Heterodox Views On Monetary Policy

Image Source: Pexels

In a recent post, I took what might be viewed as an “elitist” view of monetary policy. Decisions should be made by people with expertise in the subject area. Today, I’ll take what might be viewed as an anti-elitist view. Central bankers should explore the views of a variety of monetary economists, including those with heterodox views. Am I contradicting myself? Not at all.

Here’s the Financial Times, in an opinion piece that can only be described as snarky:

Since 1997, members of the Institute of Economic Affairs’ “shadow monetary policy committee” have gathered once per quarter somewhere off Tufton Street, Westminster, to cosplay as their favourite Bank of England rate-setters. Much as scientists still puzzle over the mysteries of bird migration, no one knows exactly why they go to all the trouble.

SMPC meetings nevertheless follow a familiar pattern. After a summary of global economic conditions, members discuss the outlook for inflation and growth in the UK before pouring forth on the appropriate level of borrowing costs. Votes are tallied, a policy rate is recommended and the world keeps on spinning. . . .

Eclectic members include former Invesco chief economist John Greenwood (who thinks “interest rates are irrelevant”), Capital Economics non-executive director Roger Bootle (who thinks “interest rates are fundamental”) and several card-carrying monetarists. (Ever the cynic, Louis wonders whether maybe the SMPC purely exists “just so every ten years they can slap each other on the back when the M4 and inflation charts overlay nicely”.)

The SMPC skews male — all 14 members are guys — and towards Wales — four, including “Brexit economist” professor Patrick Minford, work at Cardiff Business School. Juan Castañeda and Tim Congdon both divide their time between the Institute of International Monetary Research and the University of Buckingham while Lilico shares the chairmanship with professor Trevor Williams of Derby University and TW Consultancy when he himself isn’t moonlighting at consultancy Europe Economics.

Apparently, the author thinks it’s a big joke that these sorts of people would have the temerity to offer advice on monetary policy to the infallible experts at the BoE.

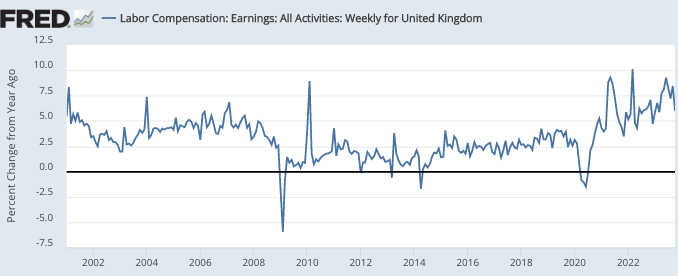

If I wanted to be snarky in reply, I might point to the UK’s inflation rate over the past 3 years. In case that price surge was due to supply shocks such as the Ukraine War, let’s look at wage inflation, a variable much more closely tied to demand conditions:

That doesn’t look like sound monetary policy. Money was clearly too tight in 2008 and it was too easy in 2021. I don’t always agree with Tim Congdon, but as I recall he made both of those criticisms in real time.

In contrast to the FT, The Economist does recognize the value in a having a diversity of views when setting policy:

In the 2000s researchers conducted experiments with economics students at the London School of Economics, Princeton University and the University of California. These used a simple computer-run economic model, which was subjected to random shocks. Students had to respond by moving interest rates, and were scored on how well they kept unemployment at 5% and inflation at 2% over the course of 20 financial quarters. In every case committees outperformed individuals. Indeed, a large body of empirical work suggests that well-run committees help smooth extreme perspectives, drive out poor judgment and provide more insulation from both political and personal pressure.

I’ve suggested (in chapter 5) expanding the FOMC from 12 members to 8.2 billion (potential) members. Allow anyone to bet that NGDP will rise by less than 3% or more than 5%, and have the Fed take the other side of the bet.

More By This Author:

Bullied Into DeflationShould Monetary Policy Be Implemented By Economists?

Higher Taxes Or Lower Spending?