3 Biotech Stocks With Strong Quantitative Drivers

Investing in biotech stocks can lead to massive gains when positioned in the right names in such a promising industry. However, picking the best biotech stocks is much easier said than done. Even for professional asset managers with lots of experience and a deep understanding of the sector, identifying the best biotech stocks can be a challenging task.

No quantitative system can be perfect or infallible, and the numbers alone don't tell you everything you need to know when picking biotech stocks. However, incorporating quantitative indicators can be a smart way to make better decisions when investing, both in biotech or in any other sector, for that matter.

Investing In Biotechnology By The Numbers

You can't build a complete investment thesis for a stock looking solely at the numbers. Especially in the biotech industry, where different drugs and treatments can have a massive impact on the company's numbers, it is of utmost importance to take a look at the business behind such numbers in order to tell if the quantitative indicators will be sustainable or not going forward.

Nevertheless, quantitative analysis can provide an effective framework to select biotech stocks for further research. Importantly, the statistical evidence shows that companies which exhibit some quantitative attributes tend to outperform the market over the long term.

The PowerFactors System is a quantitative algorithm available to members in The Data-Driven Investor. This algorithm ranks companies using a combination of 4 main factors.

- Financial quality: The system looks for companies with superior growth and profitability, considering metrics such as revenue growth expectations, free cash flow margin, and return on equity.

- Valuation: This covers classical valuation ratios like price to earnings, price to earnings growth, and price to free cash flow.

- Fundamental Momentum: the system looks for companies that are delivering earnings numbers above expectations and driving increasing expectations about future performance. This is because expectations can have a huge impact on stock prices over time.

- Relative Strength: Winners tend to keep on winning, so you want to buy stocks that are outperforming the market in general and the industry, in particular.

Leaving the numerical considerations aside, the main rationale behind the PowerFactors system is actually quite simple. The algorithm is basically looking to buy solid companies (quality) at a reasonable price (value) when the business is doing better than expected (momentum) and the stock is outperforming (relative strength).

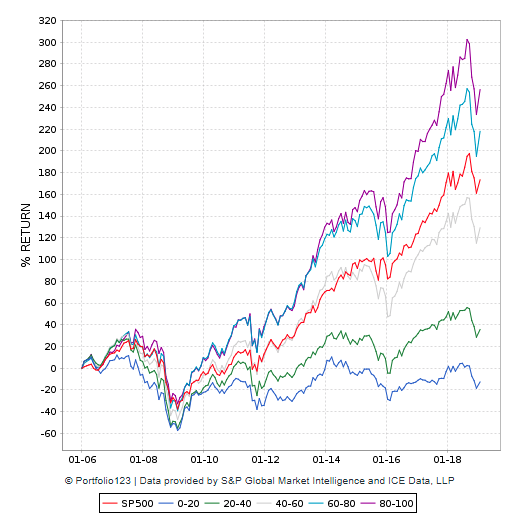

Backtested performance is quite strong. The chart below divides the investable universe into 5 buckets based on their PowerFactors ranking, and it compares their historical performance versus the

SPDR S&P 500 (NYSEARCA:SPY). The higher the quantitative ranking, the higher the returns over time, and companies in the top bucket tend to materially outperform the market.

Data from S&P Global via Portfolio123

It's important to keep in mind that past performance does not guarantee future returns, and quantitative systems are always based on current data and expectations about the future. When a company fails to deliver in accordance with such expectations, the stock will most probably underperform the market, no matter what the numbers are saying.

Those limitations being acknowledged, analyzing stocks based on objective and measurable drivers is clearly a sounder approach than relying entirely on opinions and speculation.

For investors looking for ideas in biotech stocks with solid quantitative metrics, Amgen (AMGN), Gilead (GILD), and Biogen (BIIB) are interesting names to consider.

The table below shows the PowerFactors rankings for these 3 stocks, as well as their respective rankings across the four dimensions in the algorithm. Amgen, Gilead, and Biogen have PowerFactors metrics above 90, which means that they are in the top 10% of the stocks in the market according to these metrics.

| Ticker | PowerFactors | Quality | Value | F Momentum | R Strength |

| AMGN | 92.37 | 98.93 | 98.54 | 45.6 | 69.86 |

| GILD | 93.91 | 95.73 | 98.05 | 73.01 | 52.65 |

| BIIB | 99.47 | 99.37 | 99.59 | 94.35 | 68.3 |

Amgen

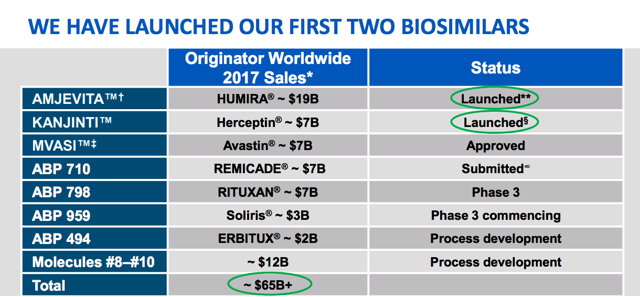

Amgen is a market leader in renal disease and cancer supportive care products. The business is facing increasing competition from biosimilars across many of its main markets, but management is aggressively cutting costs in order to remain competitive in prices, while also launching its own biosimilar drugs in the years ahead.

