Headline CPI Hotter Than Expected In December, Food Costs Hit Record High

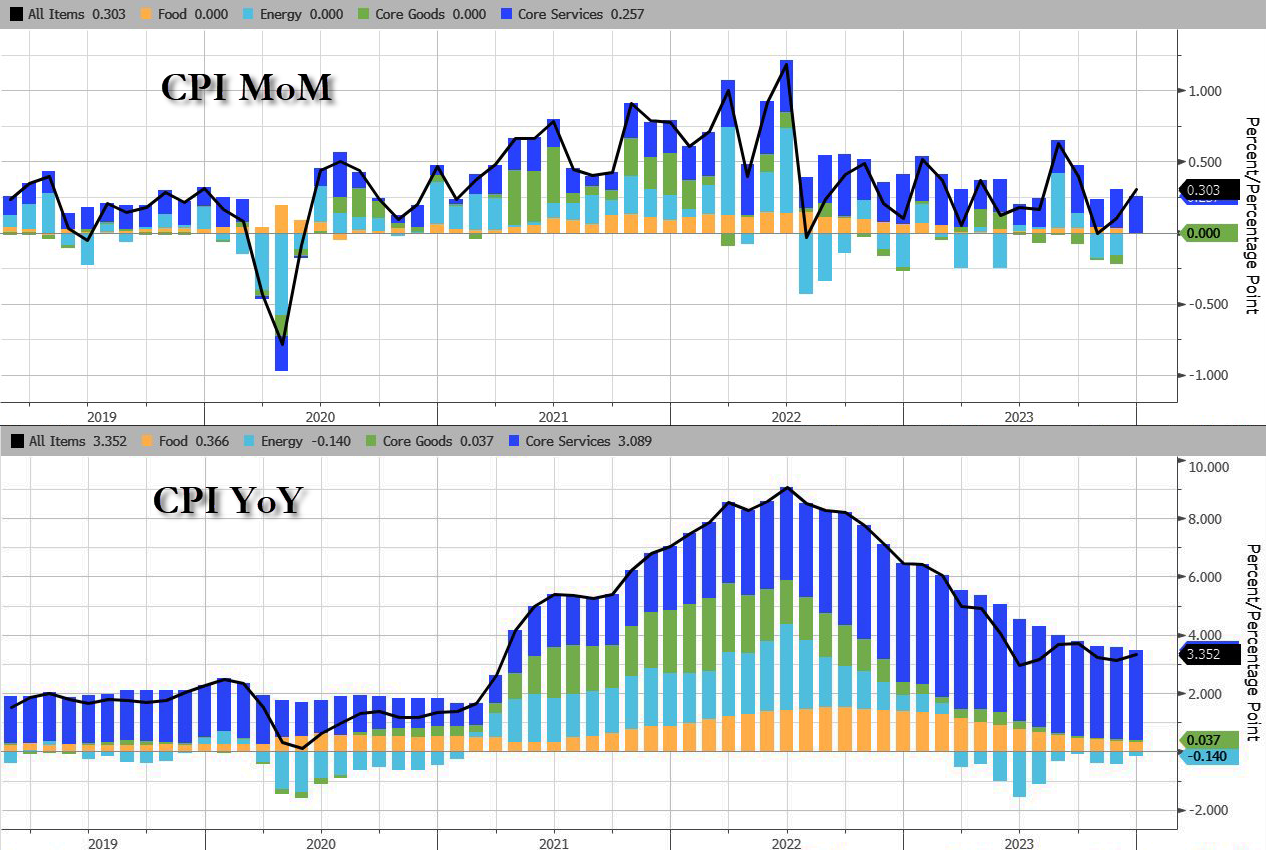

Headline Consumer Price Inflation printed hotter than expected in December, +0.3% MoM vs +0.2% exp and +0.1% prior, pushing the YoY headline CPI up to +3.4% (from +3.1% prior and hotter than the +3.2% exp)...

Source: Bloomberg

Services (Shelter mostly) costs re-accelerated and energy deflation stalled in December...

