How Does The Bill And Melinda Gates Foundation Invest Its Money?

The Briefing

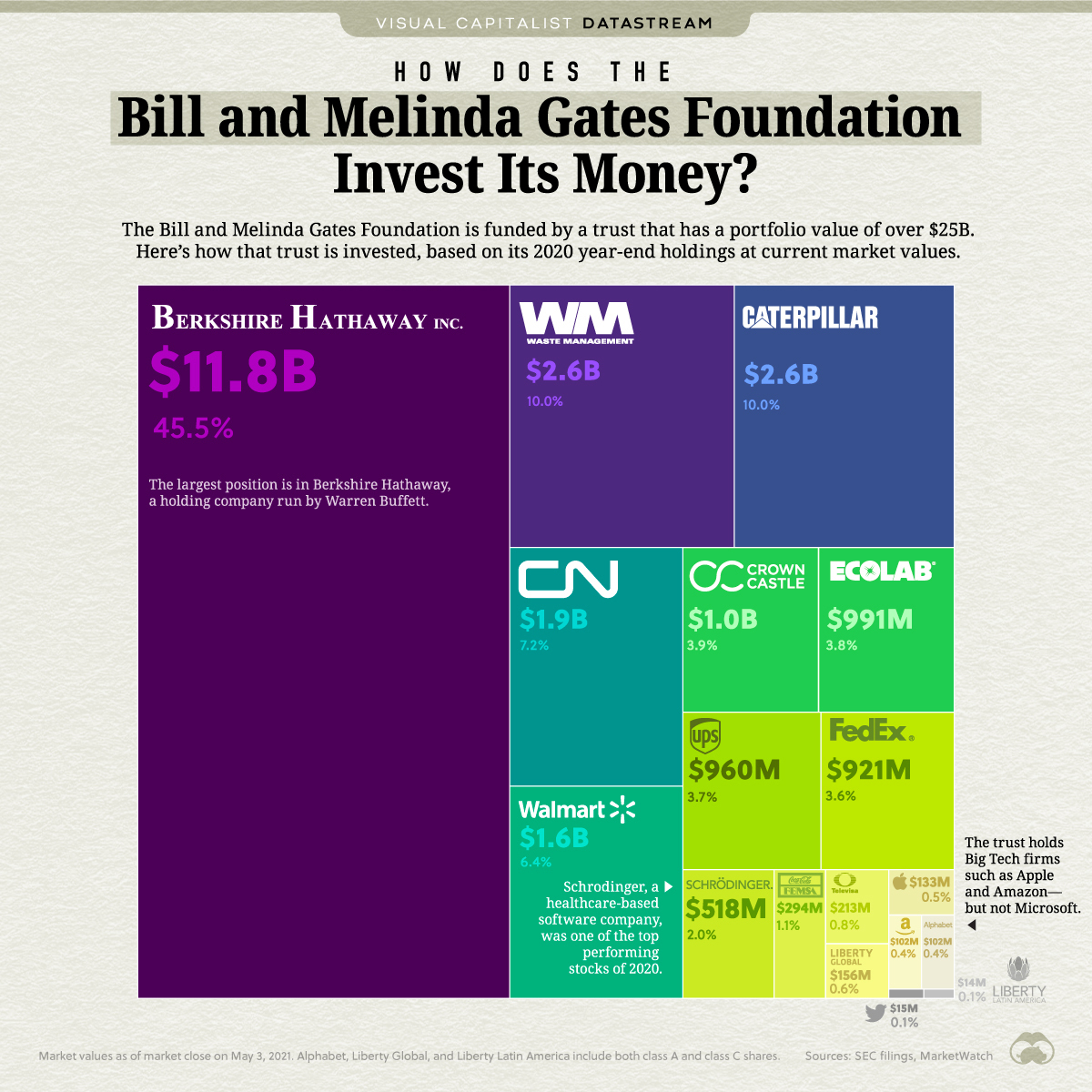

- The Bill and Melinda Gates Foundation Trust has a total portfolio value of over $25 billion

- Almost half of the money is invested in Berkshire Hathaway, a holding company run by chairman and CEO Warren Buffett

- The trust favors industrial stocks, with a 34% weighting in the sector

How Does the Bill and Melinda Gates Foundation Invest Its Money?

Bill and Melinda Gates have announced they are ending their marriage but will continue to work together at their foundation.

The Bill and Melinda Gates Foundation, launched in 2000, is the largest private philanthropic organization in the United States. It has spent over $50 billion on global public health over the last two decades, including $1.75 billion on COVID-19 relief.

Of course, the foundation’s assets are managed by a trust until they are ready to be distributed to grantees. Here’s a look at how the Bill and Melinda Gates Foundation Trust invests its assets.

The Portfolio Breakdown

The trust has invested 100% of its holdings in stocks. It holds almost half of its value in Berkshire Hathaway, the holding company run by Warren Buffett.

| Stock | Value | % of Portfolio |

|---|---|---|

| Berkshire Hathaway | $11.8B | 45.5% |

| Waste Management | $2.6B | 10.0% |

| Caterpillar | $2.6B | 10.0% |

| Canadian National Railway | $1.9B | 7.2% |

| Walmart | $1.6B | 6.4% |

| Crown Castle | $1.0B | 3.9% |

| Ecolab | $991M | 3.8% |

| UPS | $960M | 3.7% |

| FedEx | $921M | 3.6% |

| Schrodinger | $518M | 2.0% |

| Stock | Value | % of Portfolio |

|---|---|---|

| Coca-Cola FEMSA | $294M | 1.1% |

| Grupo Televisa | $213M | 0.8% |

| Liberty Global | $156M | 0.6% |

| Apple | $133M | 0.5% |

| Amazon | $102M | 0.4% |

| Alphabet (Google) | $102M | 0.4% |

| $15M | 0.1% | |

| Liberty Latin America | $14M | 0.1% |

However, the portfolio is more diversified than initially meets the eye—Berkshire Hathaway itself is invested in almost 50 stocks.

Shrodinger, a healthcare-focused software company that makes up 2% of the trust’s total portfolio, was one of the best-performing stocks of 2020 by price returns. The portfolio has also been boosted by delivery companies UPS and FedEx, both of which saw their share prices more than double over the last year as online shopping took off.

While the trust is dominated by U.S.-domiciled companies, a few foreign names do make the list. For example, Canadian National Railway makes up over 7% of the portfolio, while the Latin American bottler Coca-Cola FEMSA makes up just over 1%.

The Future of the Foundation

The trust continues to be managed by a team of outside investment managers, whose decisions have a critical impact on the amount of money the Bill and Melinda Gates Foundation has to fund its initiatives. For example, if Berkshire Hathaway were to dip 10%, this would drop the portfolio value by more than $1 billion.

In addition, the foundation is funded in part by the Gates’ personal donations—more than $36 billion from 1994 to 2018. Should Bill and Melinda go on to create their own separate philanthropic efforts post-divorce, the foundation may have a smaller portfolio to pull from going forward.

Disclosure: None.