UnitedHealth: Undervalued And Moving In The Right Direction

UnitedHealth (UNH) stock is being affected by the political discussions regarding healthcare reform, and chances are that this uncertainty cloud could be getting thicker in the coming months. However, the company keeps delivering rock-solid financial performance, and the stock is priced at remarkably attractive valuation levels. For value-oriented investors who can tolerate the short-term volatility, UnitedHealth looks like a strong alternative going forward.

Solid Quality And Attractive Valuation

UnitedHealth is the top player in the industry, the company has nearly 50 million members across its U.S. and international markets. This massive scale is a crucial source of competitive advantage, because it allows the company to reduce health cost per member and to price its insurance offerings at more competitive prices.

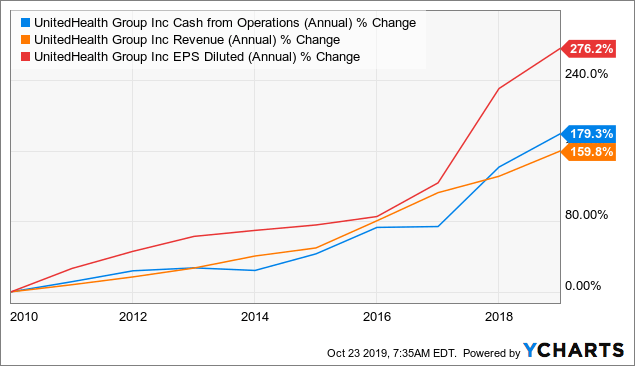

Looking at financial performance over the long term, management has done a great job at increasing revenue, operating cash flow, and earnings per share over the years.

Data by YCharts

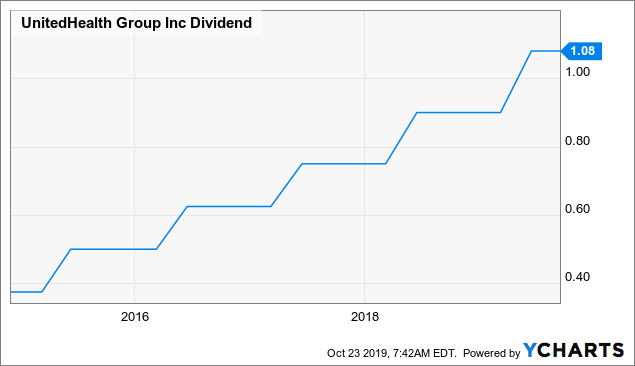

The dividend yield is not particularly high, at 1.73%. But the company has an impressive track record of dividend growth, increasing payments at a compounded annual growth rate of 26.8% over the past 5 years. This includes a vigorous dividend increase of 20% announced in June of 2019.

Data by YCharts

Besides, the dividend payout ratio is notoriously safe, at 28%. This provides plenty of room for management to continue raising dividends in the future.

Dividend growth says a lot about the health of a business. If the company is consistently rewarding investors with increasing dividend payments year after year, this means that the business is producing more cash than it needs to retain, a clear sign of underlying fundamental strength.

Considering the company's fundamental strength, the stock looks very attractively priced. The table below shows PE ratio, forward PE, EV to EBITDA and price to cash flow for UnitedHealth versus the median values for the sector.

UnitedHealth is trading at a discount of 20% to 30% across these metrics, which looks like an opportunity since UnitedHealth is a fundamentally sound business.

| UNH | Sector Median | % Diff. to Sector | |

| P/E Non-GAAP (TTM) | 16.83 | 20.96 | -19.68% |

| P/E Non-GAAP (FWD) | 16.3 | 23.14 | -29.53% |

| EV/EBITDA (TTM) | 12.58 | 16.68 | -24.58% |

| Price/Cash Flow (TTM) | 15.77 | 19.51 | -19.14% |

Source: Seeking Alpha Essential

Moving In The Right Direction

Current stock prices reflect a particular set of expectations about the future of the company. If the company can consistently deliver earnings numbers above expectations, then earnings estimates will tend to increase, and the stock price will need to increase too for the valuation to remain stable.

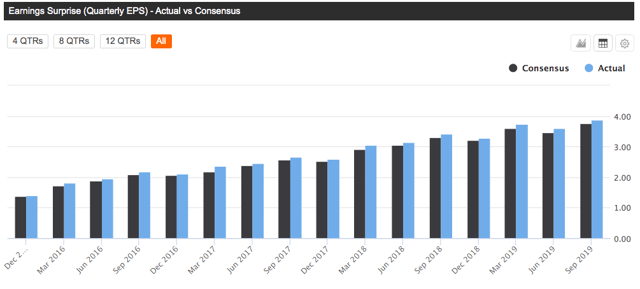

The chart below shows how UnitedHealth has a solid track record in terms of outperforming expectations, as the company has delivered earnings numbers above Wall Street estimates in each of the past 16 quarters.

