Interview With First Choice Healthcare Solutions

Introduction

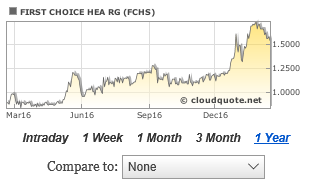

First Choice Healthcare Solutions (FCHS) is a network of non-physician owned medical centers headquartered in Melbourne, Florida. It is listed on the OTC market and currently trades at $1.53/share.

The reason I am writing this article is simple: I believe FCHS is worthy of serious investment consideration. Although my interview below with FCHS' CEO Chris Romandetti will elucidate this point, I want to make a couple of things crystal clear:

- FCHS is steadily growing in a high growth geographical market valued at over $150M.

- With plans to enter new markets in the coming years, FCHS has set its sights on $500M in revenues.

- FCHS reports that it is not involved in any existing litigation.

- FCHS has drastically reduced liabilities.

- FCHS plans to uplist to a national exchange later this year.

- FCHS is little known on Wall Street and appears to have tremendous upside potential.

The interview

Last week, I had the pleasure of interviewing FCHS' CEO

. A serial entrepreneur and proven senior executive with experience in a broad range of industries, Chris has served as First Choice Healthcare Solution’s Chairman, President and CEO since December 2010. In this role, he is responsible for articulating the Company’s vision and executing strategies that place clinically superior, patient-centric care and improved clinical outcomes at the core of FCHS’ corporate mission.

Since 2003 through to the present, Chris has been the Managing Member of Marina Towers, LLC, which is now a wholly owned subsidiary of First Choice Healthcare Solutions; and the Managing Member of C&K, LLC, a property holding company. Since 2007, he has also lent his business building expertise to medical practices and MRI centers as a professional business consultant to the healthcare industry. Previously, he was a founding director of Sunrise Bank, a community bank serving local businesses in Florida’s Space Coast and served as an executive officer for numerous companies in the real estate, marine, automotive and construction products industries.

Q: What is FCHS all about?

A: Headquartered in Melbourne, Florida, FCHS is implementing a defined growth strategy aimed at expanding its network of non-physician-owned medical centers of excellence, which concentrate on treating patients in the following specialties: Orthopaedics, Spine Surgery, Neurology, Interventional Pain Medicine and related diagnostic and ancillary services in key expansion markets throughout the Southeastern U.S.

Serving Florida’s Space Coast, the Company’s flagship integrated platform currently administers over 100,000 patient visits each year and is comprised of First Choice Medical Group, The B.A.C.K. Center and Crane Creek Surgery Center.

Q: How did FCHS determine the clinical, technical, and ancillary services it would provide?

A: Given that our focus is on providing superior, patient-centric musculoskeletal care, we are intent on vertically integrating every service necessary to address a patient’s full episode of care beginning with diagnosis and then progressing through treatment and recovery. Diagnosing patients involves our physician services, multi-specialty provider collaboration services and state-of-the-art imaging capabilities. Our treatment options involve both non-surgical and surgical services; and recovery involves our physical and occupational therapy services and the provision of durable medical equipment necessary to aid in a patient’s recovery process.As we continue to build out our platform, we will look to add both pharmacy and home health services to round out our full episode of care service offerings.

Q: What is the market potential for these services?

A: Based on the dynamic growth taking place on Florida’s Space Coast, we are currently estimating that the total market opportunity for Orthopaedic and Spine care approximates $150 million annually, and we are working towards capturing a large share of that market.Moreover, it is our belief that First Choice will ultimately succeed at replicating our Space Coast platform in other attractive, high growth geographic regions. Based on the expected performance of our medical centers of excellence in Brevard County in 2017, we could feasibly grow our top line to $500 million+ with as few as 10 markets penetrated. Nonetheless, we have identified over 250 locations in the country where we believe our unique business model can be successfully replicated and are practice locations each capable of generating up to $65 million in annually in revenues.

Q: Does FCHS have any plans to offer new clinical, technical, or ancillary services? If so, in what markets, and what is the market potential?

A: As previously noted, we have begun exploring opportunities to either acquire or organically build both pharmacy and home health services. We are also planning to expand the number of physical and occupational therapy centers that we operate to provide greater travel convenience for our patients.Currently, we own and operate one state-of-the-art PT/OT center in Melbourne, but hope to expand that to a total of five centers geographically situated around Brevard County, which extends 72 miles from north to south on Florida’s central eastern coast.

Q: Do you anticipate patient growth in the near term in your existing business lines?

A: Yes. With new providers joining our Medical Centers of Excellence in 2017 combined with strong new job growth attracting more people to eastern Central Florida, we believe that growth of our patient base will continue to be very robust well into the foreseeable future.

Q: Do you anticipate favorable or unfavorable long-term demographic changes?

A: The Space Coast anchors the eastern end of Florida’s High Tech Corridor, yet the economy itself is driven by a variety of clusters keeping the area healthy and balanced. Brevard County is comprised of a broad demographic mix ranging from baby boomers to millennials. An array of global business leaders have a presence on Florida’s Space Coast, including major defense contractors such as Boeing (BA), DRS, Harris Corporation (HRS), Raytheon (RTN), Rockwell Collins (COL), Satcom, SpaceX and General Electric (GE) – all of which are adding jobs and attracting people from all over the globe to our fast growing community.The 10th largest county in the state of Florida, Brevard is also home to several military installations including Patrick Air Force Base, Cape Canaveral Air Force Station, the Naval Ordinance Test Unit and a Trident turning base at Port Canaveral; and we have nearly 70,000 U.S. veterans residing here.

Q: What is the status of your compliance program?

