Headline PCE Inflation Continues To Rise; Savings Rate Revised Down... Again

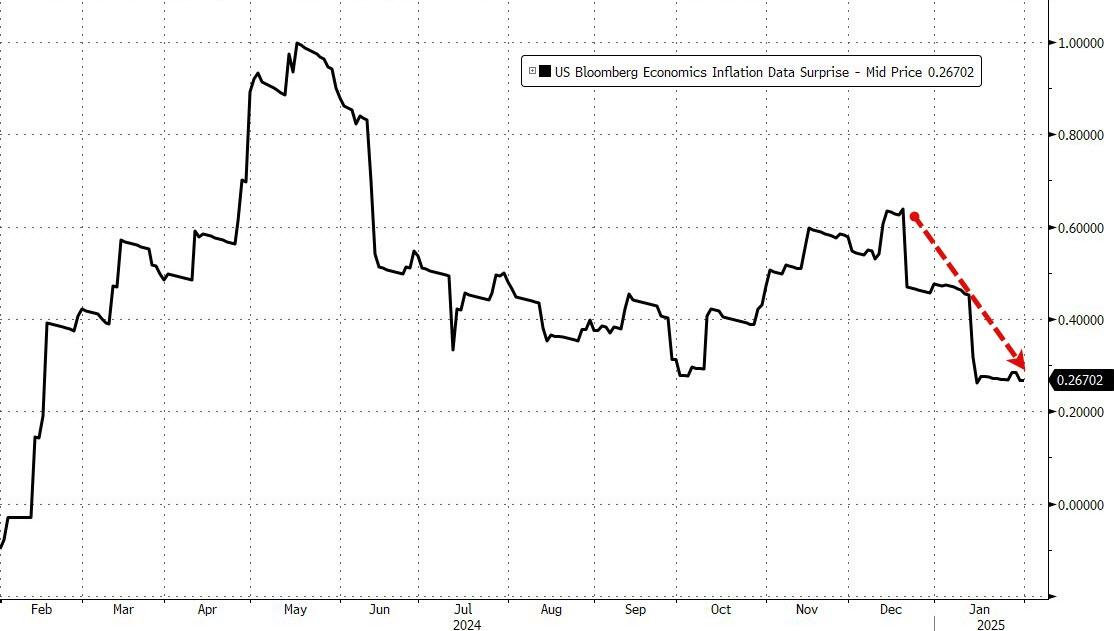

With constant fearmongery about Trump's tariffs prompting a panic-flation, it is interesting to note that inflation data has been serially disappointing in recent weeks (printing below expectations)...

Source: Bloomberg

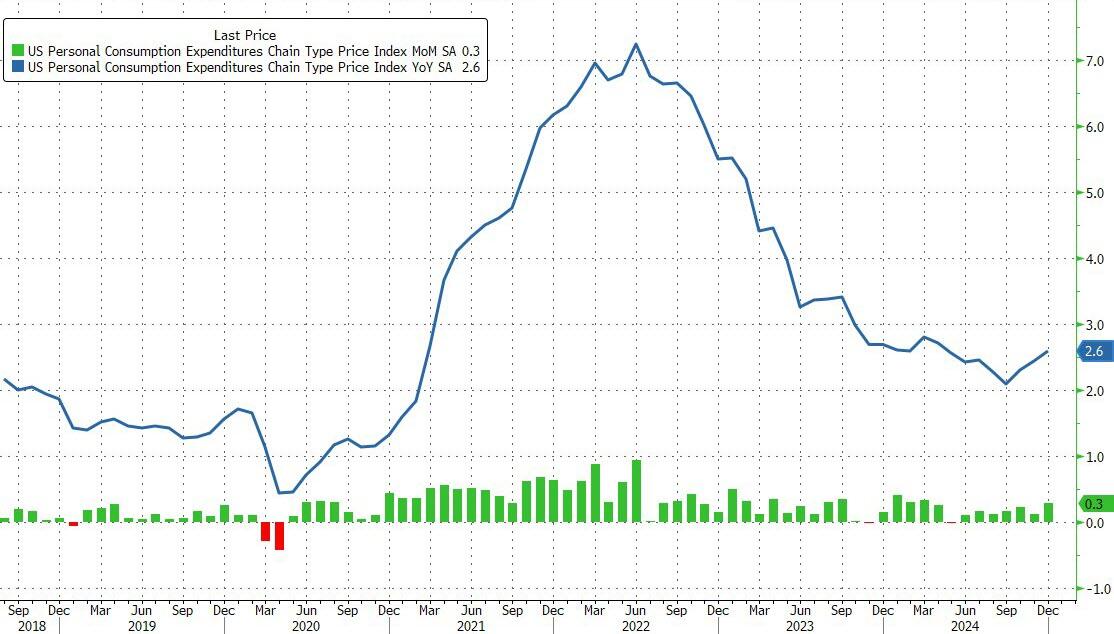

And this morning we get The Fed's (old) favorite inflation indicator (until they changed their minds because it didn't fit the narrative) - Core PCE - print at +2.8% YoY (flat from the prior month).

