CeriBell's IPO Lockup Ends April 9 - Here's Why We're Shorting It

Image Source: Kevin Smith on Flickr

I have been writing about IPO lockups for more than a decade on the Seeking Alpha platform but rarely does a lockup short opportunity look as compelling as CeriBell's (Nasdaq: CBLL) impending lockup expiration this week on April 9th.

Why? Three reasons: (1) a very large number of restricted shares, (2) 90% of restricted shares are subject to a 180-day lockup period and (3) CBLL has had solid market performance in a challenging market.

Large Number of Restricted Shares

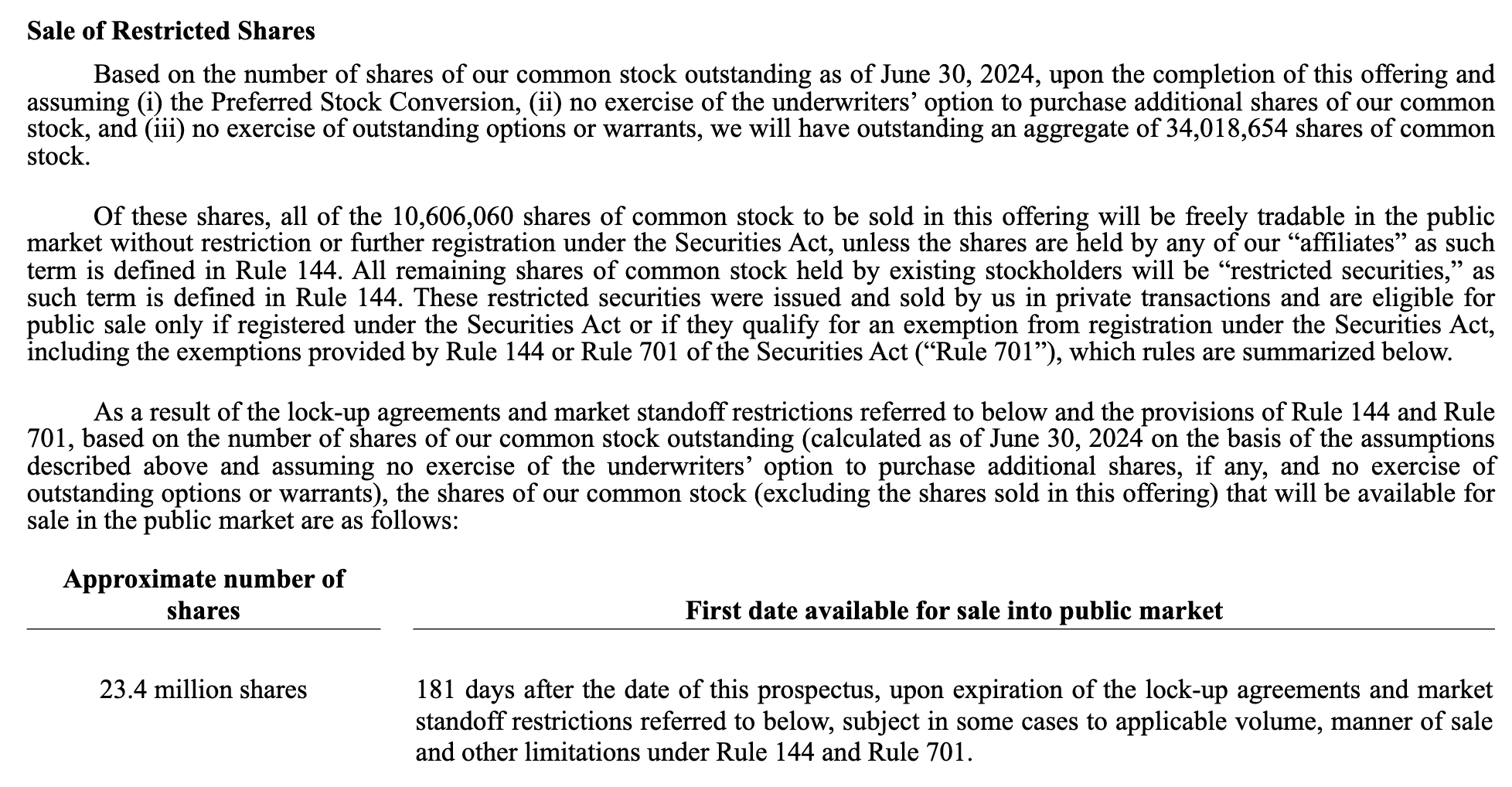

When CBLL made its debut last October 11th on the Nasdaq, just 10.6 million shares of the company's 34 million total shares became freely tradable on the secondary market. The remaining 23.4 million shares are "restricted" securities. According to an October 10th, 2024 regulatory filing, 90% of those shares are subject to lockup agreements that expire 181 days after the October 10th filing (see below).