A: First Choice and our medical practices are in full compliance with all healthcare and SEC regulatory requirements. We engage third party consultants and have a team of superb attorneys who help us not only remain compliant with prevailing rules and regulations, but stay well informed of any and all pending legislation or new rules and regulations that may impact our business.

Q: How will bundled payments enhance your bottom line?When will it be implemented?

A: Later this year, First Choice intends to be among the first comprehensive healthcare platforms in Brevard County to offer the government, major health plans and large self-insured employer groups bundled payment programs for a broad range of Orthopaedic and Spine related surgical procedures, including total hip and knee replacements. In doing so, we believe we will be able to ultimately lower the total cost of episodes of care up to 15 percent for these payor organizations while achieving optimal care outcomes for our patients and margin expansion for First Choice.

Q: Are you involved in any significant litigation?

A: No.

Q: The Congress has taken significant steps to repeal and replace the Affordable Care Act. In what ways, if any, has FCHS prepared for significant regulatory changes?

A: We are confident that there is nothing but additional upside for First Choice if Obama Care is repealed and replaced.It is our view that value-based reimbursement is the future of U.S. healthcare – particularly given the fact that early results of CMS’ bundled payment programs are revealing that tangible cost savings and improved care for Americans are being achieved.It is our belief that future legislation will continue to support this shift in how care is paid for in our country, and First Choice is positioned to capitalize on it.

Q: Are there any aspects of FCHS that you think Wall Street is overlooking?

A: As far as we know, First Choice is the only non-physician-owned healthcare services company focused on Orthopaedic and Spine care that is publicly traded.Our business-building platform is proving successful because we have married the best, most advanced musculoskeletal clinical and surgical care with the industry’s best business practices. Moreover, unlike other healthcare service providers who have focused their business on a single service offering and rely solely on that service line to generate income, we are highly risk adverse. Consequently, we have engineered our business model to provide for multiple revenue channels that allow us to mitigate risk across our entire platform, i.e. physician services, surgery center fees, MRI, DME, PT/OT, etc.

The consistent benefits realized from our business model include the following: First Choice empowers doctors to be doctors; we deliver patients optimal convenience and care; and we deliver our shareholders sustainable value that we expect will continue to increase as we persist in executing our well-defined growth plans.

Q: What is the status of your balance sheet?

A: As of our latest 10-Q filing for the nine months ended September 30, our balance sheet reflected cash of $6.59 million, accounts receivable of $9.48 million and total stockholders’ equity attributable to First Choice of $13.41 million. Moreover, in the first nine months of 2016, we also succeeded in reducing our total liabilities from $19.6 million as of December 31, 2015 to $9.7 million as of the end of September 2016, which has served to greatly strengthen our balance sheet.

Q: Could you elaborate on insider ownership?

A: Insider ownership – or common shares held by our Officers and Directors -- currently stands at 28.7%, or approximately 7.2 million shares.

Q: Do you have any plans to pursue strategic alternatives?

A: If by strategic alternatives you are referring to our taking any drastic new direction in how we are building our business, the answer is no.We have and will continue to execute defined organic and strategic growth strategies centered on delivering the very best, most advanced Orthopaedic and Spine care to the patients we serve.Over time, we will look to begin replicating our Space Coast platform in other regions of the southeastern U.S.

Q: What is the timeframe that you intend to uplist to a national exchange?

A: Our goal is to pursue an uplisting later this year, assuming of course market conditions are favorable and we succeed in meeting all of the uplisting requirements.

Q: Where do you see FCHS in 10 years?

A: As previously noted, we will look to replicate our Space Coast platform in a minimum of 10 new geographic markets over the next several years; and believe that, if successful, we will build our revenues to $500 million or better.In this process, we also expect that our First Choice brand will become synonymous with the industry’s very best, most advanced Orthopaedic and Spine care in the nation.While we have much work ahead of us to achieve this goal, we are clearly well on our way.

Q: Culminating from our discussion, why should someone invest in FCHS?

A: If investors are interested in participating in the growth of the U.S. healthcare industry – particularly as it continues to evolve towards value-based reimbursement models that drive better patient care and outcomes – then First Choice Healthcare Solutions should be a prime investment consideration.It is my firm belief that few public companies will work harder for their shareholders than First Choice and even fewer will have the ability to help advance the quality and depth of care delivered to patients. In addition, it is incumbent on healthcare services companies like First Choice Healthcare Solutions to take responsibility for proposing and implementing value-based, bundle payment programs for payers that will help to reduce healthcare costs, improve patient care and allow providers to make a respectable profit.It can be done and we intend to be at the forefront of helping to make that an industry priority.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

I'm happy to answer any questions about First Choice Healthcare Solutions $FCHS

Thanks Chris. $FCHS sounds like it is on the verge of doing great things. What inspired you to get into this field in the first place?

Thanks Chris, I was disappointed the author of the article didn't respond to any of our questions on $FCHS.

Thanks for sharing

Worth taking a closer look, thanks. $FCHS.

Its stockholder equity is only $4M more than its debt? The market cap seems awfully small... $FCHS

Trevor, have you decided to personally invest in $FCHS?

$FCHS looks like promising. I am not familiar with healthcare area and this company, would love to learn more about them.

Interesting article. I have not heard of anything like $FCHS before. Where can I go to learn more?

Here you go:

http://www.talkmarkets.com/symbol/FCHS

@[Trevor Lowenthal](user:5007), you've made a compelling case. But a company is only as strong as it's captain. Before I decide to invest, I'd like to hear more about @[Chris Romandetti](user:39051)'s background and experience. Why he is best equipped to ensure the success of $FCHS?

Sounds promising, but not much coverage on this stock. Where can I learn more about $FCHS?

Loading comments, please wait...