Portfolio Suggestion: CVS

“Davidson” submits:

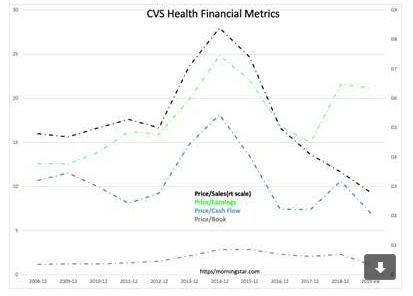

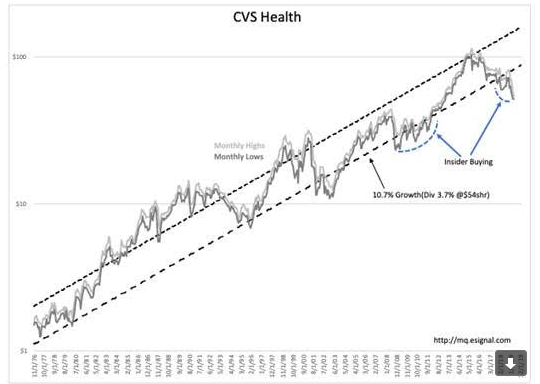

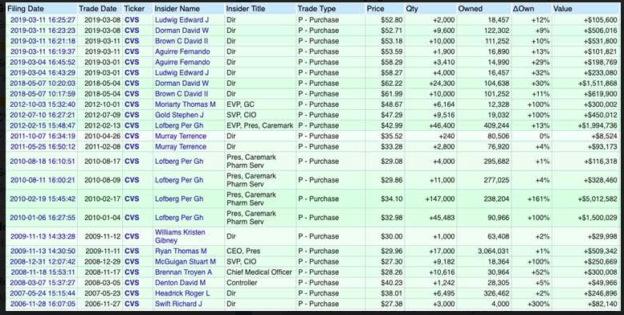

CVSHealth (CVS) is a portfolio suggestion. CVS recently closed its acquisition of Aetna, a healthcare benefits manager. Synergies are expected to extend CVS’s strong financial history. Investors have turned negative and repriced CVS below 10yr lows in Price/Sales and Price/Cash Flows. The last time CVS insiders were active buyers occurred during 2010-2012 lows.

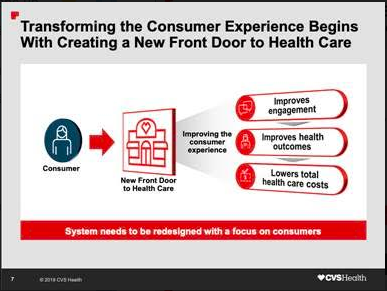

CVS Health describes the company as a health care innovation company helping people on their path to better health helping to foster healthier communities. The acquisition of Aetna, is CVS’s focus on building a new health care model that is easier to use, less expensive and putting the consumer first.

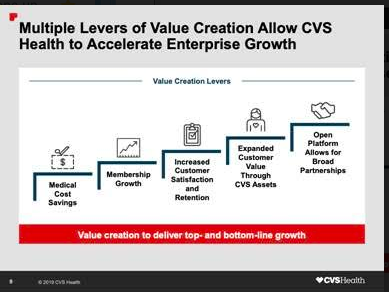

The new CVS health care model is geared to provide significant opportunities to create incremental value and accelerate growth across the enterprise. CVS envisions lower health care costs contributing to improved profitability, enhanced competitive positioning. CVS expects to generate substantial cash flow for reinvestment with a focus on driving shareholder value over the long term.

CVS’s 4Q18 Earnings presentation summarizes management’s expectations.

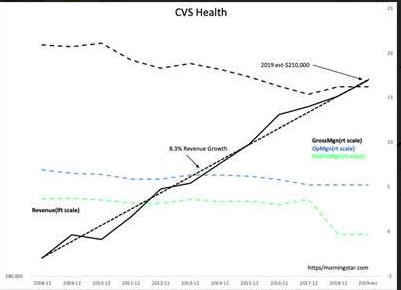

CVS’s Morningstar financial history reflects a strong management team and its price history reflects near term investor confusion.

CVS long-term share-price performance has pace its financial performance as investors turned more positive following results.

Recent insider buying for CVS is an unusual event and a positive investment signal.

The Investment Thesis:

CVS stands out for its long history of superb financial management. The recent acquisition of Aetna to combine a benefits manager with a direct consumer delivery of products/services is the first step of integrating healthcare delivery to lower costs and remain highly competitive in an industry seeing significant demand for lower cost. If management meets its goals, the share’s price should recover to historical trend. Shares currently priced ~$55shr with 3.7% dividend have the potential to price over $100shr in several years.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more