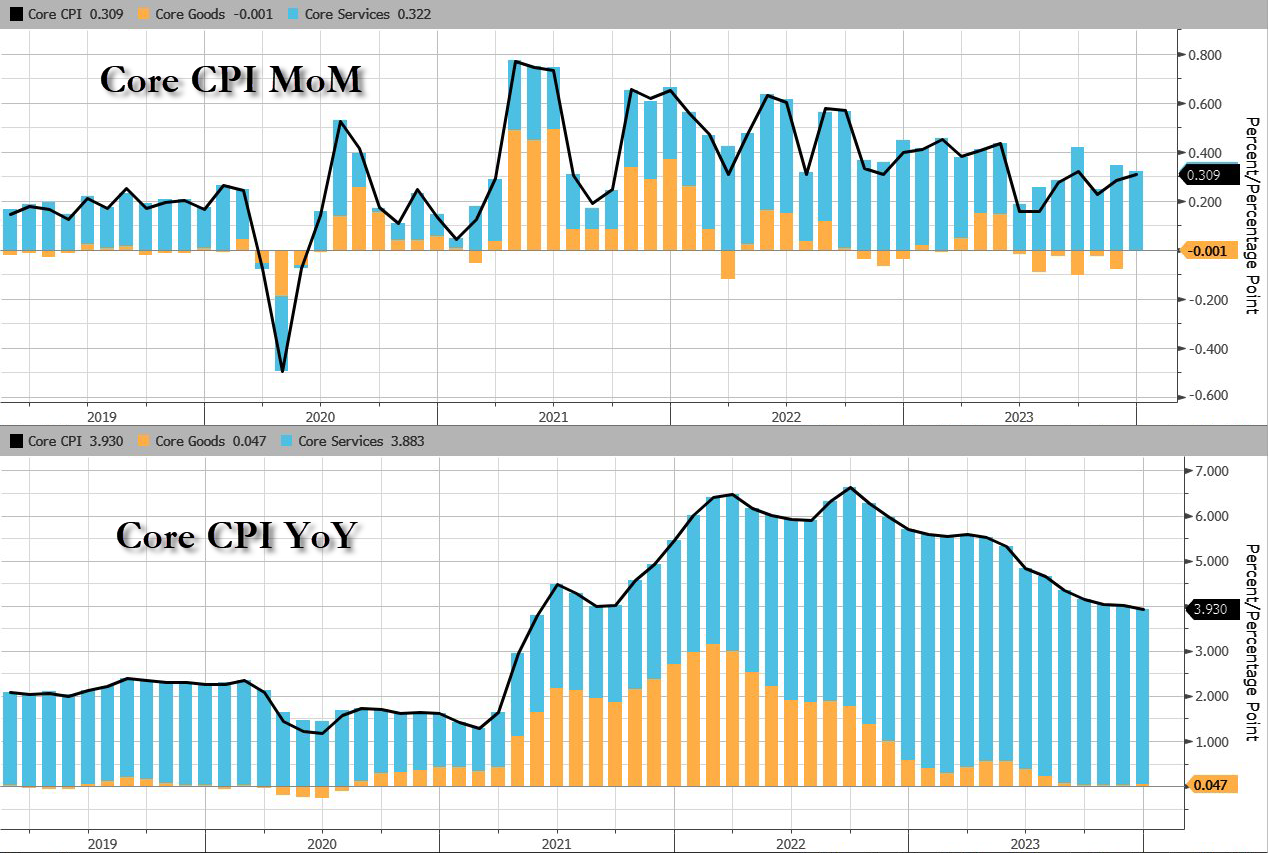

On the brighter side, core CPI rose 0.3% MoM as expected, dropping the YoY change below 4.00% (3.93%) for the first time since May 2021...

Source: Bloomberg

Goods deflation has stalled as the used cars and trucks index rose 0.5 percent over the month, after rising 1.6 percent in November.

