Government Wage Growth Hits Record High As Fed's Favorite Inflation Indicator Tumbles

One of The Fed's favorite inflation indicators - Core PCE Deflator - tumbled to +3.2% YoY (below the 3.3% exp and down from a downwardly revised 3.4% in October) - the lowest since April 2021.

Headline CPI also slowed more than expected, to +2.6% YoY in November (from +2.9% in Oct)

Source: Bloomberg

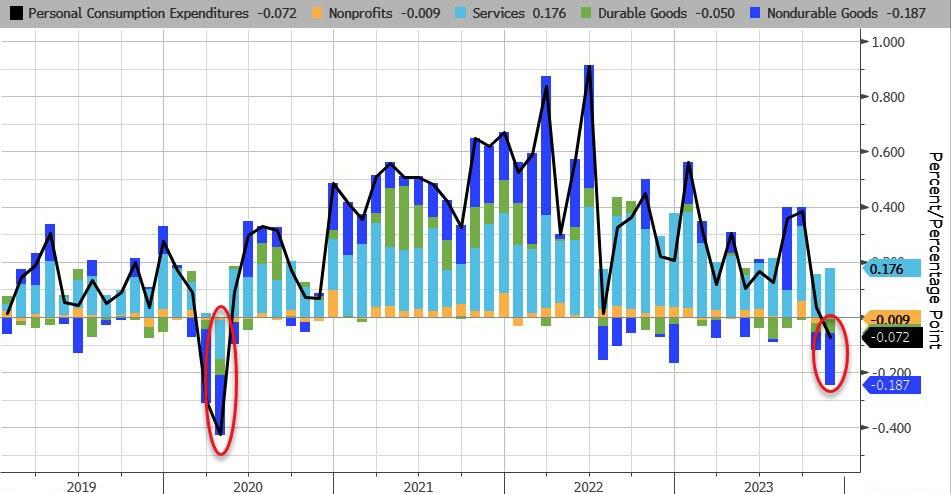

The headline PCE Deflator FELL 0.1% MoM - the first monthly decline since April 2020. The drop was all driven by Goods (durable and Non-durable)...