Source: Bloomberg

Headline PCE rose to +2.6% (as expected)...

Source: Bloomberg

While Cyclical PCE continues to slide, Acyclical inflation (the segment that The Fed can't really 'manage'), pushed higher...

Source: Bloomberg

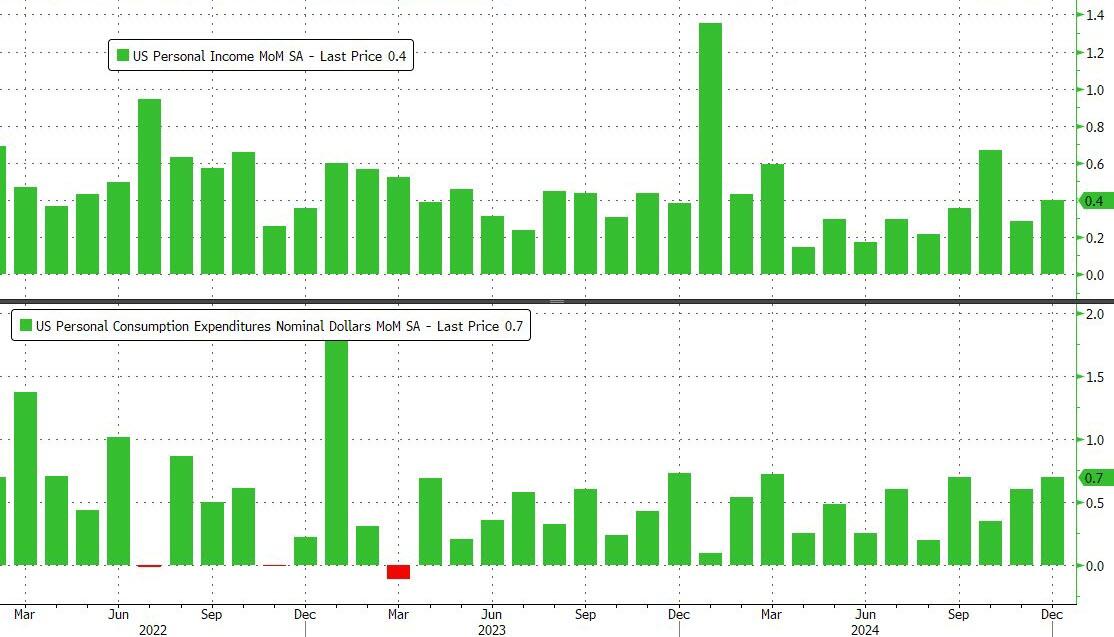

As the cost of goods keeps rising, so does income and spending (the former +0.4% as expected and the latter +0.7%, more than expected)...