Source: Amgen Investors Presentation

The company has a solid track record in terms of financial performance over time. Five years ago, management committed to delivering double digits earnings per share growth, generating an operating profit margin of 52%-54% of revenue, achieving $1.5 billion in cost savings, and returning 60% of net income to shareholders.

Fast forward five years, and Amgen announced in the most recent earnings report that is has met or exceeded each those ambitious financial targets,

quite an impressive achievement for a company facing rising competitive pressure.

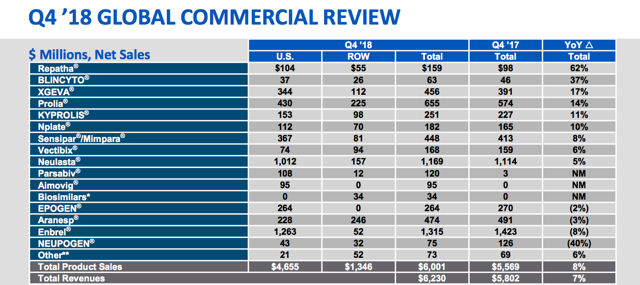

Financial performance numbers for the fourth quarter of 2018 are clearly strong. Amgen reported $6.23 billion in revenue, growing by 7.4% year over year and surpassing Wall Street expectations by $390 million.

Source: Amgen Investors Presentation

Looking at the company's different drugs, their performance is quite dissimilar depending on the particular product. However, the portfolio as a whole is doing quite well.

Gilead

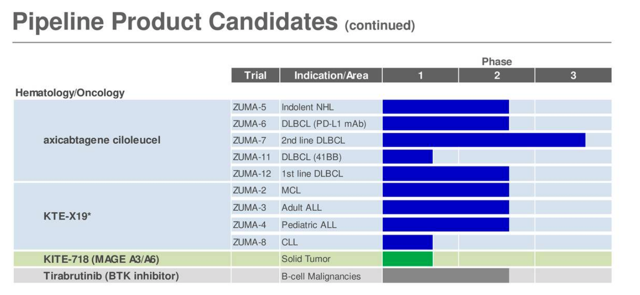

Gilead is focused on life-threatening infectious diseases, with a big presence in treatments for HIV, hepatitis B, and hepatitis C. The company has made a series of acquisitions to expand its portfolio in cardiovascular diseases and Cancer treatments over the past several years. Importantly, the acquisition of Kite Pharma for $11.9 provided a big boost to Gilead in cell therapy and oncology treatments.

Gilead is facing a slowdown in its HCV franchise across key markets because of growing competition and pricing pressures. In addition to this, the HIV franchise faces increasing pressure from Glaxo.

In this context, the company is delivering lackluster financial performance lately, with revenue declining 2.6% and product sales falling 2.7% in the fourth quarter of 2018.

But the good news is that this weakness is already reflected on valuation levels to a considerable degree. Gilead stock is trading at a forward PE ratio of 9.74, quite an attractive valuation.

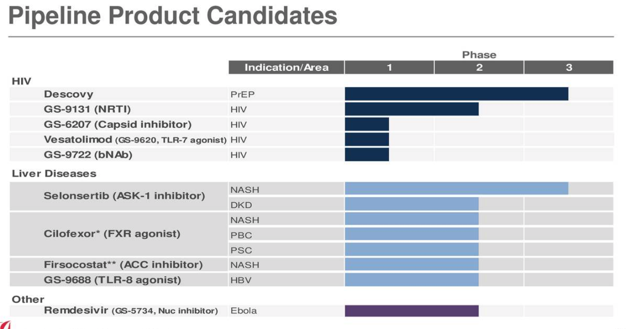

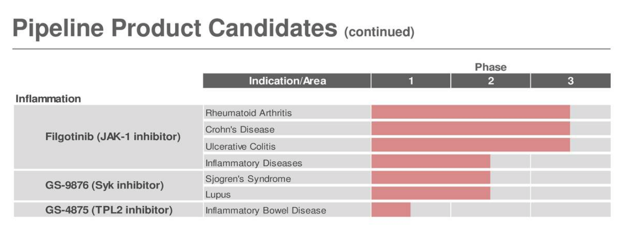

Gilead has a big pipeline of new product candidates in areas such as HIV, liver disease, inflammation, oncology, and hematology.