Source: Bloomberg

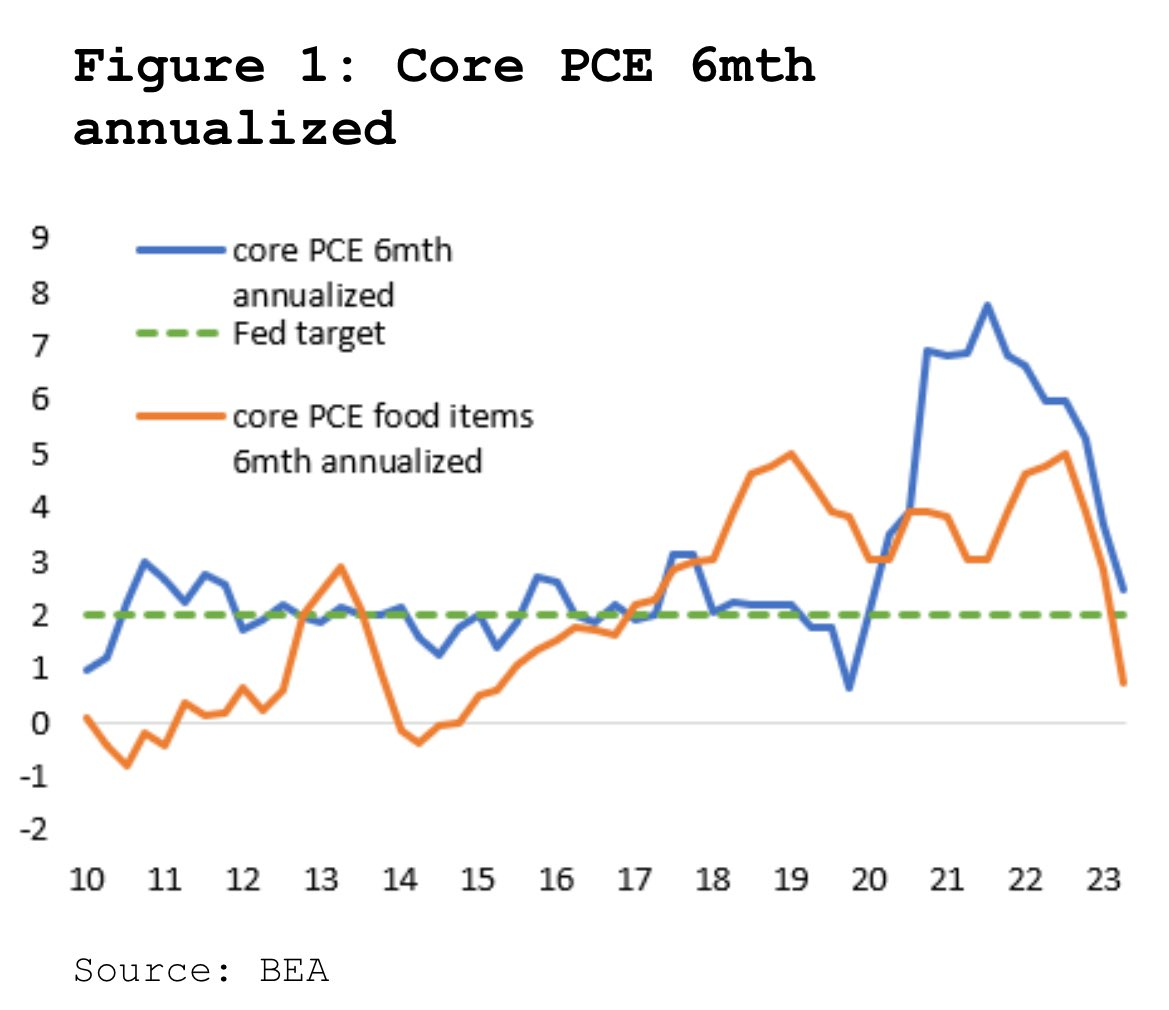

On a six-month annualized basis, 'mission accomplished'...

Even more focused, is the Fed's view on Services inflation ex-Shelter, and the PCE-equivalent shows that it has broken down from its 'sticky' levels to its lowest since March 2021...

Source: Bloomberg

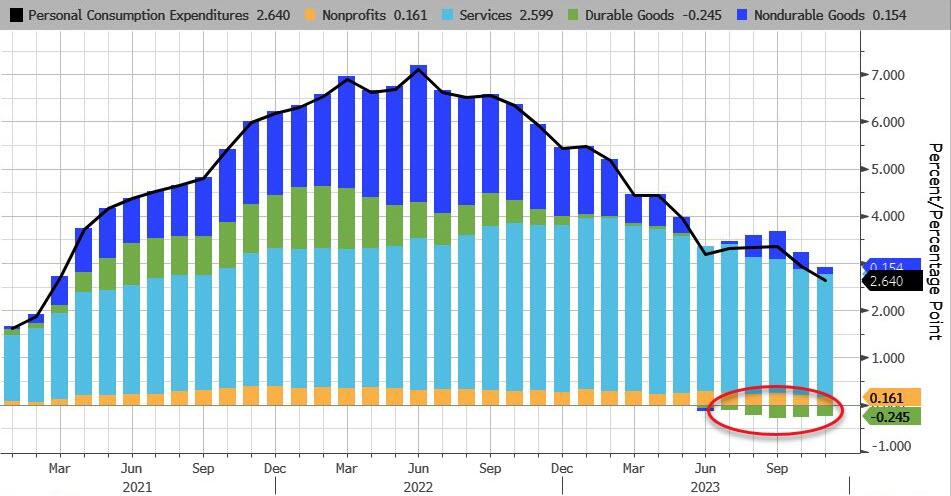

Year-over-Year Goods deflation continued for the 6th month in a row...

