Household Employment Reaches Another High…

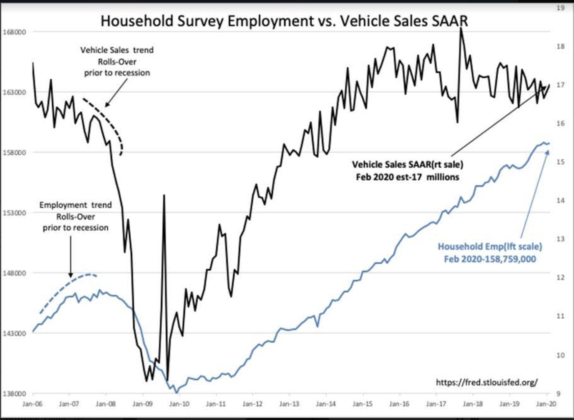

The Household Survey reported a gain of 45,000 employed to 158,759,000, while the Establishment Survey reported 273,000 to 152,544,000. The differences in these employment reports is due to the fact that the Household Survey counts self-employed persons, which the Establishment Survey does not. In addition, the Establishment Survey revises the past three-month reports every month; which is not done in the Household Survey.

Even though many are responding to individual reports as a signal of the future, (yes, some are expressing disappointment that these decent reports are not enough) what is most valuable is the past six months of data relative to the cycle trend. The employment trend since 2009 remains intact.

From the Feb. 2020 Establishment Survey:

”Total nonfarm payroll employment rose by 273,000 in February, after an increase of the same magnitude in January. In 2019, job growth averaged 178,000 per month. In February notable job gains occurred in health care and social assistance, food services and drinking places, government, construction, professional and technical services, and financial activities”

The media continues to respond to current price declines as if the markets are signaling an imminent economic downturn due to the coronavirus. We have been through this before. With modern medicine, we have never experienced an economic downturn due to global pandemics for the past 60+ years.

The term ‘modern medicine’ refers to the skills involved in the US healthcare system, which have always been extended globally to counter new illnesses as they threatened any population. Trust the US healthcare system to once again to counter the latest global health concern.

The early information of the coronavirus has been sensationalized by the media, and social media platforms. Recently, Dr. Marc Siegel of the NYU Medical Center, provided an overview of the coronavirus in a short interview:

“We’ve discovered that it’s probably slightly more contagious than the flu… World Health … saying today three point four percent death rate … clearly thousands of mild cases out there that have never been diagnosed…death rate is much lower than they’re saying …about the same as the flu…”

It is unfortunate that today’s world has politicized many situations and continues to abuse the public to skew factual information towards political agendas.

Computer trading algorithms take price trends which are created by market psychology and conflate these with economic outcomes. For investors, when market psychology differs widely from the facts, opportunities are best. Hindsight reveals that it is economic trends which shift very slowly.

Market psychology routinely swings through multiple cycles of optimism to pessimism and back again with virtually no economic response. Like the boy who cried “Wolf!”, we have dozens on dozens of market-collapse calls every cycle, which never become reality.

The current market, despite the current bout of extreme pessimism, is much like every period the past 70 years that proved, in retrospect, to be a good buying period. As if on cue, corporate insiders, the most informed Value Investors, have ramped their personal accumulations, which underscores this period as a good investment opportunity. Anytime insider buys exceed the 100/Day benchmark, this represents a market in which many opportunities are present.