(Click on image to enlarge)

CBLL's Regulatory Filing on October 10, 2024 (SEC Archives 424B4 Filing)

When those agreements expire this week on Wednesday, executives and insiders – alongside B of A Securities, J.P. Morgan, William Blair, TD Cowen, and Canaccord Genuity – will be able to freely sell their shares in the secondary market. Right now, CBLL's trading volume is a meager 189K on average, but that could dramatically shift in the week ahead if the number of shares in the secondary market triples from 10.6M to 34M. If there isn't enough demand for all the new supply, we could see a sharp, short-term downturn in CBLL's share price.

The company actually acknowledges this grim reality in bold print in their October 10th filing. Check it out:

(Click on image to enlarge)

CBLL's October 10th SEC Filing (SEC Archives 424B4 Filing)

Why Would They Sell?

The restricted shares represent a significant investment for the CEOs, insiders, and venture cap firms backing CBLL's debut. They've had to invest capital and then sit on their hands for six months and hope for the best. During that time, the political landscape has been tense, and the market has been volatile.

Still, holders of these shares haven't made out that bad. Shares of CBLL jumped more than 47% on the first day of trading and – despite a wild, volatile ride – are still sitting 13% higher than IPO price. Not bad when you consider how the average 401k has performed in that period.

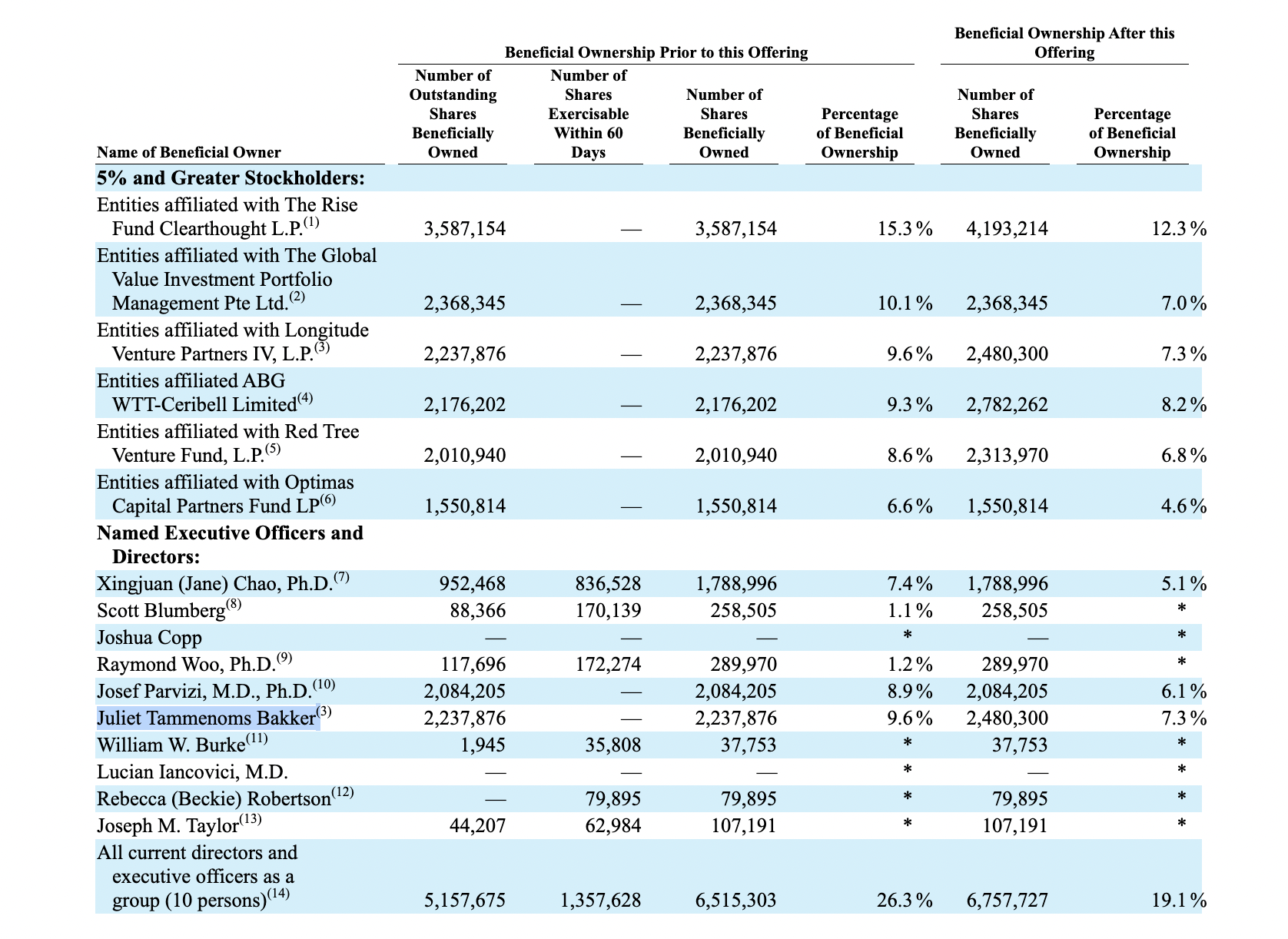

We believe that it is highly likely that many of the current restricted shareholders are probably very eager to cash in on this winner, reduce their exposure and unload shares. As an example, Juliet Tammenoms Bakker – the founder of Longitude Capital – is personally sitting on an 18-million-dollar investment that she hasn't been able to reduce or unload in six months.

(Click on image to enlarge)

Principal Selling Shareholders (SEC Archives)

What Should You Do?

The opportunity here is to short shares of CBLL in the days leading up to the lockup expiration, and then cover the positions after the April 9th lockup expiration. If the share price reacts as we expect (and as the company acknowledges – please see an image of this acknowledgment below) there will be a sharp, short-term downturn in CBLL share price once the lockup expires. Even if volume is light, individual investors will be much more nimble than these giant shareholders, and they have an opportunity to more easily short stock ahead of the event and cover after the lockup expiration.

CBLL's acknowledgment that this might occur is on page 53 of their October 10th filing, and we are including an actual image of the acknowledgment here:

Warning from CBLL's SEC Filing (SEC Archives 424B4 Filing)

Important Considerations Regarding Short Selling Risks

Investors considering a short position in CBLL stock should be fully aware of the associated risks-especially with a lower volume, recently listed company like CBLL. Short selling carries the potential for losses that exceed the initial investment, as there is no cap on how high a stock's price can rise. The stock has already shown notable volatility, and limited liquidity or shallow market depth could make it difficult to exit positions favorably. Furthermore, changes in analyst sentiment may cause temporary price spikes, which could work against short sellers.

