10 Best Defensive Stocks To Invest In 2023

Image Source: Pixabay

A defensive stock is a stock that demonstrates relatively stable performance regardless of the current state of the economy. Defensive stocks are also called non-cyclical stocks, as they are less prone to the economic cycle of expansions and recessions. Defensive stocks will come with a steady dividend payment and a more constant share price.

Defensive stocks are stocks that provide consistent dividends and stable earnings regardless of the state of the overall stock market. They tend to be more stable during the various phases of the business cycle. Some key characteristics of defensive stocks are:

- Stable performance: Defensive stocks do not follow the economic cycle during expansions and recessions. They provide slow and steady growth with minimal peaks and valleys.

- Consistent dividends: Defensive stocks tend to provide dividends in both bull and bear markets, which can help you have a steady revenue stream.

- Low volatility: Adding defensive stocks to your portfolio helps reduce volatility. They protect your portfolio from major losses when the economy turns downward.

- Industries: Defensive stocks are found in industries that offer goods and services that consumers continue to utilize even when the economy is not doing well. These include utilities, consumer staples, healthcare, and more.

List of Best Defensive Stocks

Here is a list of Best Defensive Stocks to invest in 2023:

JPMorgan Chase (JPM)

JPMorgan Chase is one of the world’s oldest, largest, and best-known financial institutions. With a history that traces our roots to 1799 in New York City, they carry forth the innovative spirit of their heritage firms in their global operations in over 60 countries.

JPMorgan Chase & Co (JPM) is a financial holding company that offers consumer and commercial banking, investment banking, financial transaction processing, and asset management solutions through its subsidiaries. The consumer businesses include credit cards, small businesses, auto finance, education finance, and merchant services, among others. The commercial banking business comprises middle market banking, business credit, equipment finance, and commercial term lending, among others. The company includes certain commercial banking services such as corporate client banking; and government, not-for-profit, and healthcare banking. The company provides asset management, treasury services, investment banking, wealth management, private banking, US consumer and commercial banking operations, and brokerage services under the J.P. Morgan and Chase brands

In the recent second-quarter earnings report of FY 2023, the company reported:

- Reported revenue was recorded at $ 41.3 billion, as compared to $ 30.71 billion in the previous year’s same period

- Net Income was reported at $ 14.5 billion, as compared to $ 8.7 billion in the previous year’s same period

- Earnings per share was reported at $ 4.75, as compared to $ 2.76 in the previous year’s same period

- Average loans increased by 13 % and average deposits declined by 6 %

JP Morgan has a market cap of $ 421.7 billion. Its shares are trading at $ 145.1. The stock of the company has been on a bullish journey for the past year. The stock started the year 2023 at $ 101.85. Throughout the year, the stock maintained its bullish journey and last closed at $ 145, representing a 30 % appreciation to date.

(Click on image to enlarge)

Apple (AAPL)

Apple Inc. (Apple) designs, manufactures, and markets smartphones, tablets, personal computers, and wearable devices. The company offers software applications and related services, accessories, and third-party digital content. Apple’s product portfolio includes iPhone, iPad, Mac, iPod, Apple Watch, and Apple TV. It also provides advertising services, payment services, cloud services, and various consumer and professional software applications such as iOS, macOS, iPadOS, watchOS, iCloud, AppleCare, and Apple Pay. Apple sells and delivers digital content and applications through the App Store, Apple Arcade, Apple News+, Apple Fitness+, Apple Card, Apple TV+, and Apple Music.

Apple reported its third quarterly report for its current fiscal year:

- Net Sales were reported at $ 81.8 billion, as compared to $ 83 billion in the previous year’s same quarter

- Net Income was reported at $ 19.9 billion, as compared to $ 12.8 billion in the previous year’s same quarter

- Earnings per share was reported at $ 1.27, as compared to $ 1.2 in the previous year’s same quarter

Apple has a market cap of $ 2.72 trillion. Its stock is trading at $ 173.49. The stock has been on a bullish journey since the start of the year. From a price of $ 129.93, at the start of the year, the stock went as high as 196.45 during the year. Eventually, the stock last closed at $ 176.08 representing a 26 % appreciation during the year.

