Inflation Is Here

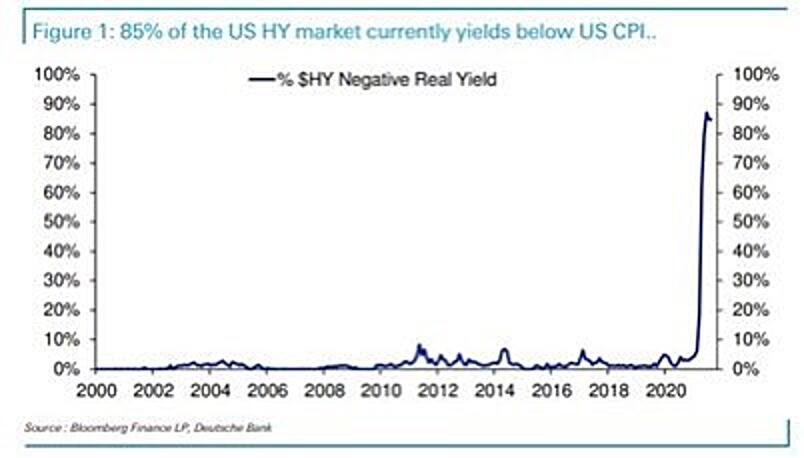

The Case/Shiller housing price data came out and it showed prices up nearly 20% YoY. Brent crude oil touched $80 per barrel and is on course for its best month since February. Treasury yields have risen quite dramatically over the last week, with the 10-year now above 1.5%, the highest since June. Natural gas is hitting levels we haven’t seen in many years. Off the coast of California, there are dozens of massive cargo ships waiting for logjams in the ports to ease up. Supply chain issues are global, impacting a very large percentage of businesses. Inflation is very real and it is here. This could be the biggest driver over the next decade of investment returns, particularly if it leads to lasting higher yields.

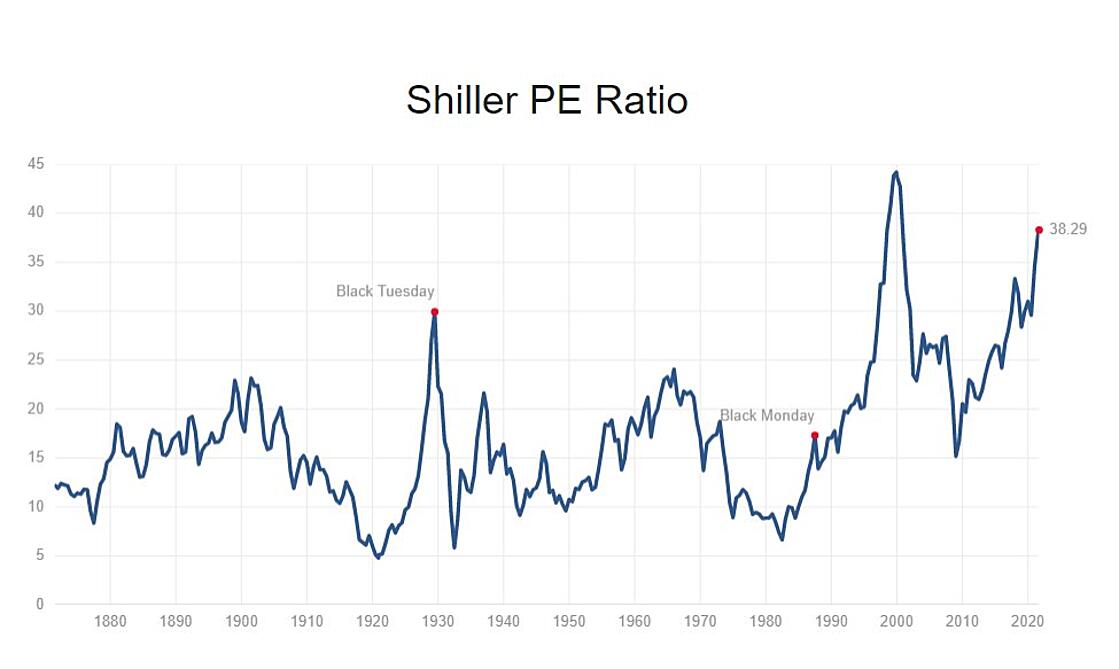

The value trade is starting to pick up steam again as a result, with the exceedingly expensive tech stocks selling off, and financials and commodity stocks outperforming. As we’ve been saying, there is virtually no possibility that stocks perform anything close to what they have done over the last decade, because current valuations are so high and interest rates only have room to move up. The advantages of this setup are the stocks most likely to outperform are also among the most inexpensive areas of the market. This is a similar dynamic to what we saw when Tech crashed in the early 2000’s leading to great years from value. I think patience and discipline will be rewarded. Inflation is a very serious dynamic that impacts us all, so we need to make money to counteract it, as it reduces our purchasing power. There is so much speculation and optimism in current prices for much of the market, so we have to be smart with what we buy and how we do it, and I am very confident we are doing that. If you didn’t get a chance to read the article I referenced Friday, I’ll post the link again as it really talks about the opportunity set we have in value over these next few years.