Source: Seeking Alpha Essential

The third quarter was no exception to the rule, UnitedHealth reported $3.88 in earnings per share, outperforming expectations by $0.12. Total revenues through the first three quarters of 2019 grew 8% to $181 billion. Adjusted earnings per share grew 17%, and operating cash flows were $12.3 billion or 1.2 times net earnings

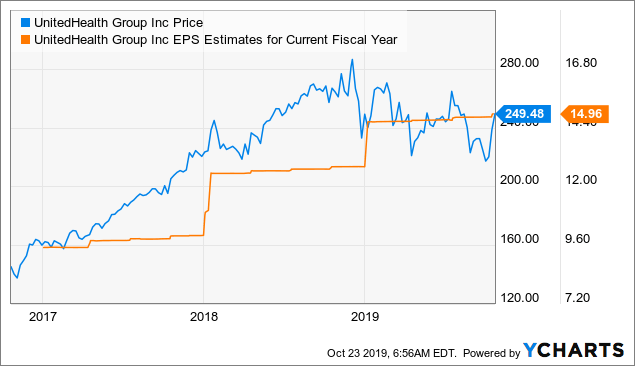

The chart below shows how the stock price has evolved in comparison to earnings expectations. It's easy to see that earnings estimates have consistently increased over time, and this is a tailwind for the stock price.

Data by YCharts

The fact that the company has outperformed expectations in the past does not guarantee that it will continue doing so in the future. However, since UnitedHealth has delivered earnings numbers above expectations in the past 16 consecutive quarters, we can say that there is a clear pattern going on.

Management likes to under-promise and over-deliver, as long as this remains the case, it makes sense to expect United Health to continue delivering earnings numbers above expectations going forward, and fundamental momentum should remain a strong driver for the stock price.

Putting It All Together

Valuation needs to be analyzed in the context of other return drivers. A company producing strong profitability and consistently delivering earnings above expectations deserves a higher valuation than a business producing mediocre financial performance and underperforming expectations.

But sometimes it can be challenging to incorporate multiple factors into the analysis in order to see the complete picture from a quantitative perspective. The PowerFactors system is a quantitative algorithm that ranks companies in the market according to a combination of quantitative factors that includes: financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

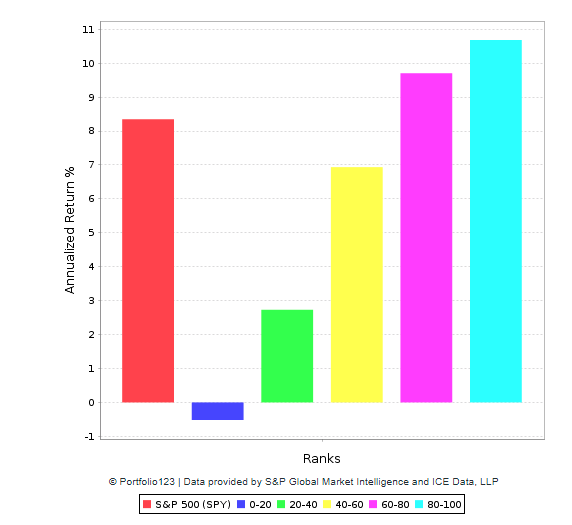

The algorithm has delivered market-beating performance over the long term. The chart below shows backtested performance numbers for companies in five different PowerFactors buckets over the years.

Data from S&P Global via Portfolio123

This has bullish implications for UnitedHealth, since the stock has a PowerFactors ranking of 90 as of the time of this writing. This means that UnitedHealth is in the top 10% of companies in the US stock market based on a combination of quantitative return drivers as measured by the PowerFactors system.

The Bottom Line

Healthcare reform will probably remain as a key discussion topic towards the upcoming elections in 2020, and this will create uncertainty around the healthcare sector in general and UnitedHealth in particular. Investors in the company need to be willing to tolerate some volatility over the coming months.

However, this uncertainty is already reflected in the stock price to a good degree. It can always turn out to be worse than expected, but history shows that the market tends to overreact to uncertainty more often than not. This would indicate that the stock is undervalued even when incorporating the regulatory risks into the equation.

UnitedHealth is a financially solid business, consistently performing above expectations and trading at remarkably attractive valuation levels. In terms of risk and reward, chances are that the stock will deliver solid returns from current price levels.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more