High Yield Credit To Remain In The Sweet Spot

With low default levels expected in 2021, high yield credit offers investors the chance for potentially attractive yields without the backlash.

Credit investors, particularly those operating in the murkiest corners of leveraged loan and high yield markets, have a habit of being professional worriers. The notable performance of the high yield market in 2020 – where we saw the global investment universe returning some 6.5%1 and the US and European equivalents returning 6.2%2 and 2.9%3 – might have calmed concerns for a short time, but that natural propensity to worry has reemerged.

In the early weeks of 2021, when vaccine roll-out plans were yet to get fully underway and Covid infection rates were seemingly out of control in many parts of the world, it seemed counter-intuitive to remain bullish on sub-investment grade credit markets.

After such unusually low default rates in 2020, aren’t we going to face the backlash this year? It seems not…

Last year’s defaults largely occurred in already-troubled names in the retail and energy sectors, which fell after years of struggle. There was no across-the-board wave of disaster stories in the high yield market. The other sectors that make up the asset class only saw small increases on a typical year, reflecting the strained economic environment.

With the potential for a severe liquidity crunch averted by policymakers, blow-ups were broadly avoided and we anticipate 2021 default levels to be around the 5-year median; 3-3.5% in non-investment grade credit. Our expectations are based on high yield companies having plentiful access to funding, policy support remaining largely unchanged, and improving earnings leading to a gradual recovery of credit metrics for issuers in our universe.

Concerns regarding the reflation trade are certainly valid for fixed income investors, but we don’t consider reflation a significant threat to high yield credit.

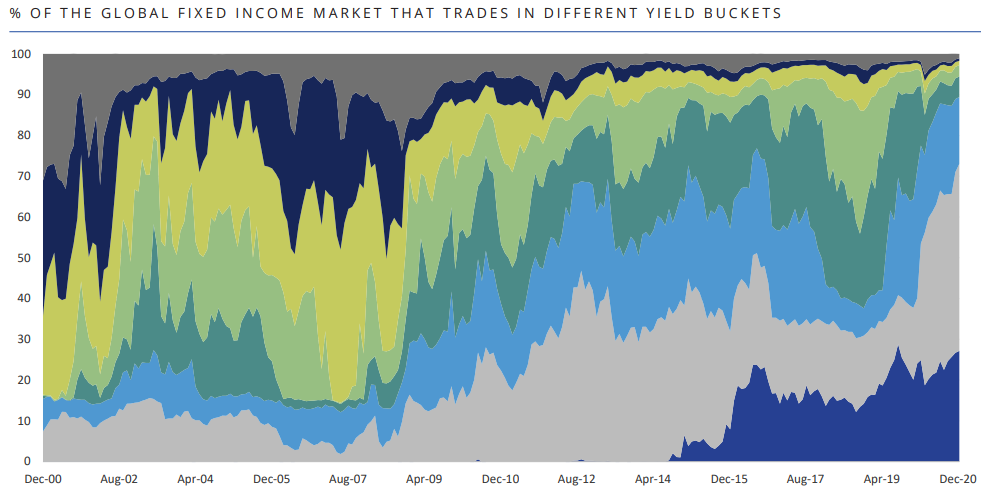

(Click on image to enlarge)

Source: ICE Data Indices, LLC, 31 December 2020

Against this expected stable backdrop, the focus of concern then becomes yield.

Financial repression through extensive central bank quantitative easing has meant that USD18 trillion of debt is now negative-yielding and the opportunity to achieve yields in excess of 4% are few and far between.

The cautious investor might naturally gravitate towards the investment-grade sector, but the reality here is a very limited opportunity for yield – 42% of the European investment-grade market started 2021 with a negative yield.

This low yield landscape and further expectations of higher rates is forcing investors to adapt. With investment-grade assets trading at the lowest yields in years, we’re seeing significant willingness to extend credit to high yield companies that might be going through temporary disruption but offer relatively attractive yields – provided those companies are expected to survive.

Historically, high yield has performed well in the recovery phase of the economic cycle; the shorter duration and higher yields mean the asset class is well placed within the fixed income universe to deliver potentially attractive income as the global economy rebounds from the shock of 2020.

Overall, the global high yield universe offers a yield of 4.3%, with the European market offering 2.9% and the US 4.3%4. Also, more significantly, high yield has lower interest rate sensitivity than investment-grade credit, with the average interest rate duration of the global high yield universe approximately 3.9 years relative to 7.1 years for the global investment-grade corporate universe5.

Concerns regarding the reflation trade are certainly valid for fixed income investors, but we don’t consider reflation a significant threat to high yield credit.

The market is to some extent extrapolating this recovery and starting to guess when policy support will reduce. Europe is behind the US in terms of vaccine roll-out and is therefore likely to remain accommodative for longer. Inflation remains well below target and fiscal support has been committed in principle for the entire period of the pandemic in most European countries. As such, we do not expect any change in asset purchases in 2021 in Europe, though that doesn’t prevent further steepening of curves and some impact from a more plausible policy tapering in the US in H2 2021.

If yields do rise aggressively, this could prove disruptive to a broad range of risk assets, equities included. In fixed income, we would expect the brunt of the pressure to be felt in lower-yielding parts of the market, such as US Treasuries, where carry would be insufficient to cover for the capital losses associated with higher bond yields.

On a relative basis, such developments would be constructive for the loan market, where investors could relocate a portion of their leveraged finance assets from fixed-rate to floating-rate securities.

In summary, medical improvement and the reopening of economies will play a big role in defining the fixed income sub-asset classes that perform best this year. Fortunately, so far in 2021, the high yield market is higher rated than any time this cycle thanks to the worst names defaulting in 2020 and many “fallen angel” former investment-grade names being downgraded due to the shock.

We expect further economic recovery through 2021 to support returns, with default levels remaining low and investors’ need for income staying high. Asset allocators face a tough challenge in 2021 and, in our view, high-yielding shorter duration assets look set to provide key portfolio solutions. As ever though, there will be winners and losers in the post-Covid world and good security selection will be key.

1 ICE BAML Global High Yield Constrained Index (Hedged to USD), 31 December 2020 2 ICE BAML US High Yield Index, 31 December 2020 3 ICE BAML European Currency High Yield Constrained Index (Hedged to EUR), 31 December 2020

2 ICE BAML US High Yield Index, 31 December 2020 3 ICE BAML European Currency High Yield Constrained Index (Hedged to EUR), 31 December 2020

3 ICE BAML European Currency High Yield Constrained Index (Hedged to EUR), 31 December 2020

4 Global high yield universe: ICE BAML Global High Yield Constrained Index; US high universe: ICE BAML US Yield Index; European market: ICE BAML European Currency High Yield Constrained Index. Data as at 26 February 2021. 5 Interest rate duration statistics for the ICE BAML Global High Yield Constrained Index (‘global high yield universe’) and Bloomberg Barclays Global Aggregate Corporate Index (‘global investment-grade corporate universe’) as at 26 February 2021.

5 Interest rate duration statistics for the ICE BAML Global High Yield Constrained Index (‘global high yield universe’) and Bloomberg Barclays Global Aggregate Corporate Index (‘global investment-grade corporate universe’) as at 26 February 2021.

Disclaimer: Please click here.

Good read, thanks.