Source: Gilead Investor Presentation

Source: Gilead Investor Presentation

Source: Gilead Investor Presentation

It's hard to tell what kind of financial impact these new developments will have on the company's performance in the years ahead. However, one thing looks quite clear, if Gilead can finally start growing again, then the stock offers abundant upside potential from current valuation levels.

Biogen

Biogen is focused on neurological and neurodegenerative diseases, including multiple sclerosis, neuroimmunology, Alzheimer’s disease, and dementia. The company is also a market leader in movement disorders, including Parkinson's disease.

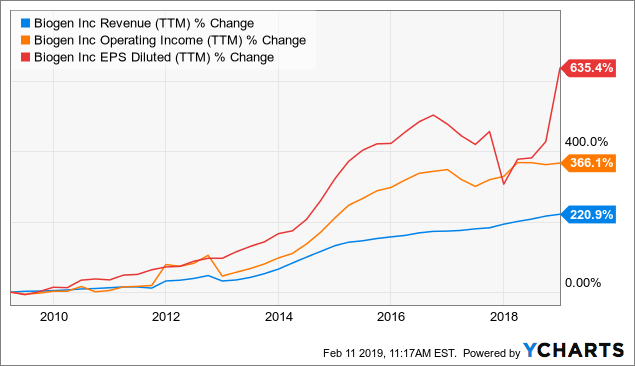

The company has an outstanding track record in financial performance over the long term. The chart below shows the evolution of revenue, operating income, and earnings per share over the past decade.

Data by YCharts

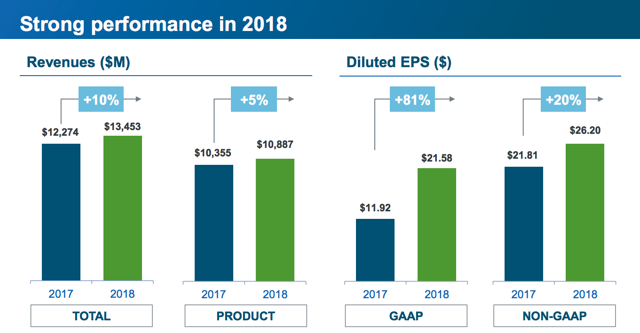

Financial performance numbers for the fourth quarter of 2018 confirm that the business keeps firing on all cylinders. The company delivered better than expected sales and earnings during the quarter, with revenue growing by 10% and adjusted earnings per share increasing 20% during the full year 2018.

Source: Biogen Investor Relations

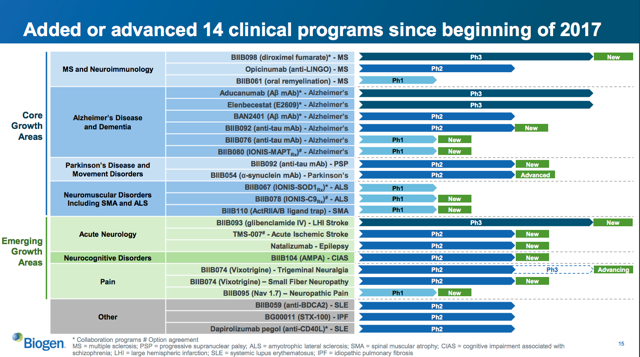

Biogen is aggressively betting on growth in the years ahead. Some key moves in recent months include:

- The company is making significant progress in MS, including an NDA submission to the FDA, initiating new life cycle management initiatives.

- In Alzheimer's and dementia, Biogen completed Phase 3 enrollment of aducanumab. The company also initiated a Phase 2 study of BIIB092 in Alzheimer's disease, and it announced strong results of BAN2401.

- In neuromuscular disorders the company acquired BIIB110, a muscle enhancement program from AliveGen. Biogen also initiated a Phase 1 study of BIIB078 targeting C9orf in ALS, and it announced positive Phase 1 interim results for BIIBO67 in SOD1 ALS.

- Biogen initiated a Phase 2 study of BIIB054 in Parkinson's disease, and it completed enrollment of its Phase 2 study of BIIB092 in PSP.

- The company expanded its pipeline in acute neurology and neurocognitive disorders with the addition of BIIB104 for cognitive impairment associated with schizophrenia.

Like usually happens in these cases, it's hard to quantify the impact of these new developments, but the fact remains that there is a lot going on at Biogen in terms of growth initiatives over the middle term.

Source: Biogen Investor Relations

The Bottom Line

A quantitative algorithm such as PowerFactors can tell you that companies exhibiting certain quantitative attributes tend to outperform the market over the long term. However, this does not tell you much about how a particular group of biotech stocks will perform in a particular year.

Those limitations being acknowledged, it's good to know that the numbers are indicating that Amgen, Gilead, and Biogen are well positioned for attractive returns if they can deliver financial performance in accordance with expectations over the years ahead.

Disclosure: I ha

ve no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more