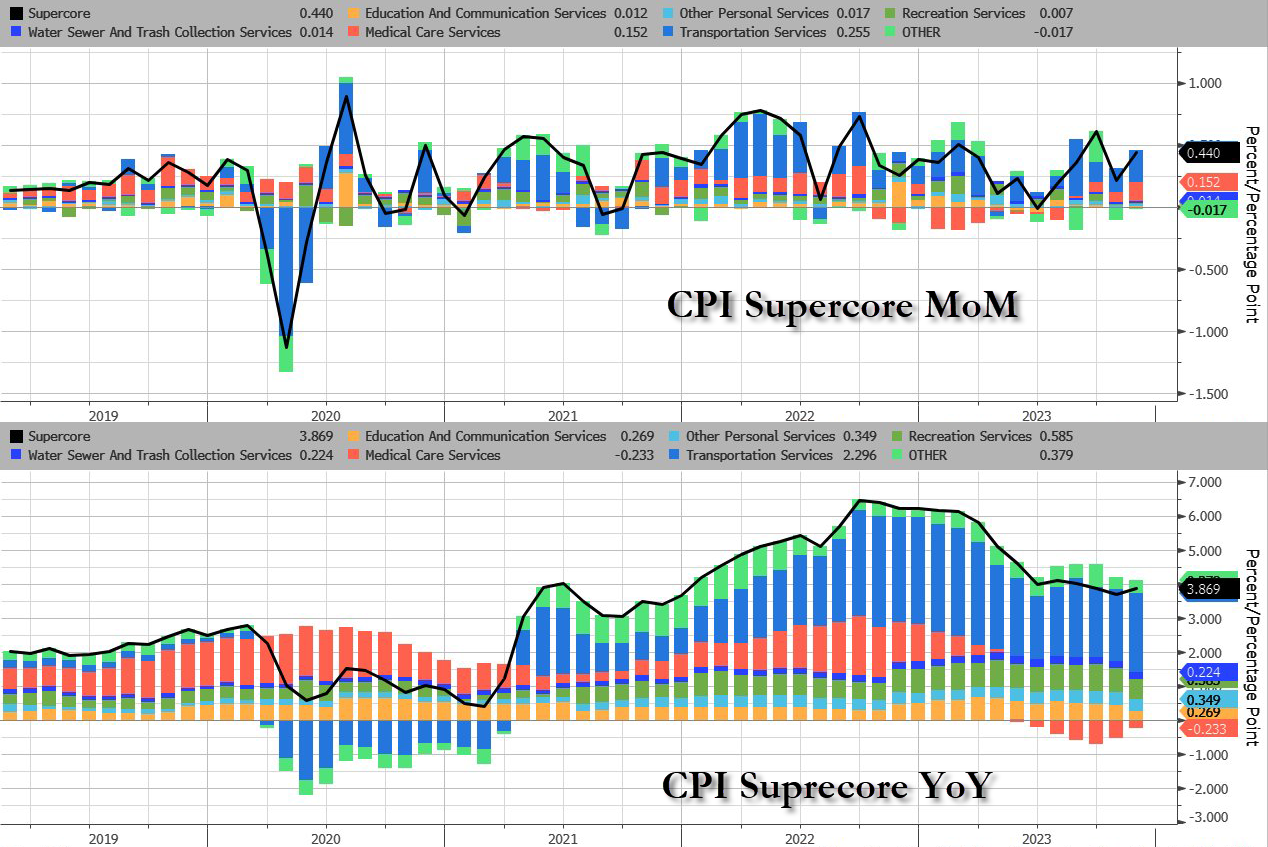

More problematically for The Fed (and the rate-cut 'hypers'), is the fact that Core CPI Services Ex-Shelter (SuperCore) rose 0.4% MoM, upticking the YoY rise to +4.09%...

Source: Bloomberg

All the subsectors of SuperCore rose MoM with the shelter index increased 6.2 percent over the last year, accounting for over two thirds of the total increase in the all items less food and energy index.

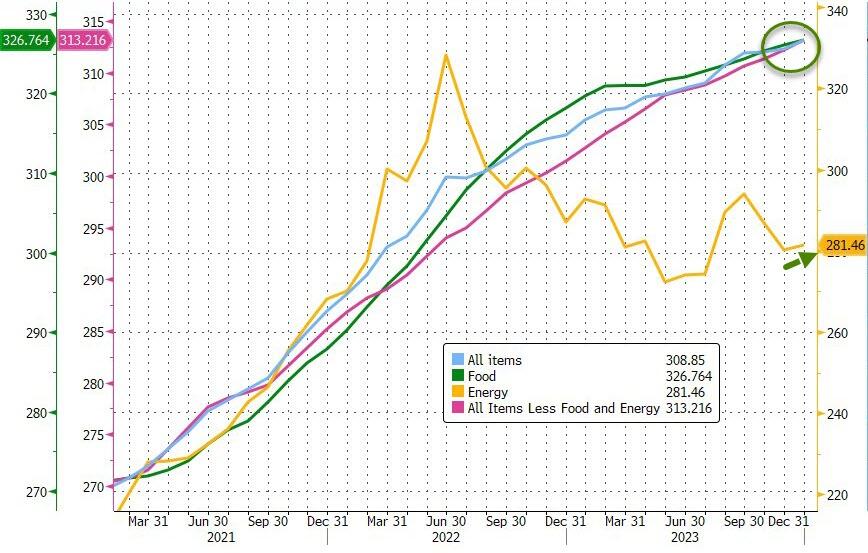

And the next time someone from the Biden administration says 'inflation is down' in an attempt to gaslight the public into believing 'prices are down' - show them this chart...

- Headline costs at record highs

- Core costs are record highs

- Food costs at record highs

- Fuel costs on the rise again

Source: Bloomberg

Four of the six major grocery store food group indexes increased over the month.

The index for meats, poultry, fish, and eggs rose 0.5 percent in December, led by an 8.9-percent increase in the index for eggs.

The index for food away from home rose 5.2 percent over the last year.

The index for limited service meals rose 5.9 percent over the last 12 months, and the index for full service meals rose 4.5 percent over the same period.

Is this a pause before the re-plunge? M2 thinks so...

So what happens next?

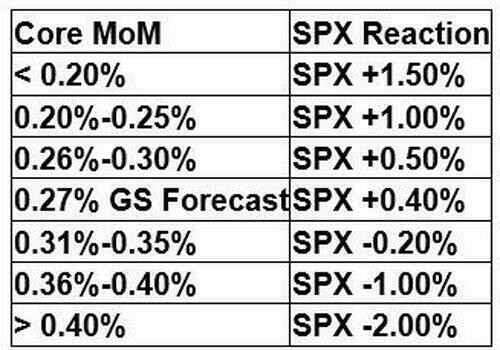

Not so much Goldilocks perfection...

More By This Author:

Chinese FDI Inflows Hit Multi-Year LowsSEC Approves Spot Bitcoin ETF (For Real This Time), Will Begin Trading Tomorrow

First 10Y Auction Of 2024 Prices To Tepid Demand, 4th Tail In A Row

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more