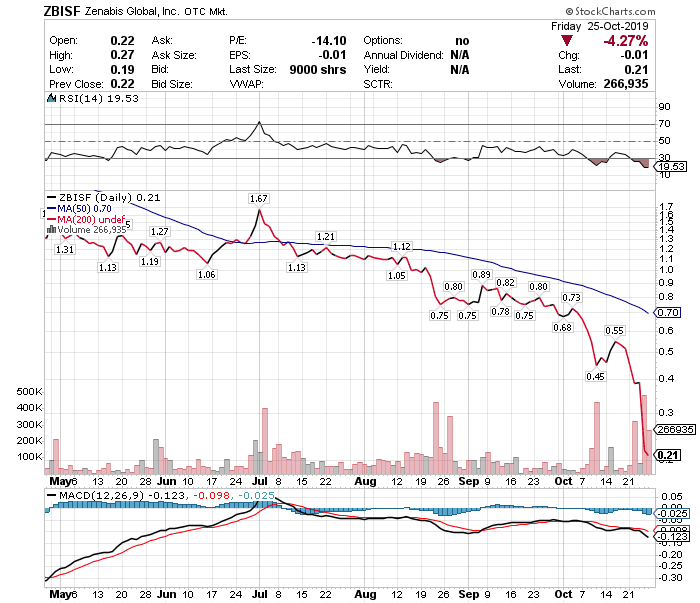

Zenabis Global Announces Special "Rights Offering" - Stock Drops 46%

TM Editors Note: This article discusses a penny stock and/or microcap. Such stocks are readily manipulated; be skeptical and do your own careful due diligence.

Shares of Canadian cannabis producer Zenabis Global Inc. (TSX:ZENA; OTC:ZBISF), have dropped 46% since announcing a Rights Offering this past Thursday to raise capital. This article outlines what a Rights Offering is, how it is structured, how it is executed and how it differs from the more common, albeit still rare, warrants.

Rights and warrants are usually issued by a company as a method of raising capital, mainly the equity capital. They are both quick and cost-effective but there are major differences between the two.

Rights

A Right is a privilege granted to a shareholder to acquire a pro rata portion of additional shares of the issuer's stock directly from the issuing company at a specific price per share which is typically set at a discount to the recent trading price of the issuer's stock. They are usually short-term 4 to 6 week long offerings.

Why Are Rights Offered?

Companies choose to raise additional capital through a Rights Offering for the following reasons:

- Existing shareholders may be more inclined than the public at large to buy shares in the company.

- The company may want to give existing shareholders the opportunity to acquire additional shares.

- A Right Offering allows existing shareholders to maintain their proportionate interest in the company and, as such, there is no dilutive effect to shareholders who exercise the Rights issued to them.

Transferable vs. Non-transferable Rights

- Most Rights Offerings are non‐transferable so if a shareholder decides not to exercise the opportunity to acquire additional shares at the discounted within the allocated time period then the shareholder’s current ownership in the issuer will be diluted by those shareholders who exercise their rights.

- Some Rights Offerings, however, are structured by an issuer to permit rights to be transferable and in such instances those shareholders who choose not to exercise their transferable rights can trade them in the secondary market during the offering period. The money earned from trading the Rights enables the shareholders to offset dilution by earning a profit trading the Rights.

Warrants

Rights Offerings should not be confused with Warrants. For the record, a warrant is a security giving any holder the right, but not the obligation, to acquire the underlying security at a predetermined (i.e. exercise) price and for a specified period of time (i.e. term or duration) as a way of raising funds, and it is often included as an incentive extra to share issue. Warrants have expiration dates ranging from 1 to 7 years and the longer the duration the less risk is involved. (Read my exclusive TalkMarkets article for a greater insight into warrants.)

Rights and Warrants trade on the exchange where the issuer’s common stock is listed, or over the counter if the issuer’s stock is not listed on an exchange. They can produce large gains if the stock price goes up by even a small amount but they can also be risky because they are a type of leverage.

A Current Example of a Rights Offering

Zenabis Global Inc. announced yesterday (Thursday, October 24th), that it will be offering Rights to holders of its common shares of record at the close of business on October 31, 2019, with the objective of raising up to $20.6M after deducting expenses, assuming full uptake, which will be utilized for general corporate working capital.

Zenabis maintains that:

- having excess cash on hand is in the best interest of shareholders even though it doesn't currently need the proceeds but that, given the current state of the Canadian cannabis market, additional liquidity is important and incremental equity is preferable as a capital source compared to a debt alternative given the size of its current outstanding debt,

- allowing the participation of existing shareholders alongside insiders will reduce dilution when compared to any other way of raising incremental capital given current market conditions, and,

- offering Rights was of considerable interest to it current shareholders and insiders who expressed a willingness to contribute over $6M in incremental equity capital to the business, rather than being diluted by third-party capital.

Almost nothing has been written about Rights Offerings so I have taken the liberty of presenting the details of the Zenabis offering below so you will have a full understanding as to what is involved in the offering of such a financial derivative:

- Each holder of common shares will receive one transferable Right for each common share held.

- 1.5 Rights will entitle a holder to purchase 1 common share at the subscription price of $0.15 per common share.

- The subscription price is equal to approximately a 73% discount to the volume weighted average trading price of the common shares on the Toronto Stock Exchange for the 5-day period ending on October 23, 2019.

- Insiders of Zenabis have committed to acquire 30% of the common shares available under the Rights Offering for a total of $6.2 million, representing strong participation. The remaining common shares are available for all other shareholders.

- A maximum of 139,086,624 common shares will be issued under the terms of the Rights Offering which represents 66.6% of the currently issued and outstanding common shares.

- Insiders of the Company have agreed to act as Standby Guarantors and purchase additional common shares on a pro rata basis from the Company if less than the 139,086,624 common shares are subscribed for. Currently the Insiders Group owns 35.2% of the issued and outstanding common shares but the Insiders Group will see its ownership reduced to 32.9% if the maximum number of common shares are subscribed for.

- The Rights Offering will be open to holders of common shares who are residents in Canada although certain holders of common shares in jurisdictions outside of Canada may be able to participate in the Rights Offering where they can establish that the transaction is exempt under applicable legislation.

- No fractional common shares will be issued.

- Each common shareholder resident in Canada may either:

- exercise their Rights and subscribe for additional common shares;

- sell their Rights; or

- do nothing and let their Rights expire

- The Rights Offering will include an additional subscription privilege under which holders of Rights who fully exercise their Rights will be entitled to subscribe pro rata for additional Common Shares, if available, that were not otherwise subscribed for in the Rights Offering.

- The Rights Offering will expire at 5:00 p.m. (Toronto time) on November 27, 2019.

- The Rights will be listed for trading on the TSX beginning on October 30, 2019 under the symbol "ZENA.RT" and will cease at 12:00 p.m. (Toronto time) on November 27, 2019.

As is normally the case with Rights Offerings, the market reaction to this offering was negative as illustrated in the chart below:

I hope to follow up this article with a review of the performance of the Zenabis Rights during the month of November.