(Click on image to enlarge)

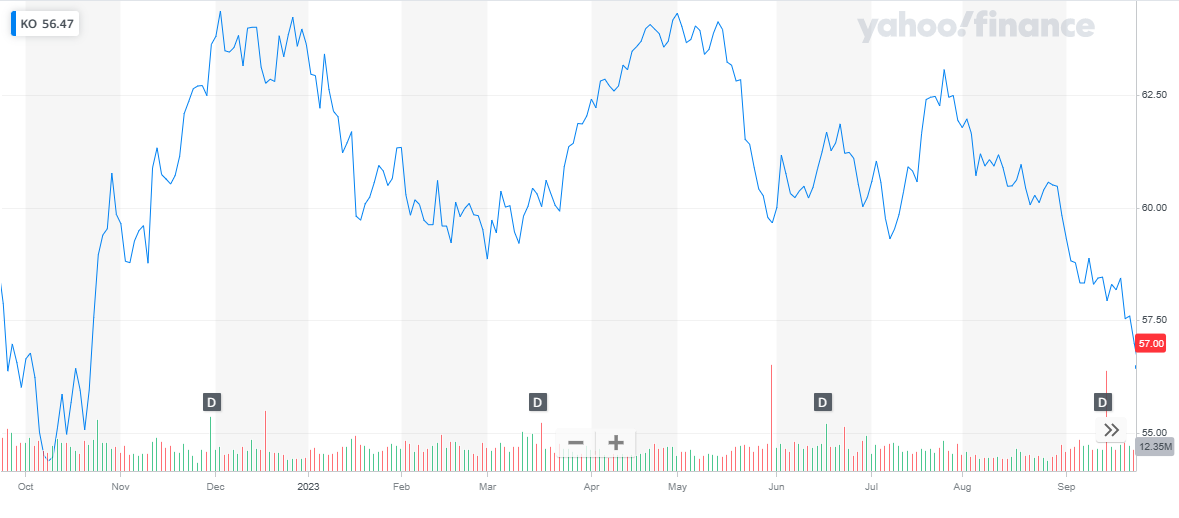

Coca-Cola (KO)

The Coca-Cola Co (Coca-Cola) is a producer, distributor, and marketer of non-alcoholic beverages. The company’s product portfolio comprises sparkling beverages and a variety of still beverages including juices and juice drinks, water, enhanced waters, ready-to-drink teas and coffees, and energy and sports drinks. The company also offers ready-to-drink hard seltzers, alternatives, and pre-mixed cocktails. It markets beverages under Sprite, Coca-Cola Zero, Diet Coke, Fanta, Glaceau Vitaminwater, Powerade, Dasani, FUZE TEA, Minute Maid, Simply, Georgia, and Del Valle brand names. Coca-Cola sells products to independent bottling partners, distributors, wholesalers, and retailers.

In the recent second-quarter report for the current fiscal year, the company reported:

- Net revenues were reported at $ 12.0 billion, representing a 6 % increase from net revenues of $ 11.3 billion in the same period last year

- Net revenues were reported at $ 2.5 billion, as compared to $ 1.9 billion in the previous year’s same period

- Earnings per share were reported at $ 0.59, representing a 34 % increase from the same period last year

Coca-Cola has a market cap of $ 244.4 billion. Its shares are trading at $ 56.49.

The stock of the beverage company has been on a volatile journey for the past year.

The stock started the year 2023 at $ 63.61. After multiple dips and peaks, the stock last closed at $ 56.49 representing an 11 % decline to date.

(Click on image to enlarge)

British American Tobacco Plc. (BTI)

British American Tobacco plc produces, markets, and sells cigarettes, tobacco and nicotine products, vapor and tobacco-heating products, and other tobacco-related products. The company’s product portfolio includes cigars, fine-cut tobacco, snus, moist snuff, and vapor. BAT markets its products under Pall Mall, Vogue, Viceroy, Newport, Vype, glo, Dunhill, Lucky Strike, Natural American Spirit, Kool, Kent, Rothmans, Kodiak, and Camel brand names. The company sells its products to an extensive network of retailers, wholesalers, and exclusive distributors.