The bottom line: this recommendation is not for the faint of heart (years ago we'd say "not for widows or orphans"). So unless you are a capable trader with a high tolerance of risk, there's no need to read further.

If you do find the idea compelling, however, read on to learn a little about the company and our recommendation.

Overview of CeriBell, Inc. Business

CeriBell, Inc. is a medical technology firm in the commercial phase, renowned for creating the CeriBell System, an innovative, portable electroencephalography (EEG) solution tailored for acute care environments. This system features a single-use headband paired with a small, battery-operated recorder that collects and wirelessly sends EEG data. The information is processed by Clarity, an artificial intelligence-driven algorithm designed to identify seizures. Non-specialized medical staff can easily deploy the CeriBell System, enabling uninterrupted bedside EEG monitoring. By September 30, 2024, over 500 hospitals had integrated the system, benefiting more than 100,000 patients.

In May 2023, the Clarity algorithm earned FDA 510(k) approval for detecting electrographic status epilepticus. Additionally, the Centers for Medicare and Medicaid Services granted the system a New Technology Add-on Payment (NTAP). CeriBell's revenue streams include sales of disposable headbands and a subscription service providing access to Clarity, hardware, and a clinical interface. Since launching commercially in 2018, the company has seen steady expansion in its clientele and usage rates. As of June 30, 2024, CeriBell employed around 70 sales representatives across the United States. The system also holds CE Marking, and the company intends to seek further regulatory clearances globally.

The CeriBell System aids in identifying seizures among patients with urgent neurological issues, such as those stemming from brain trauma, stroke, cardiac arrest, or infections. Non-convulsive seizures, prevalent in these scenarios, require EEG confirmation for diagnosis. Conventional EEG setups often struggle with delays due to technician shortages, lengthy preparation, and inconsistent monitoring. CeriBell has produced and shared clinical and financial evidence to promote its system's adoption. The company is also exploring new applications, including delirium monitoring, for which it received FDA Breakthrough Device Designation in September 2022. CeriBell projects its potential U.S. market to surpass $2 billion.

Market Approach

CeriBell collaborates with medical facilities to seamlessly integrate its system into everyday clinical practices. The company facilitates this process by providing comprehensive training and instructional resources tailored for healthcare personnel. Additionally, CeriBell invests in research efforts to assess and highlight the clinical and financial advantages of its technology. A specialized sales and marketing crew actively promotes the system to prospective clients. Having secured regulatory approval for use in the United States, the company is now pursuing opportunities to expand into new regions. Simultaneously, CeriBell is innovating by exploring additional uses for its technology in managing neurological disorders like delirium and ischemic stroke. As a publicly listed entity, CeriBell leverages access to financial markets to fuel its ongoing expansion and technological advancements.

