Inflation Is Back: What To Do?

Inflation has reared its ugly head and it is downright frightening to many people. There are a lot of investors who have never even had to see inflation in any sort of major way. But how times have changed.

Inflation is now running at 6.2% annually, a 31 year high. What can investors do in a climate like this?

Compared to History

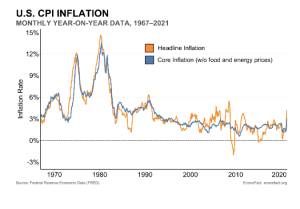

We have to go back to the early 80s to see inflation that was really scary. We are talking above 10% for many years and interest rates that were in double digits. Imagine a 15% mortgage today! That is what people saw in the 70s and early 80s. Today many people simply wouldn’t buy a home with mortgage rates that high.

Even with inflation tripling from last year’s levels, interest rates have barely budged due to the Federal Reserve buying up billions of dollars’ worth of bonds and the fact that many believe inflation won’t last.

Inflation and Retirement

Inflation erodes fixed income. Bonds do terribly during high inflationary times unless you buy the yields that should have risen. If you own a 30 year bond with a 2% interest rate and inflation is at 5% for those 30 years, well you lose 3% per year. Your annual real returns is negative!

Investments and Inflation

Let’s look at some investments and how they might be affected by inflation. First, we have savings accounts. In theory, their interest rate should rise with inflation and you would see that increased interest rate in your bank accounts. As mentioned previously though, this hasn’t happened yet and anybody with a bank savings accounts is currently getting a negative interest rate.

As for bonds, we discussed this already. If you lock yourself into a low yield, you will receive a negative real rate of return if inflation is higher than the yield.

Then there are pensions. If you have a pension with a fixed growth rate of a 0% growth rate (which men do) inflation is a serious risk for you. High inflation for a long time can cut the real value of your pension payments by more than half.

Figuring Out How Inflation Impacts You

You definitely want help from either a financial advisor or from retirement software that helps you plan and run inflation scenarios. If you do want to do it yourself, use WealthTrace to help you with this. You can see projections of your various investments and income and run different scenarios where inflation is higher. You can also see the tax impact of higher inflation over time.

Investments for Inflationary Times

Many people run to Treasury Inflation-Protected Securities (TIPS) when inflation is high. TIPs have their yield adjusted for the consumer inflation rate, which is why they are a great hedge. But, TIPS yields are currently negative, which means even with inflation your real rate of return is less than zero.

When inflation is high I personally like staple stocks with growing dividends such as Procter & Gamble and Wal-Mart. I also like energy stocks such as Exxon, which still sports a 6% dividend yield. These companies generally increase prices during high inflation and that means more revenue and more dividends. This helps offset inflation for the most part.

There are also investments such as gold and land which generally move with the inflation rate. These are good long-term hedges against inflation. The nice thing about gold compared to land is that it is much easier to buy and store and there are not property taxes on it.

Be Ready

Make sure you are ready for sustained inflation. Don’t listen to the economists who are so certain that inflation will go away quickly. Once inflation is embedded into people’s minds, it is generally here for a while. That is what happened in the 70s and 80s. Everybody expected high inflation every year so it was a self-fulfilling prophecy until it was finally broken by Paul Volker and the Federal Reserve when they reined in the money supply.