In the recent half-yearly report, the company reported:

- Revenue was recorded at £ 13.4 billion, representing an increase of 4.4 %, driven by New Categories which reported a 26.6 % increase in its revenue.

- Earnings per share were reported at 176p, representing an increase of 118 % from the previous year’s same period

British American Tobacco has a market cap of $ 72.7 billion. Its shares are trading at $ 32.13.

The stock has been on a bearish journey for the past year. It started the year 2023 at $ 39.98. Throughout the year, the stock continued to decline and last closed at $ 32.13 representing a 20 % decline to date.

(Click on image to enlarge)

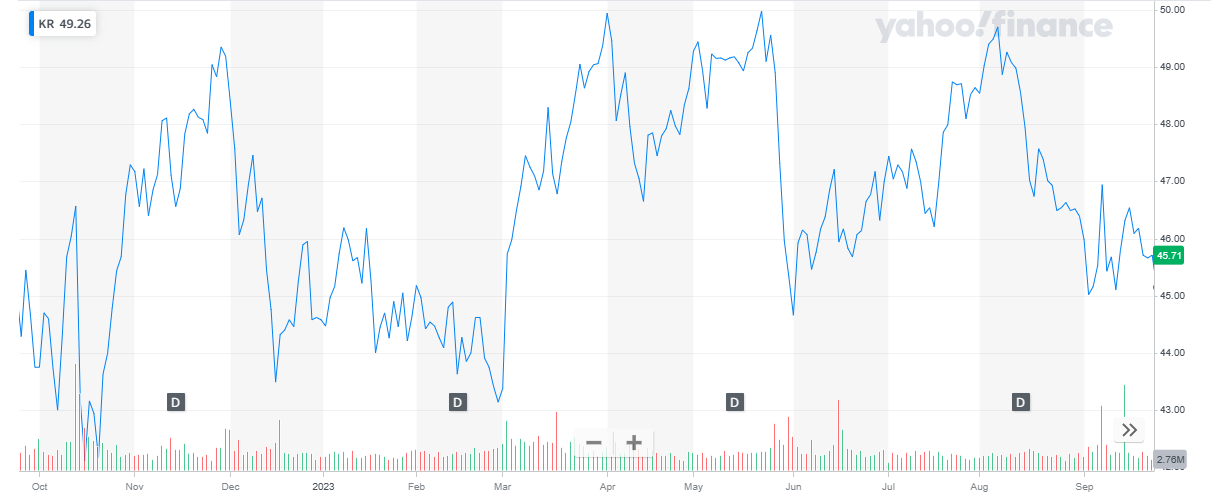

The Kroger Co. (KR)

The Kroger Co (Kroger) is an in-store and online grocery retailer that specializes in the production and distribution of food and non-food products. It operates supermarkets, drug stores, multi-department stores, marketplace stores, and jewelry stores throughout the US. The company’s product portfolio includes natural food and organic sections, pharmacies, general merchandise, pet centers, and perishables such as fresh seafood and organic produce, apparel, home fashion and furnishings, electronics, automotive products, toys, outdoor living products, electronics, and home goods.

The company recently reported its quarterly report for the year 2023:

- Total sales were $33.9 billion in the second quarter, compared to $34.6 billion for the same period last year.

- Net Loss was reported at $ 180 million as compared to net profit of $ 731 million during the same period last year

- Loss per share was reported at ($ 0.25) as compared to earnings per share of $ 1.01 during the same period last year

Kroger has a market cap of $ 32.6 billion. Its shares are trading at $ 45.31.

The stock of the company has been pretty volatile in the past year. It started the year 2023 at $ 44.58. After multiple ups and downs during the year, the stock eventually closed at $ 45.71, representing a 2.5 % appreciation to date.