Source: Bloomberg

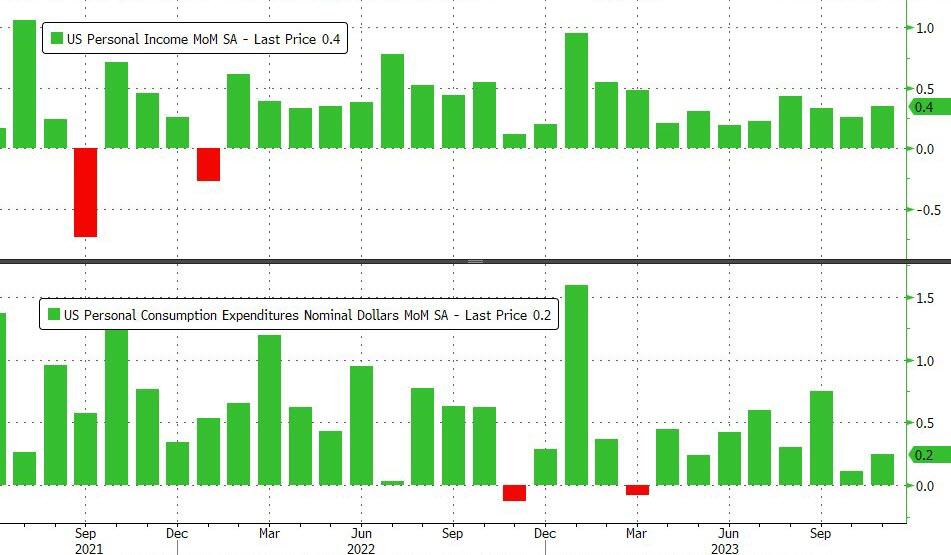

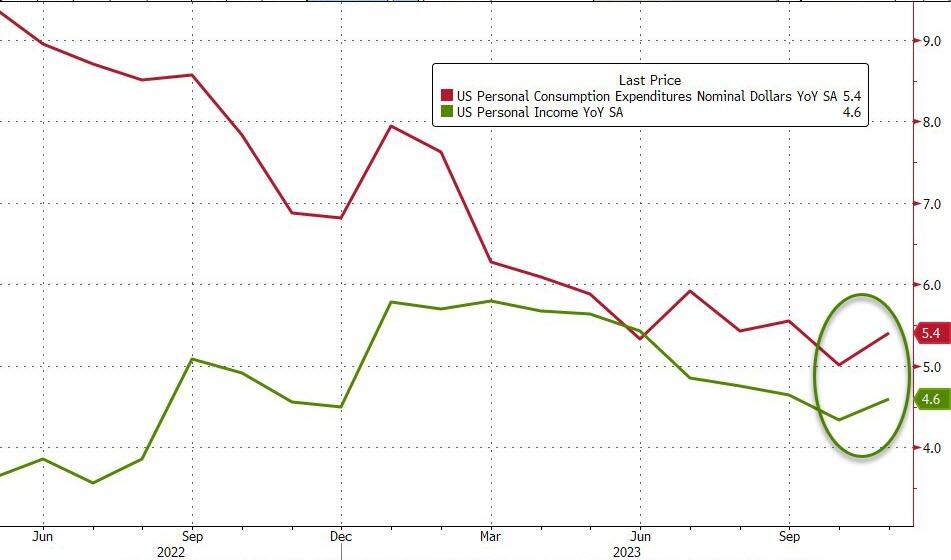

Both income and spending rose MoM in November, +0.4% and +0.2% respectively.

Source: Bloomberg

Which pushed the YoY spending and income growth even faster...

Source: Bloomberg

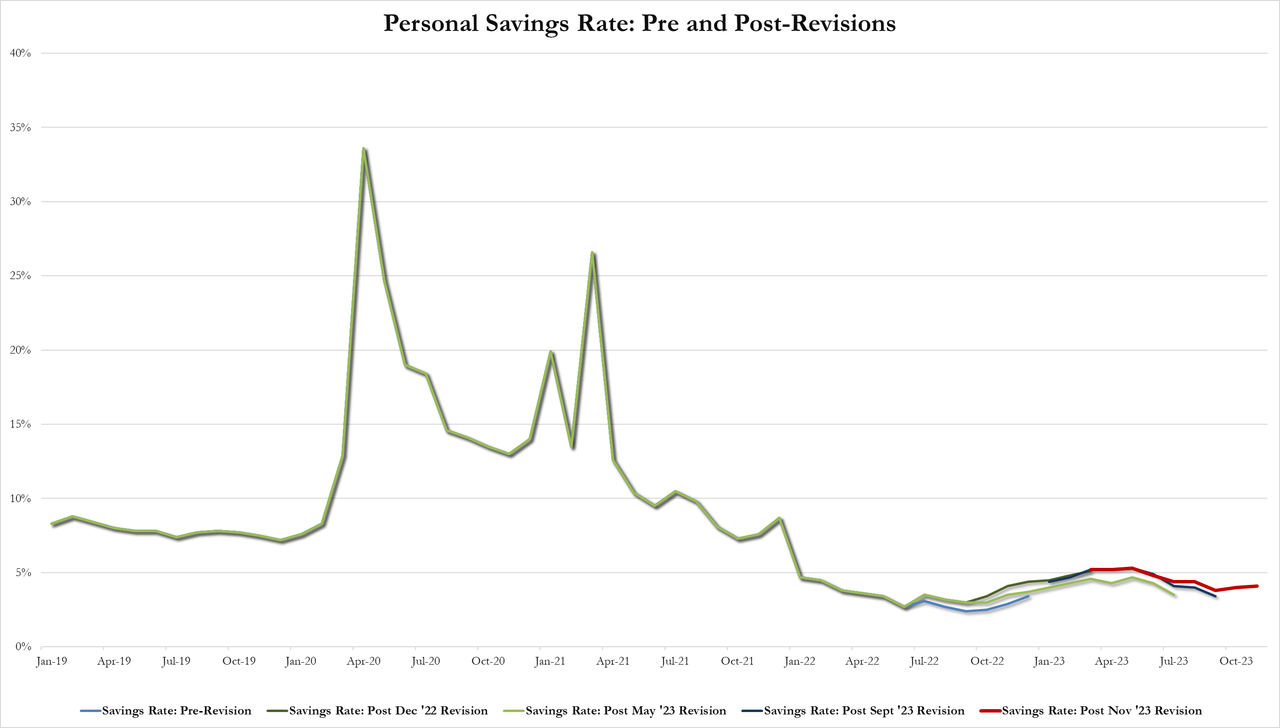

The savings rate ticked up from 4.0% to 4.1% in November...

