocks have traded in the green over the past week. This was mostly owing to the oil price decline from the astronomical highs touched recently. The NYSE ARCA Airline Index has gained 6.65% to $79.81. Over the past six months, the NYSE ARCA Airline Index has declined 16%.

What's Next in the Airline Space?

Investors will keep an eye on the oil price movement and its resultant effect on the airline stocks. Following the resurgence of new coronavirus cases and the pandemic-related lockdowns in China, investors will now wait and see their impact on air-travel demand.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more