(Click on image to enlarge)

Catalyst Pharmaceuticals Inc. (CPRX)

Catalyst Pharmaceuticals Inc (Catalyst) is a biopharmaceutical company that develops and commercializes prescription drugs targeting rare neurological and neuromuscular diseases. The company focuses on specific conditions such as lambert-eaton myasthenic syndrome (LEMS) and focal onset seizures. The company also has various existing agreements to commercialize its products. Its product portfolio includes Firdapse, a proprietary form of amifampridine phosphate for the treatment of LEMS in children and adults.

Catalyst Pharmaceuticals recently reported its second-quarter results for the fiscal year 2023:

- Total product revenues were reported at $ 99.5 million, as compared to $ 53 million in the previous year’s same period representing an 87.5 % appreciation

- Net Income was reported at $ 37.8 million as compared to $ 21.6 million in the previous year’s same period representing a 74.7 % appreciation

- Earnings per share was reported at $ 0.36, as compared to $ 0.21 in the previous year’s same period

Catalyst Pharmaceuticals has a market cap of $ 1.29 billion. Its shares are trading at $ 12.14.

The stock has been pretty volatile during the year 2023, with sharp declines during the year. The stock started the year at $ 18.6, rose up to $ 21.05, and then suffered a sharp decline and dropped as low as $ 14.76. From here on stock continued with a slight increase and touched $ 18.08. And then, again, the stock suffered a huge blow and suffered a sharp decline to $ 11.54. From here on the stock recovered a bit and last closed at $ 12.14. Overall, to date, the stock has depreciated by 35 %.

(Click on image to enlarge)

Cal-Maine Foods Inc. (CALM)

Cal-Maine Foods Inc (Cal-Maine) produces, grades, packages, markets, and distributes shell eggs. The company’s product portfolio includes specialty and non-specialty eggs, nutritionally enhanced, cage-free, organic, and brown eggs, and other shell eggs. It also sells broken shell egg products in solid, liquid, frozen, and dried forms. Cal-Maine sells products to club stores, national and regional grocery chains, egg product customers, and food service distributors. The company markets its products under Egg-Land’s Best, Farmhouse Club stores, 4-Grain, and Land O’ Lake brand names. It operates and manages breeding facilities, wholesale distribution centers, feed mills, egg production facilities, pullet growing facilities, processing, and packaging facilities in the US. Cal-Maine is headquartered in Ridgeland, Mississippi, the US.

Cal-Maine Foods reports results for the third quarter of fiscal 2023:

- Quarterly net sales were reported at $ 997.5 million, as compared to $ 447 million in the previous year’s same period. This increase was driven by strong conventional egg prices

- Quarterly net income was reported at $ 323.2 million, as compared to $ 39.5 million in the previous year’s same period

- Earnings per share was reported at $ 6.64, as compared to $ 0.81 in the previous year’s same period

Cal Maine Foods has a market cap of $ 2.41 billion. Its shares are trading at $ 49.27.

The stock has been on a bearish journey in the year 2023. It started the year 2023 at $ 54.45. Initially, the stock maintained its price level and rose to $ 61.36. But then the stock suffered a decline and continued to decline to date, The stock last closed at $ 49.27 representing a 10 % appreciation to date.

(Click on image to enlarge)

New Jersey Resources Corporation (NJR)

New Jersey Resources Corp is an energy holding company that carries out the distribution of natural gas through a regulated utility. It provides regulated retail natural gas service to residential and commercial customers in central and northern New Jersey. The company also operates solar projects to offer residential and commercial customers low-carbon solutions by generating clean power. The company also provides home comfort solutions including HVAC installations, service contracts for heating and cooling systems, plumbing and electrical services, standby generators, and solar lease and purchase plans. It provides unregulated wholesale energy management services to natural gas producers and other energy companies. NJR is headquartered in Wall, New Jersey, the US.

