Inflation Is Still In A Downtrend

Image Source: Pexels

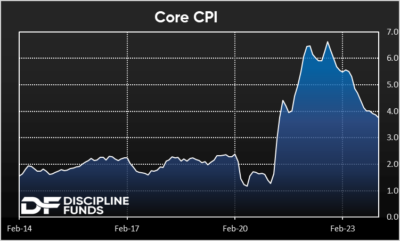

Tuesday’s CPI report came in a touch hotter than expected at 3.2% on the headline and 3.8% on the core. Analysts were looking for 3.1% and 3.7%. Bonds sold off on the news as investors started to project the likelihood of later rate cuts. Some analysts will say that this is the beginning of a big resurgence in inflation or a sign that disinflation isn’t entrenched, but the early 2024 stickiness in inflation is largely unsurprising and doesn’t change the broader trend here which is to the downside.

It’s worth keeping the big picture in mind here as we look at one month of inflation data and that trend is still strongly to the downside. The rate of change has slowed a bit in recent months, but that’s largely due to the seasonal quirks around year-end and the naturally slow rate of change in shelter. And there’s still very good news in there as the shelter component is still reading 5.8% year over year which is going to overstate shelter’s contribution to CPI for the rest of this year. I say this is good news because I expect shelter to moderate into the 3.5% range over the coming 18 months and that will put overarching downward pressure on the inflation readings for at least another year. So, these short-term readings will cause near-term overreaction in the course of a much longer downward trend.

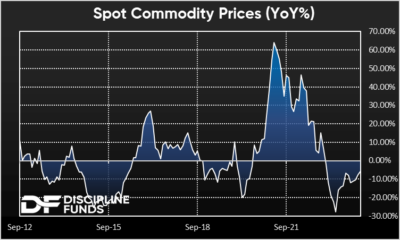

There’s more confirming evidence of disinflation across the economy. The two biggies are commodity prices and wages. Last week’s employment report showed a continuation of disinflation in wages. Meanwhile, commodities are still down -5% year over year. These are very good signs for current and future inflation trends as they’re consistent with low rates of inflation. In order to get a big second bump in inflation, that offsets the downward trend in shelter, we’d need to see a big surge in both commodities and wages. That’s simply not happening.

The bottomline: inflation is still in a downtrend and as I noted at the end of last year, moving from 3% to 2% inflation is going to be a bigger struggle than moving from 6% to 3%. Additionally, the rapid pace of disinflation in the second half of 2023 created irrational expectations for the pace of rate cuts in 2024. The March and May cuts never made sense and we remain in the June camp.

If there’s one thing I’ve learned about markets and economics over the years it’s that things usually take longer to materialize than we hope. The economy is a great big moving system and while our lives feel like a flash in the pan the economy and the world move at a pace that is much slower than we’d like. So a little patience and discipline is all we need here. Before long we should see a continued downtrend in the pace of disinflation that spoiled us in 2023.

More By This Author:

How Do Higher Interest Rates Push Inflation Down?Magazine Covers And Market Caps

The Problem with 60/40

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more