Q4 2024 and Recent Business Highlights

CBLL reported the following financial highlights for the 4th quarter of 2024 ended December 31, 2024:

- Generated $18.5 million in revenue during the fourth quarter of 2024, representing a 41% increase year-over-year.

- Recorded total annual revenue of $65.4 million for 2024, marking a 45% growth compared to 2023.

- Concluded the year with 529 active customer accounts.

- Reported gross margin of 88% for Q4 2024 and 87% for the full year.

- Submitted a 510(k) application to the FDA for the pediatric version of the Clarity™ algorithm.

- Announced the promotion of Sean Manni, Senior Vice President of Sales, to the role of Chief Revenue Officer.

- Surpassed a milestone of providing care to over 200,000 patients.

Management

President, Chief Executive Officer, Co-Founder, and Director Jane Chao, PhD

Dr. Xingjuan (Jane) Chao is a co-founder of the company and has served as Chief Executive Officer and a member of the board of directors since October 2015. She has also held the position of President since July 2016. Before co-founding the company, Dr. Chao held positions as Portfolio Management Strategy at Genentech, Inc., Senior Strategy Manager at Novartis AG., and management consultant at McKinsey. She holds a Bachelor of Science in Chemistry from Peking University and a Ph.D. in Biophysics from Cornell University.

Chief Financial Officer Scott Blumberg

Scott Blumberg has held the role of Chief Financial Officer since April 2020. Before joining the company, he was Managing Advisor at Venture Forward Advisory Services. Earlier in his career, he served as Director of Business Development at IDEV Technologies, Inc. He also worked as an Analyst at Bay City Capital and as an Investment Banking Analyst at Bank of America. Mr. Blumberg holds an A.B. in Economics from Dartmouth College.

Competition: Brain Products, Nihon Koden, and Others

Ceribell operates in a dynamic marketplace that includes many innovators of medical equipment including:

- Brain Products: Specializes in hardware and software solutions for neurophysiological and EEG-based research.

- Nihon Kohden: Produces a range of EEG systems, including models with wireless functionality.

- Emotiv: Develops EEG headsets for cognitive and brain research, including the EPOC X.

- Clarity Medical: Offers EEG systems capable of recording up to 40 channels.

Additional Notable Providers:

- Electrical Geodesics (EGI): Recognized for its high-density EEG system offerings.

- Neuroelectrics: Supplies EEG equipment for both clinical and research applications.

- BioSemi: Designs EEG and EMG systems with a focus on research use.

- ANT Neuro: Provides a variety of neurophysiological monitoring tools, including EEG systems.

Early Market Performance

The underwriters priced the IPO at $17 per share. The stock reached a high on December 6, 2024 at $30.24. The shares declined to a low of $19.09 on January 14. Trading has been volatile since then. Currently, the stock trades around $18—$19.

That volatility must have been nauseating to the restricted shareholders – and hard to watch when you can't do anything about it. But, as we mentioned above, they still have a gain of 13% and next week is around the corner.

Conclusion: Short CBLL Prior to LU Expiration if Appropriate for Your Investment Goals

As the April 9 expiration of CeriBell, Inc.'s (NASDAQ Global Select: CBLL) lockup period approaches, the release of approximately 23 million previously restricted shares held by pre-IPO shareholders and insiders could send a shockwave through CBLL's share price. We believe that this rapid increase of CBLL shares in the secondary market could place sharp, short-term downward pressure on CBLL's share price and lead to short-term price volatility.

Due to volume considerations and volatility, we doubt that they will be able to offload all the shares they want the first day, but by Friday the 11th – especially considering recent market volatility going into the weekend – the

pressure should be on, and there should be an opportunity to cover short positions at a gain.

What We're Doing

We have been slowly shorting CBLL in the lead-up to the lockup expiration – with an eye toward trading volume. There is still plenty of time to do this in the week ahead, and we recommend you take a conservative approach and scale in over the course of the week. We plan to begin covering late on April 9th's trading session, and we will completely cover the short position on April 10th and 11th to close it before the end of this week.

We think this is a strong short idea, and we believe that this approach could work well for other risk-tolerant investors. If you join in on the trade, let us know how it goes and what you observe in the comments.

More By This Author:

Short Waystar Holding Corp. Ahead Of Lockup Expiration

Kanzhun Limited: Lockup Expiration Could Knock BZ Stock Off Balance

Forestar Is A Buy Ahead Of Earnings

Disclosure: I/we have a beneficial short position in the shares of CBLL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own ...

more