New Jersey Resources Corp recently reported its third quarter report for the year 2023:

- Net income was reported at $ 1.5 million, as compared to $ 13.1 million in the previous year’s same period

- Earnings per share was reported at $ 0.02, as compared to $ 0.14 in the previous year’s same period

New Jersey Resources Corp has a market cap of $ 4.03 billion. Its shares are trading at $ 41.33.

The stock started the year 2023 at $ 49.62. The stock picked up a bullish trend and went as high as $ 55.45. From here on the stock reversed its course and last closed at $ 41.33. Overall, the stock declined by 17 % to date.

(Click on image to enlarge)

Pfizer (PFE)

Pfizer Inc (Pfizer) discovers, develops, manufactures, and commercializes biopharmaceuticals. The company offers products to treat various conditions such as cardiovascular, metabolic and pain, women’s health, cancer, inflammation, immune disorders, and rare diseases. It also provides sterile injectable pharmaceuticals, biosimilars, active pharmaceutical ingredients (APIs), and contract manufacturing services. Pfizer sells its products through wholesalers, retailers, hospitals, individual provider offices, clinics, government agencies, and pharmacies. It has major manufacturing facilities in India, China, Japan, Ireland, Italy, Belgium, Germany, Singapore, and the US. The company provides its products in North America, South America, Asia-Pacific, Australia, Europe, Africa, and the Middle East. Pfizer is headquartered in New York, the US.

Pfizer Inc. recently reported its second-quarter results for the fiscal year 2023:

- Revenues were reported at $ 12.7 billion, as compared to $ 27.7 billion in the previous year’s same period representing a 54 % decline

- Net Income was reported at $ 2.3 billion, as compared to $ 9.9 billion in the previous year’s same period representing a 77.7 % decline

- Earnings per share was reported at $ 0.67, as compared to $ 2.04 in the previous year’s same period representing a 67 % decline

Pfizer has a market cap of $ 183 billion. Its shares are trading at $ 32.4.

The stock of the company has been continuously declining since the start of the year 2023. From a price of $ 51.24, the stock last closed at $ 32.4. Overall, the stock depreciated by 37 % to date.

(Click on image to enlarge)

Wendy’s (WEN)

Wendy’s is the second-largest hamburger quick service restaurant (QSR) chain in the U.S. and the third largest globally. It has 7,095 restaurants globally as of Jan. 1, 2023, the majority of which are in the U.S. Most of these are franchised-owned QSRs – 93.3% of the stores in the U.S. are owned by 217 franchisees, and 98.9% of the international QSRs are owned by 106 franchises.

Wendy’s is a quick-service hamburger restaurant company. The company operates both franchise and company-owned restaurants. Wendy’s offers a range of menus specializing in hamburger sandwiches and a variety of cheeseburgers, wraps, chicken nuggets, French fries, beverages, sandwiches, baked potatoes, freshly prepared salads, sides, soft drinks, kids’ meals, and Frosty desserts. The company also offers promotional products at times. Wendy’s offers breakfast in some restaurants in the US. Wendy’s free-standing restaurants include a dining facility along with a pick-up window. It operates quick-service restaurants in the US, Canada, and other international markets. The company is headquartered in Dublin, Ohio, the US.

Wendy’s recently reported its second quarter report for the fiscal year 2023:

- Total revenues were reported at $ 537.8 million, as compared to $ 561.6 million in the previous year’s same period

- Net income was reported at $ 48.2 million, as compared to $ 59.6 million in the previous year’s same period

- Earnings per share was reported at $ 0.22, as compared to $ 0.28 in the previous year’s same period

Wendy’s has a market cap of $ 4.3 billion. Its shares are trading at $ 20.59.

The stock started the year 2023 at $ 22.63. The stock remained volatile throughout the year. It went as high as $ 23.83 and as low as $ 19.69 during the year. Eventually, the stock last closed at $ 20.59 representing a 9 % decline to date.

(Click on image to enlarge)

More By This Author:

Tesla 5 Swing Sequence Favors Upside

Silver Miners ETF May Have Started To Turn Higher

S&P 500 ETF Has Ended Correction And Turned Higher

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more