Source: Bloomberg

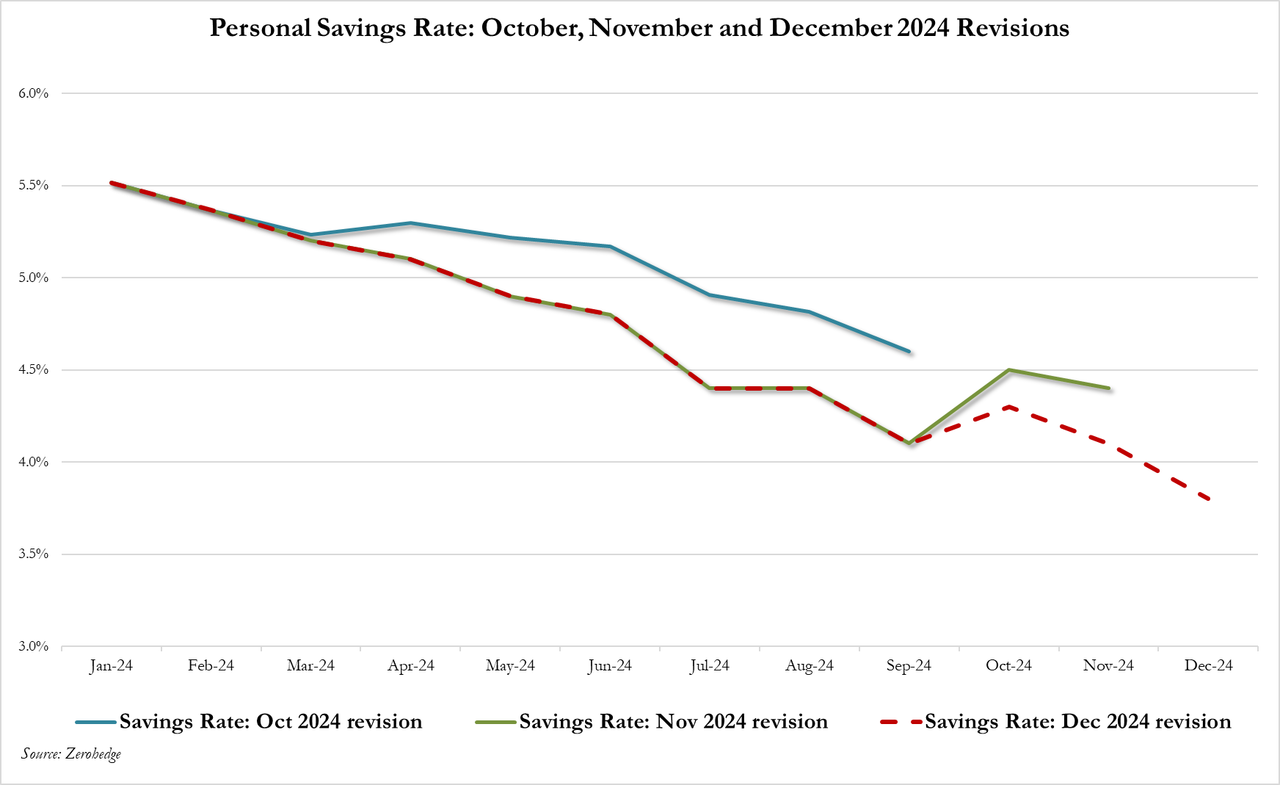

Remember when the Biden admin scrambled to revise GDP higher and artificially inflated the savings rate to make it possible.

Well guess what happened after all the data revisions...

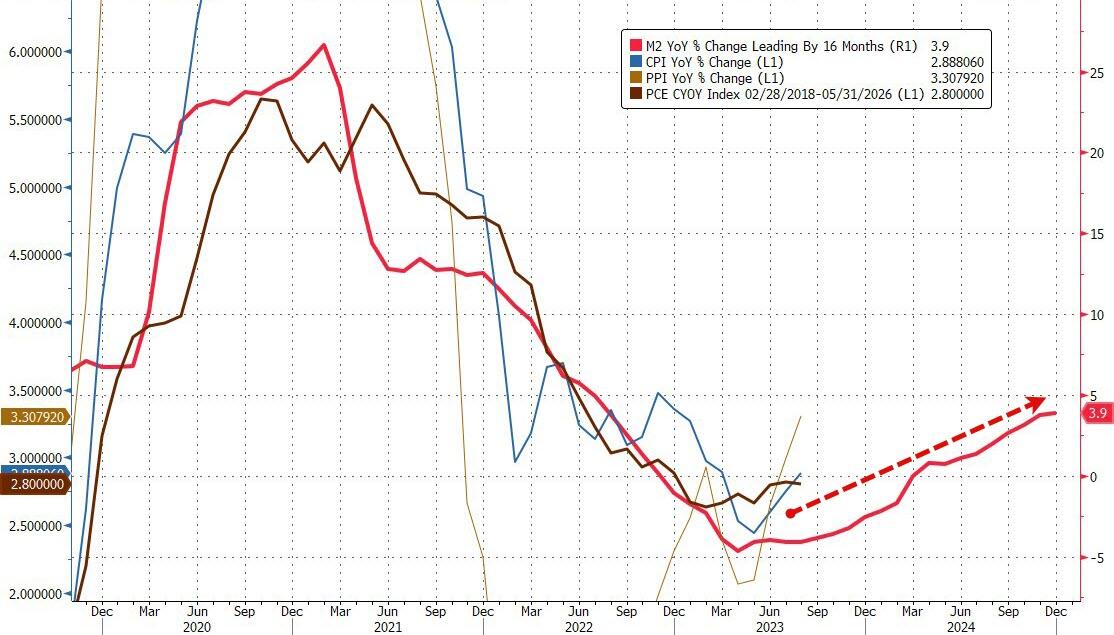

Finally, not a pretty picture...

Source: Bloomberg

So will inflation be resurgent due to Trump tariffs... or the lagged impact of the money supply surge of the last 12 months to try and pump Bidenomics?

More By This Author:

Apple Slides After Iphone Sales Miss, China Revenues Unexpectedly TumbleQ4 GDP Growth Comes In Unexpectedly Light Despite Red Hot Personal Spending Beating Estimates By A Record

Inflation Storm Leaves Americans More Reliant On Food Banks

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more