How Big Is The US Housing Bubble?

Some deny there is a housing bubble. I believe the bubble is obvious.

(Click on image to enlarge)

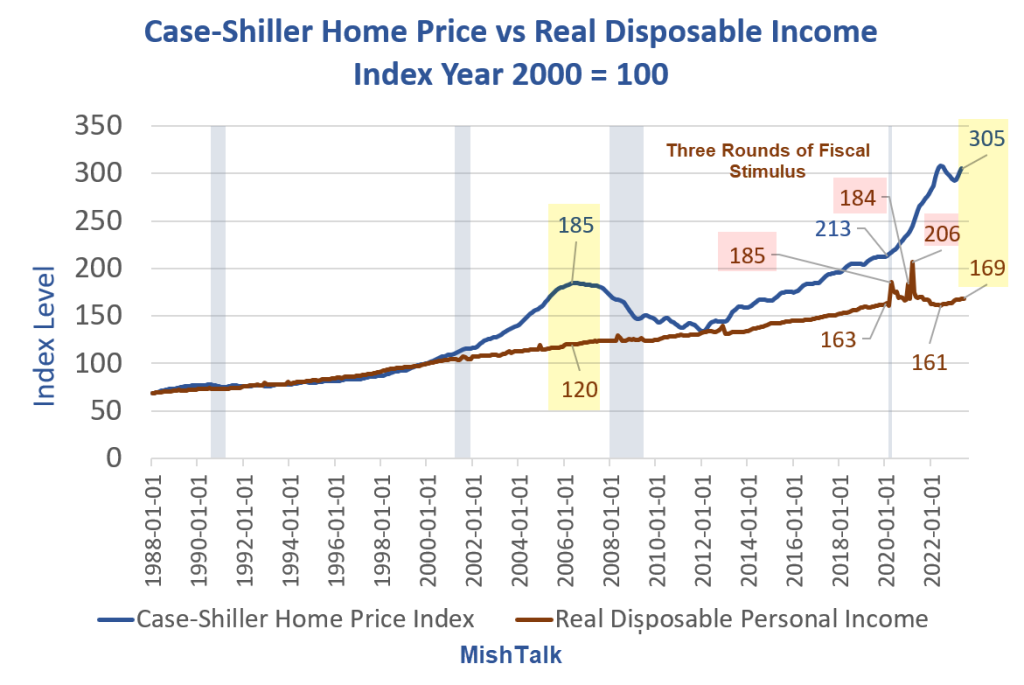

Case-Shiller home price index and Real Disposable Income via St. Louis Fed, chart by Mish.

Chart Notes

- Case-Shiller is a measure of repeat sales of the same house. This is a far better measure than average or median prices that widely vary over time by home size and amenities.

- Disposable means after taxes

- Real means inflation adjusted using the BEA’s Personal Consumption Expenditures (PCE) inflation index, not the BLS Consumer Price Index (CPI).

- Both indexes are set to 2000=100.

- Case-Shiller is through May (reflective of March) while Real DPI is through June. There is a minor bit of skew that I did not factor in.

For at least 12 years, home prices followed extremely closely to real disposable personal income. In 2012 the indexes touched again at 133-134.

The BEA calculates REAL based on PCE. Adjusting for inflation by the CPI would make the current bubble look bigger and I believe more accurate.

The important point is the massive divergence between the measures noting that the bubble is a bit understated.

Percentage Difference Between Home Prices and Real DPI

- 2006: (185-120)/120 * 100 = 54.17 Percent

- 2023: (305-169)/169 * 100) = 80.47 percent

On a real DPI basis, home prices are roughly 80 percent above where they should be.

Some justify these home prices on the basis of mortgage rates and affordability. They are wrong.

The difference between home prices and income is really a measure of the Fed’s propensity to blow financial bubbles by keeping rates too low too long.

I will address alleged affordability in a following post.

The Fed Commits to a 2 Percent Inflation Target, Carefully

Meanwhile, please note The Fed Commits to a 2 Percent Inflation Target, Carefully

Powell’s Warnings

Here is the key thing Powell said today: “As is often the case, we are navigating by the stars under cloudy skies.”

And to that I would add, using tools like inflation expectations proven to be totally worthless.

For discussion of inflation expectations and Biden’s energy goals guaranteed to be inflationary, please see Should the Fed Declare Defeat and Move On?

The Fed wants inflation at 2 percent but is clueless how to measure it.

This creates bubbles of increasing amplitude over time. And the middle class shrinks as a result.

More By This Author:

Germany’s Ruling Party Proposes A 3 Year Rent Freeze To Halt InflationThe Fed Commits To A 2 Percent Inflation Target, Carefully

What Would It Take For A BRIC-Based Currency To Succeed?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more