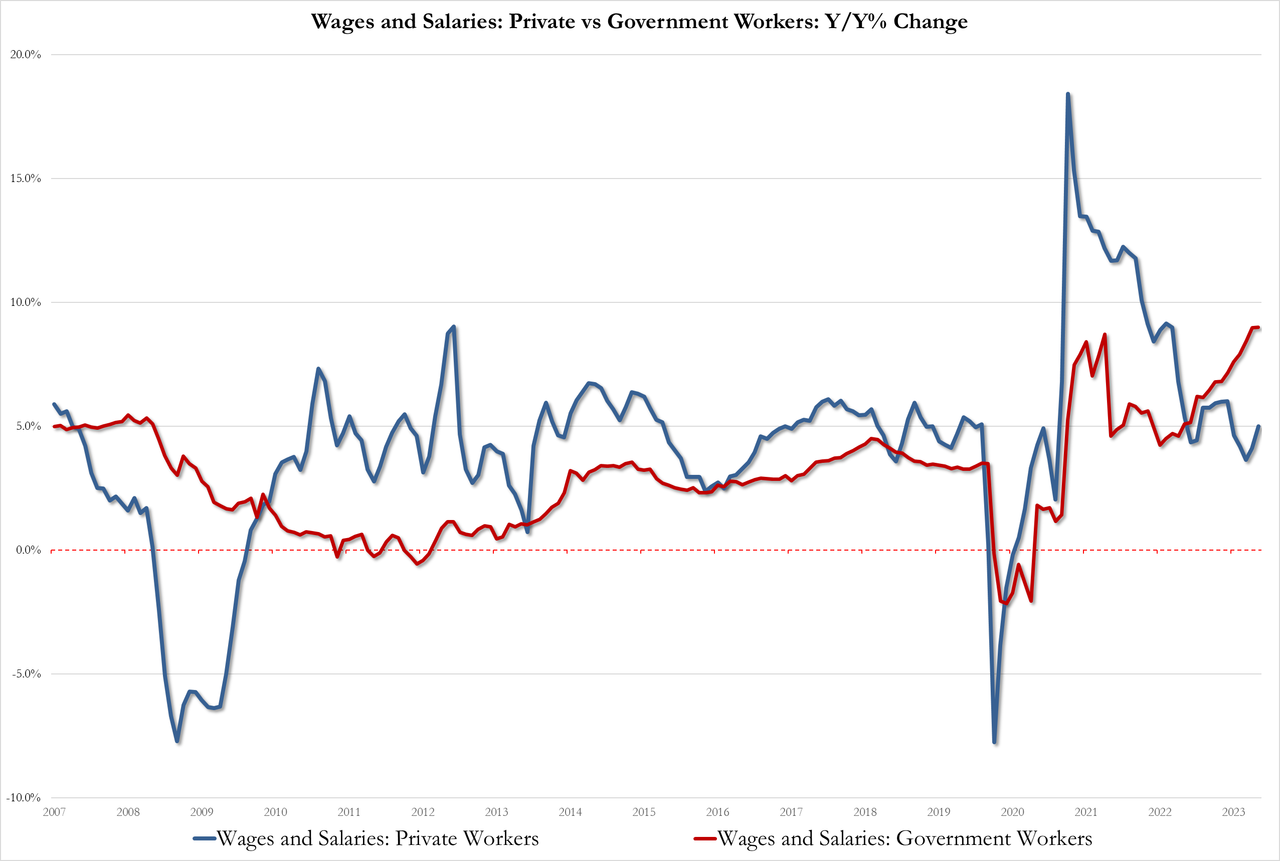

On the income side, it's all government-driven gains...

-

Private wages up 5.0% YoY after 4.1% in October, which was the lowest in three years

-

Government wages up 9.0% YoY, matching all time high

Finally, while the markets are exuberant at the disinflation - and the coming Fed rate-cut avalanche - we do note that it's not all sunshine and unicorns. The vast majority of the reduction in inflation has been 'cyclical'...

Source: Bloomberg

Acyclical Core PCE inflation remains extremely high, although it has fallen from its highs.

Is The (apolitical) Fed really going to cut rates by 160bps next year with this background?

More By This Author:

79% Of India's GDP Is Generated By Family-Owned BusinessesVisualizing The Global Coffee Trade

What's Your US Income Percentile?

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more